Recent weeks have been anything but usual on the markets with big drops and big come-backs. So you may be wondering, how does our methodology, our observations of crowd behaviour hold up?

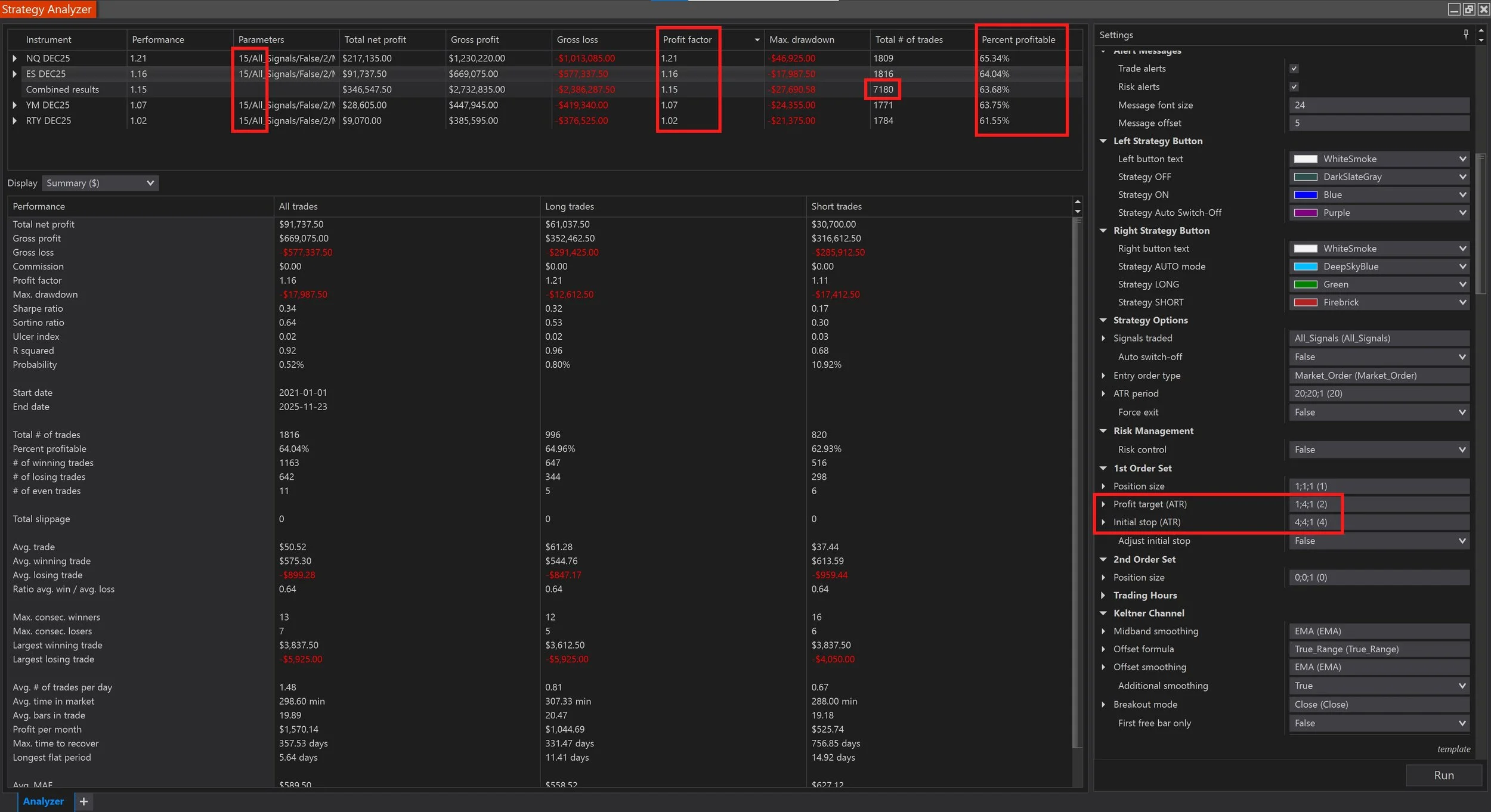

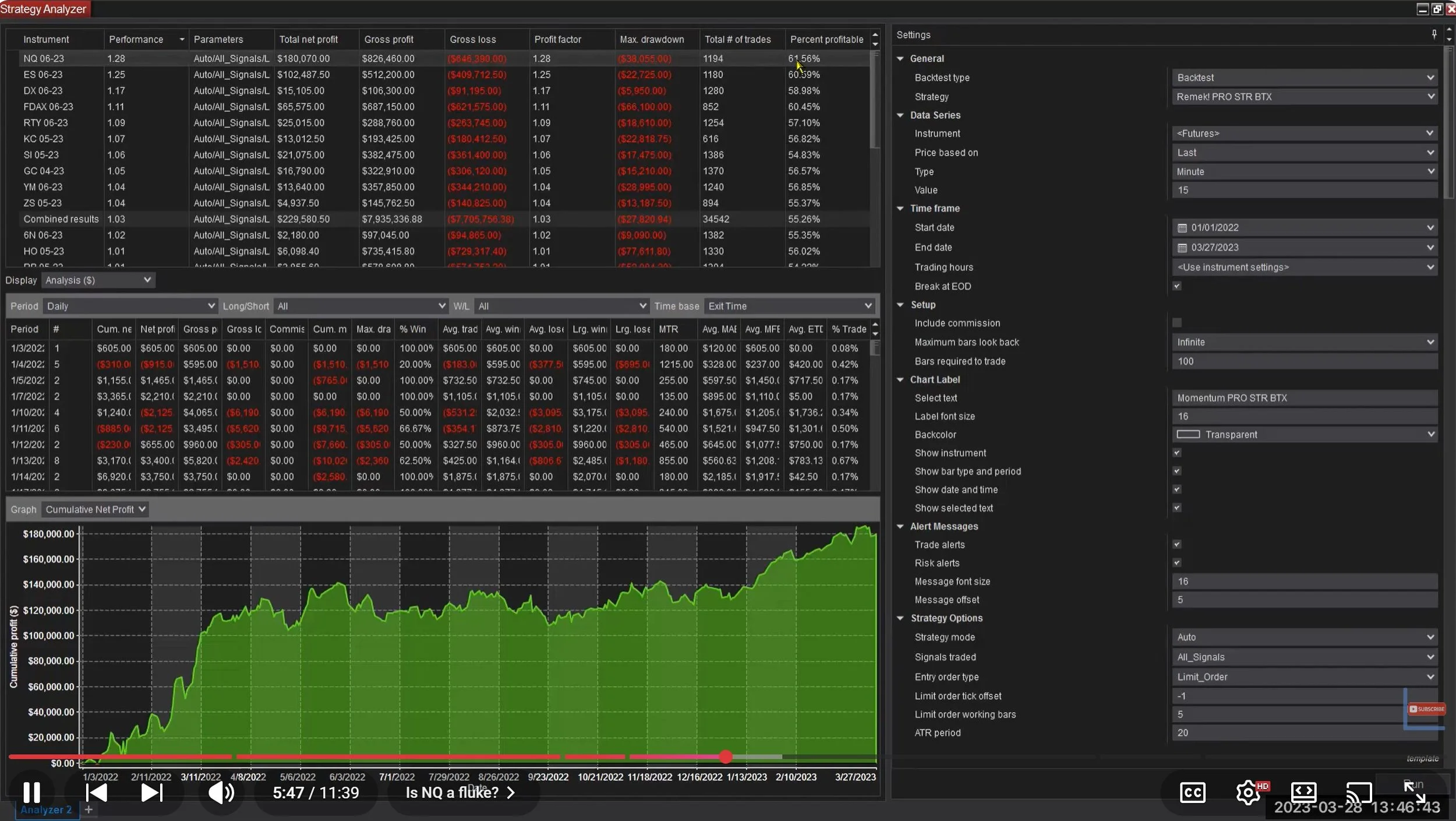

Well, not bad at all, not bad at all. Just as a rough test, we ran the algo - indiscriminately, takingevery signal over with market orders over 4.5 months - 24/7 with two contracts (one with a target, the other with a trailing stop, default settings, same as in many other tests we have published). See the results below.

Bottom line, you want to trade with a methodology that is robust. Robust meaning, it performs well in good times, and not break down in bad times, bull markets or bear markets or sideways markets, or anything in between.

See the results below, they speak for themselves. Our method is rock solid. Make it your own and put it to good use!