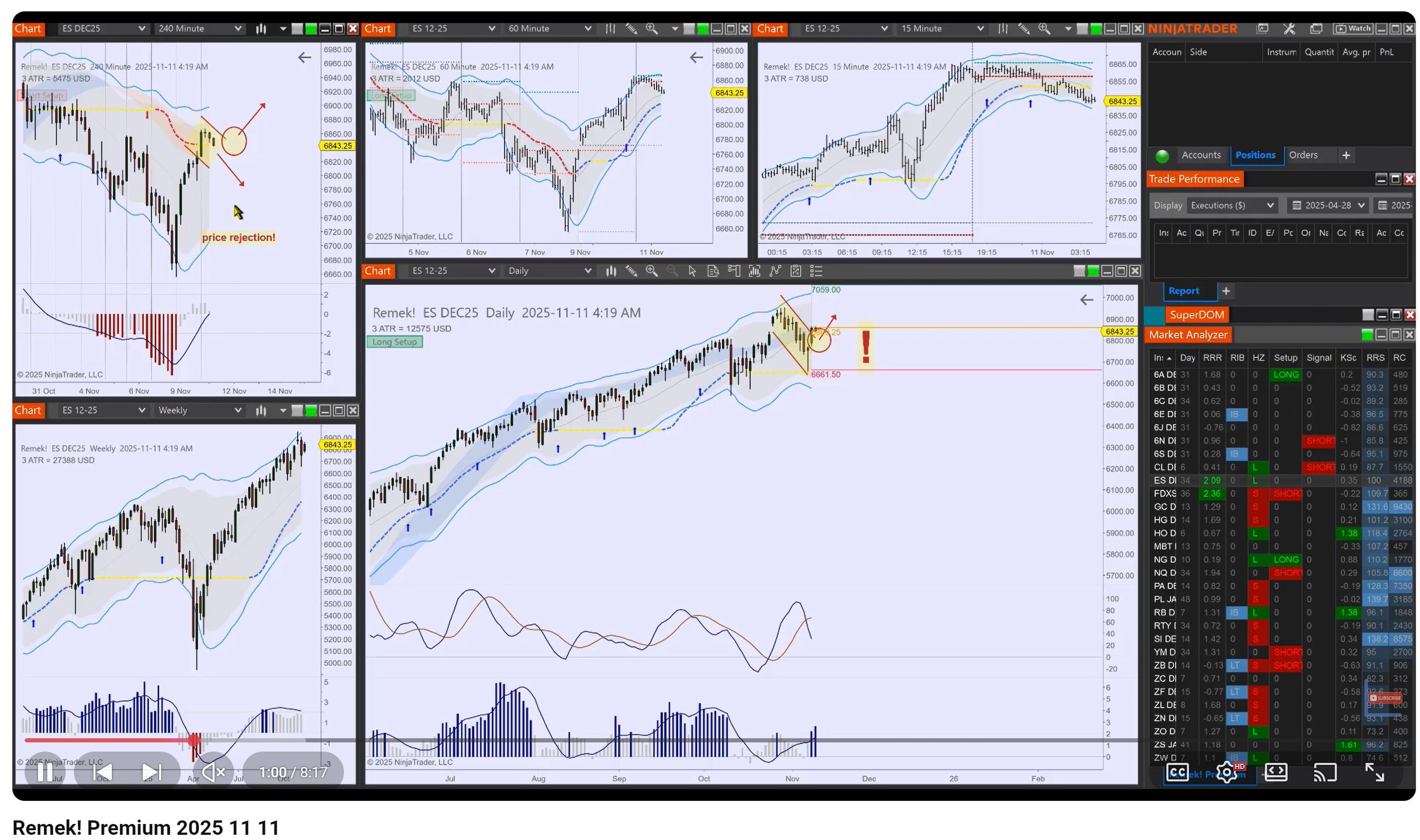

If a picture can be worth a thousand words, this ZN chart below is one of those pictures. Here are a few thoughts as we plan our actions on this market in the hours ahead. Note: the trigger hasn’t arrived yet, and we’re speaking about the proverbial hard right edge of the chart aka the future.

“Many of our basic emotions still run on stone age code.” - Yuval Noah Harari

A crowd exposed to hope and fear tends to act, however rational humans would like to think they are, in a certain way, whether it’s 10,000 BC or 2000 AD.

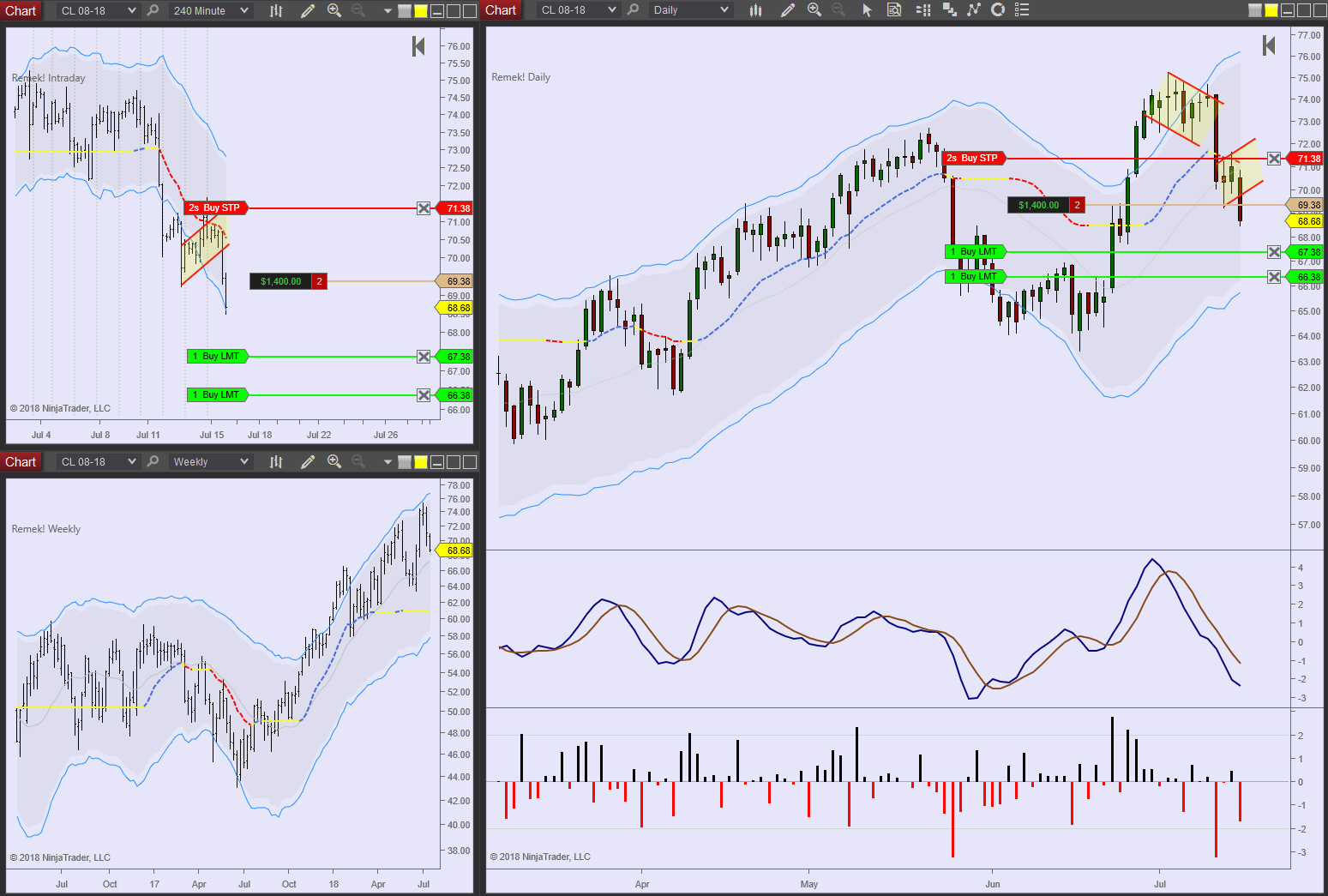

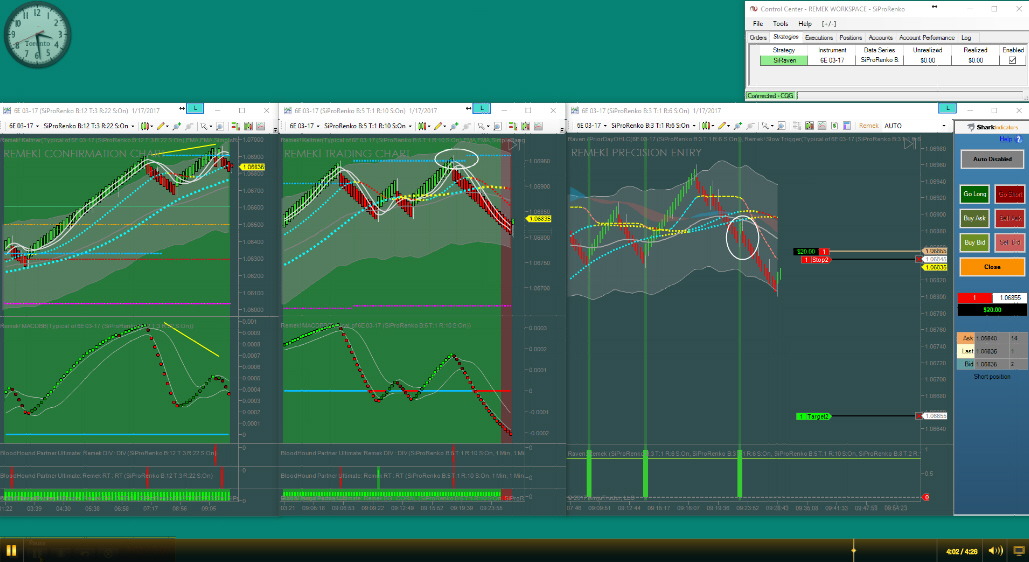

The Remek! Momentum Pro Standalones, built for Ninjatrader 8, monitors, with smart, self-adapting mathematical methods we call the Remek! algorithm, the movement of the crowd, and identifies engagement points with the highest chance of a predicted outcome (called triggers).

We then use those triggers to participate in the expected crowd behaviour

a) on a given time horizon

b) with a given pre-defined, self-adapting set of rules, we call trade management rules (i.e. target, stop, trailing rules)

c) to reach a positive probabilistic outcome over a large number of instances we call an edge.

There is no reason you should miss these opportunities: get the tool, learn the method!