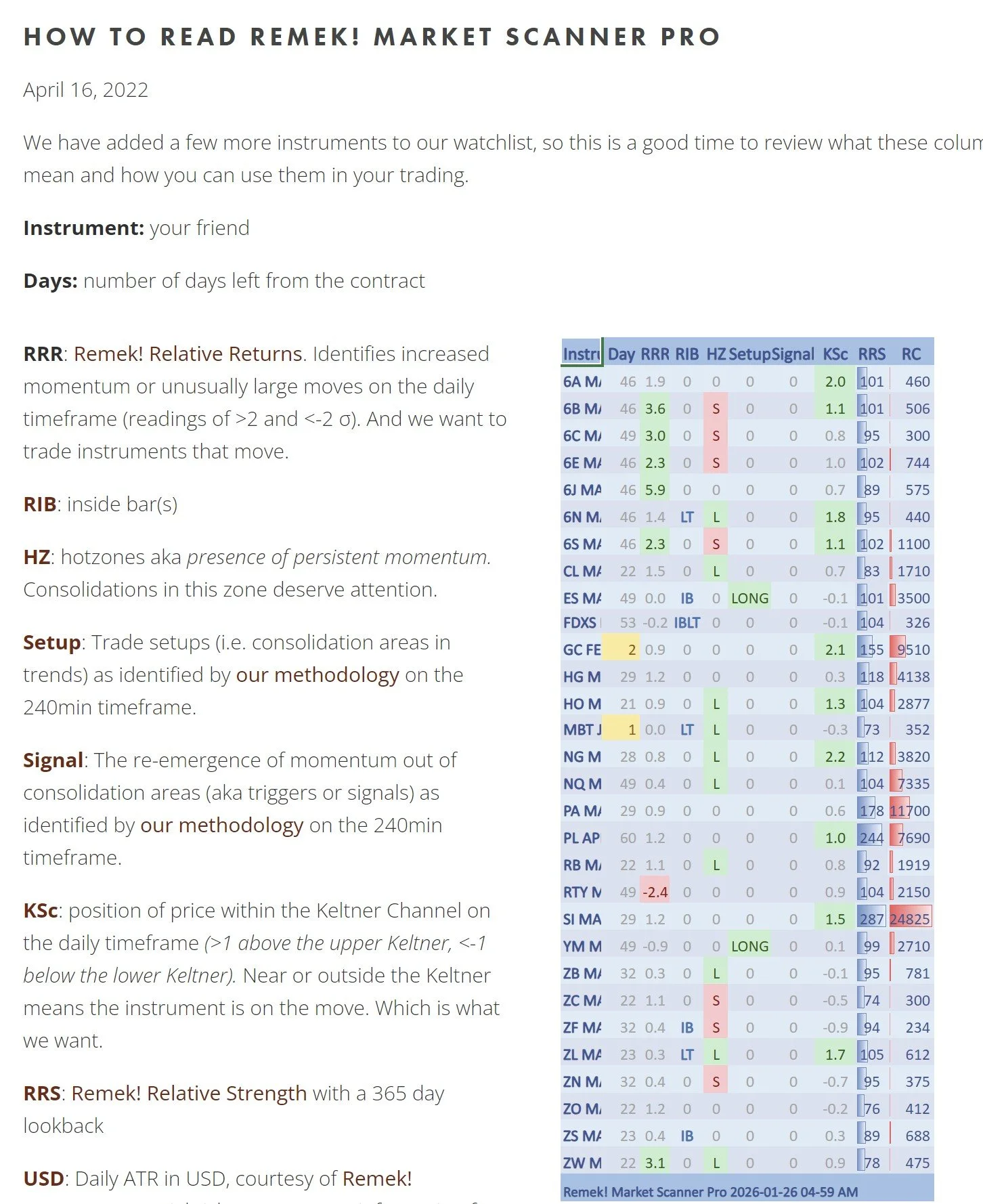

Look at our 6S short below. This trade - regardless of its final outcome, which we nonetheless expect to be good - highlights some of the most important aspects of the Remek! methodology. These are:

using lower timeframe to read the market, time entry

being ready for pullbacks to turn complex

setting targets considering higher timeframes

managing the trade knowing the future is unknown

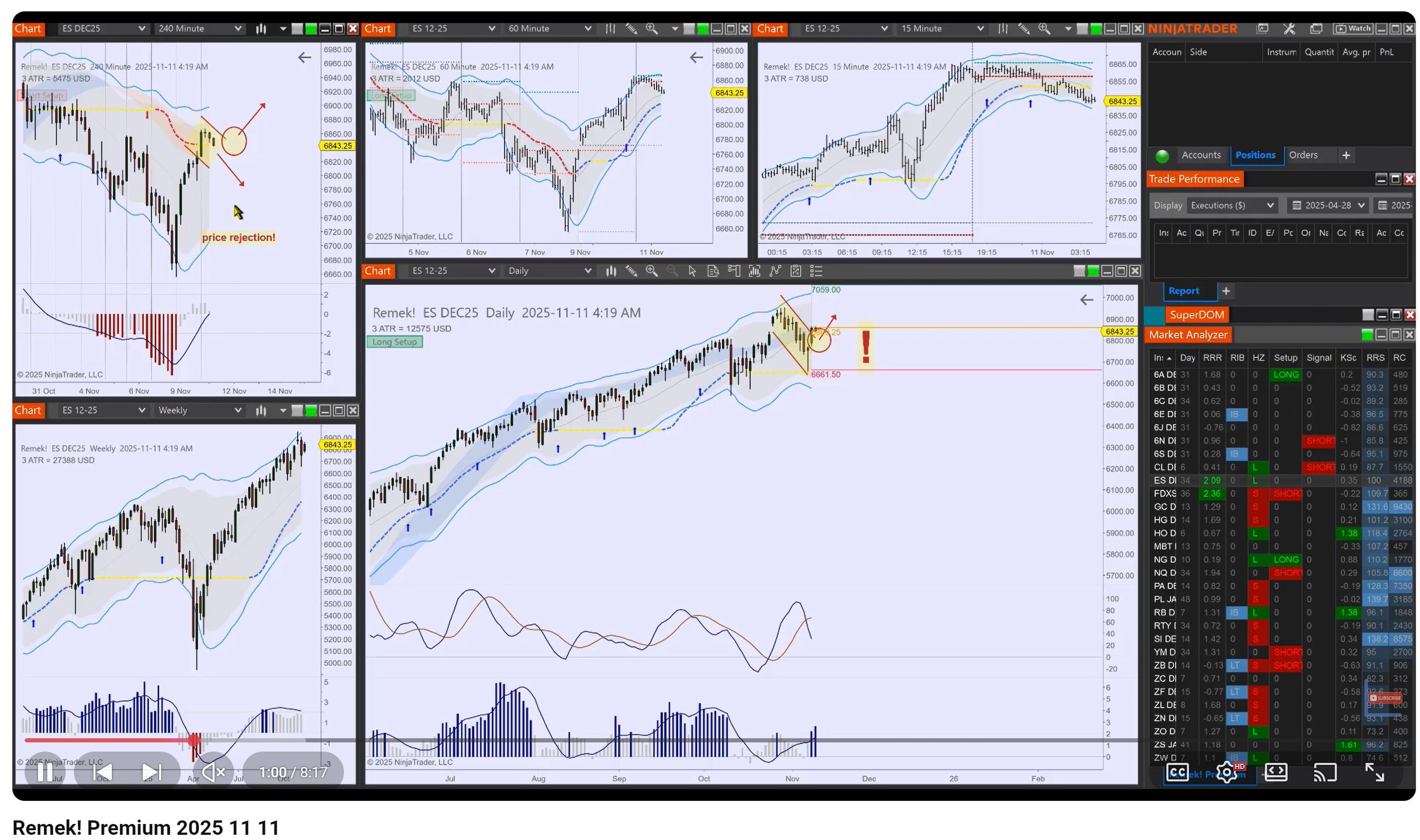

See the chart below. The major ingredients of this trade are numbered. Let’s consider them one by one:

What is a pullback setup on the trading chart (in this case: the daily), is a complex pullback on the 240m chart. This is normal, and actually helps us understand market action and time our entry (which is based on the 240m chart, and executed on the daily)

Our pullback trade, and a textbook example at that. Note: the pullback setup, which is at this moment a simple pullback on the daily, may turn into a complex pullback on the daily. While we don’t think that will happen here (based on what we see on the 240m), it is a possibility, and we have to be ready for it. Therefore the initial stop for this trade is where we put it.

Looking at the higher timeframe (in this case: the weekly) to see how far our trade may go. While keeping a runner and trailing it can pay handsomely, it is also important to remove positions and take profits as the trade develops. Important: the trade management plan must be in place before we enter the trade. Being in a position is not a time to improvise!

Always know: the future is unknown. Is this going to be a winner? Who knows. What we know: we are doing our job, and doing it well.

Mindful trading!