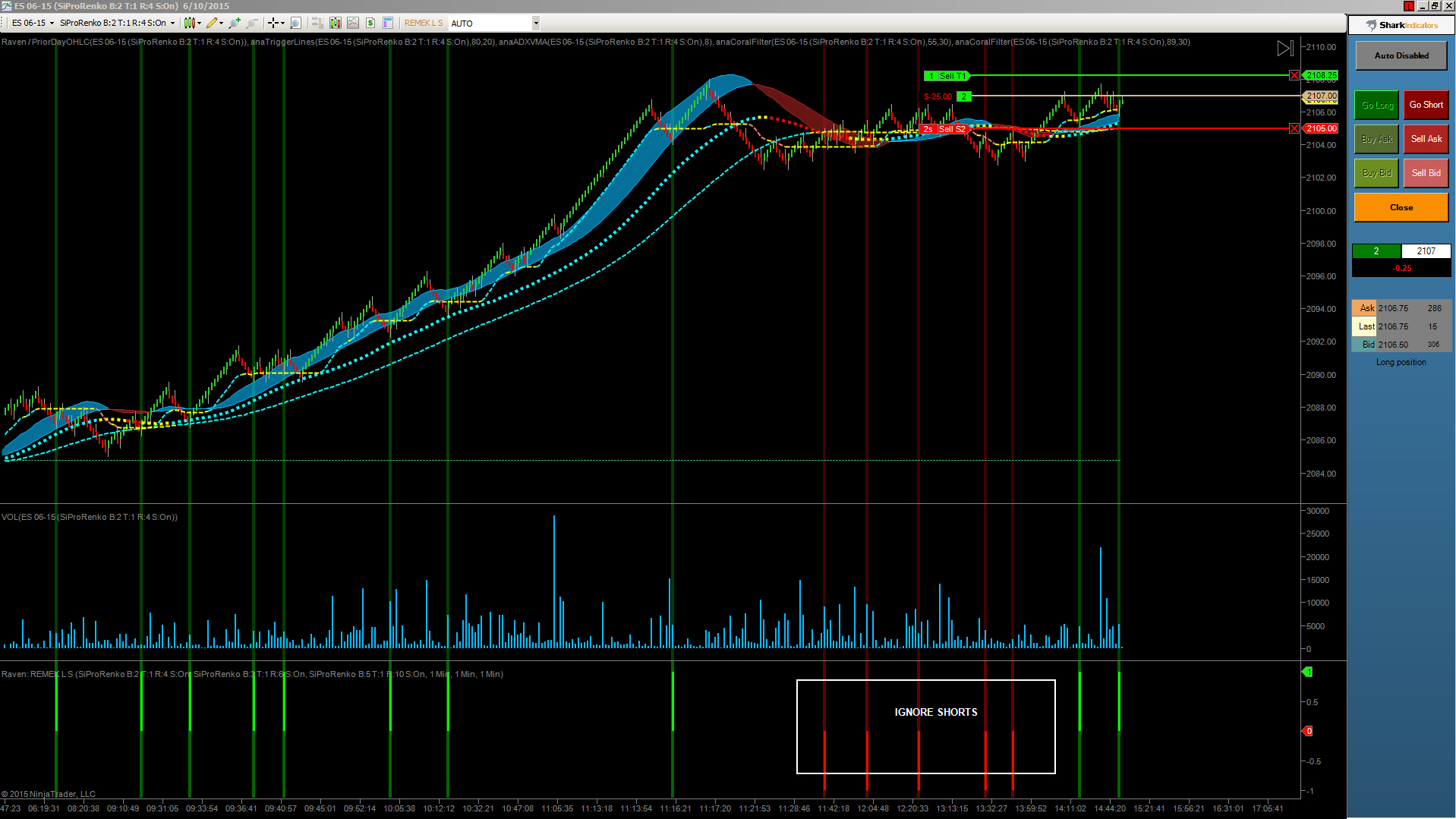

Nice intraday long on YM today, with, most likely, more to come on the 240min and the daily. Also note how jumping on a tick chart to see the trigger adds to our bottom line.

Further notes:

it's simply how life works: the minute chart, being time-based, will NOT give us the activity-based pullback, and thus the algorithmic entry signal. The tick chart, being activity-based, will (see them last night as well as in the morning session)

for advanced Remek! traders: see the beautiful work our chop filter does, between 2.20am and 9.15am! No signals in sideways action! Signal when momentum re-emerges! Our algorithm rocks!

our Premium members already did the intraday work today, with, most likely, more to come on the 240m and the daily. Again, this is how this works.

The good part? Never too late to get our tools, and allow us to teach you how to do this. There's always a next setup, there's always a next trade!

A giant bash is coming up: Victoria Day (Canada), May 19. Open House, huge learning and sales event. Mark your calendars!

by the way, traders always ask us if we trade intraday. We don't see why we shouldn't, in the right circumstances.

Join our mailing list today and try our software FREE to be in the know about upcoming learning opportunities!