Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Let’s call that long-term investing. Good! Now let’s move on to more short-term strategies to profit from the markets, which we usually call trading (although note: the only difference between investing and trading is the timeframe.) (Also note: if you can’t figure out how to make more than 7-8% per annum by the hard work of trading, then it’s obviously a better idea to just put your money in the index funds, and be content with 7-8%.)

With all the above said, what if you want to make more than the 7-8% per annum you can make by doing nothing? Well, you can trade, of course, meaning you can get in and get out of positions as opposed to sit on them long term. Now there is a strong view that markets are “efficient”, meaning “you can’t beat the market”, which means the most you can make is the baseline shift. There are traders, though, who beg to differ: they hold the view - and we have data that they might just be right - that it is possible to uncover patterns in price action that can be exploited consistently for profit. OK, fine, so why is everybody not doing it?

There are surely many reasons, which would each deserve their own separete blog post, but probably it all comes down to some type of financial darwinism, meaning the markets are very competitive, and those that constantly adapt best will, most likely, end up with others’ money.

But before all this gets too theoretical and complex, let’s try to simplify trading into a managable process. Let us show you how we do this:

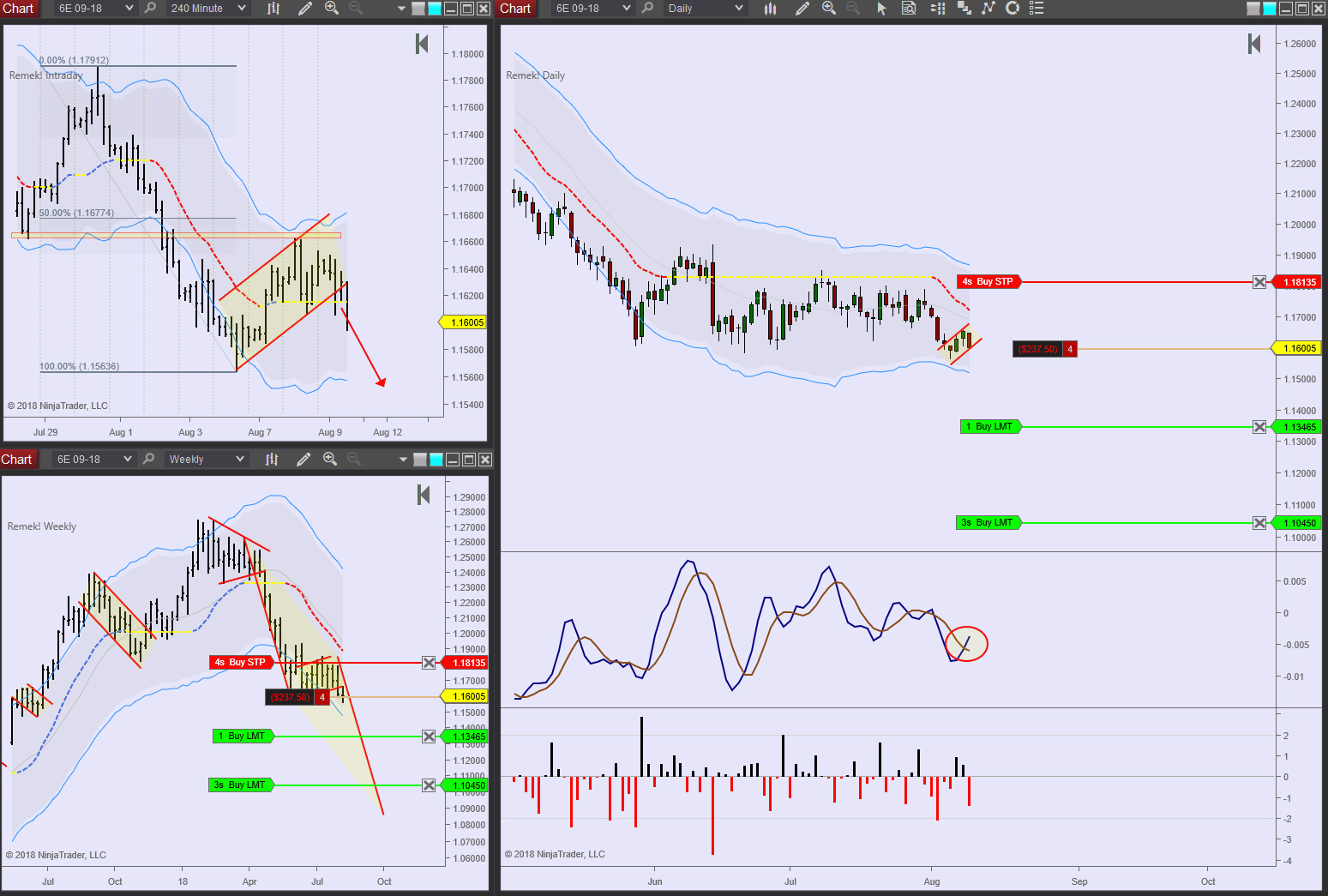

First we identify the opportunity: this means a situation on a given market that fits into what we look for based on our methodology (which, remember, we have tested a million times and we know it works.) How we do this doesn’t matter, as long as it works for us. As for us, we use our beautiful software and add to it our 15 years of daily trading experience. We challenge you to beat that combination! By the way, here’s our latest analyses, which we share with our Premium subscribers before each open. (We discuss about 7-8 markets. Look at your charts now, and count those on which we were wrong. Hint: none)