A great session yesterday in our Open House. See below the concepts we discussed and a few links for further study.

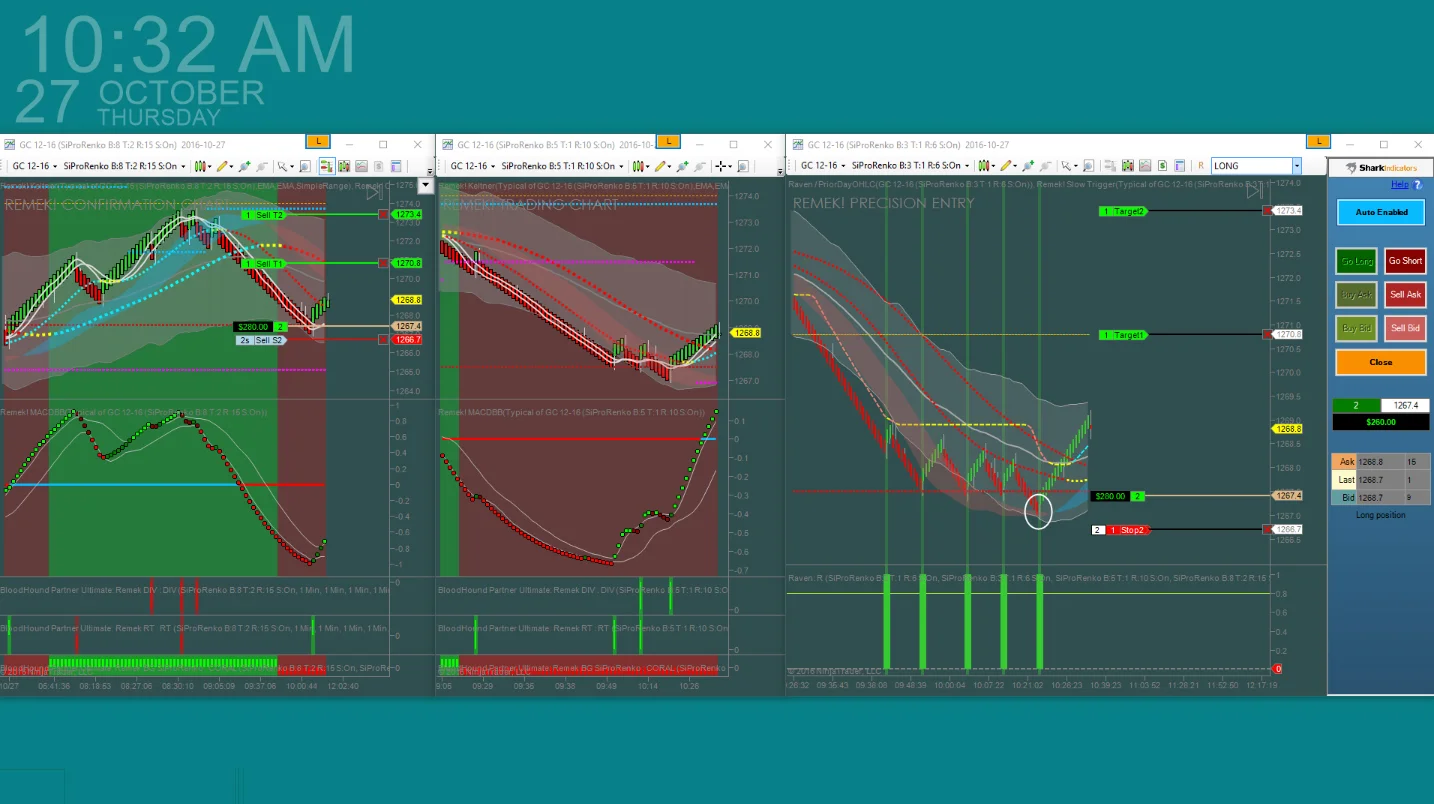

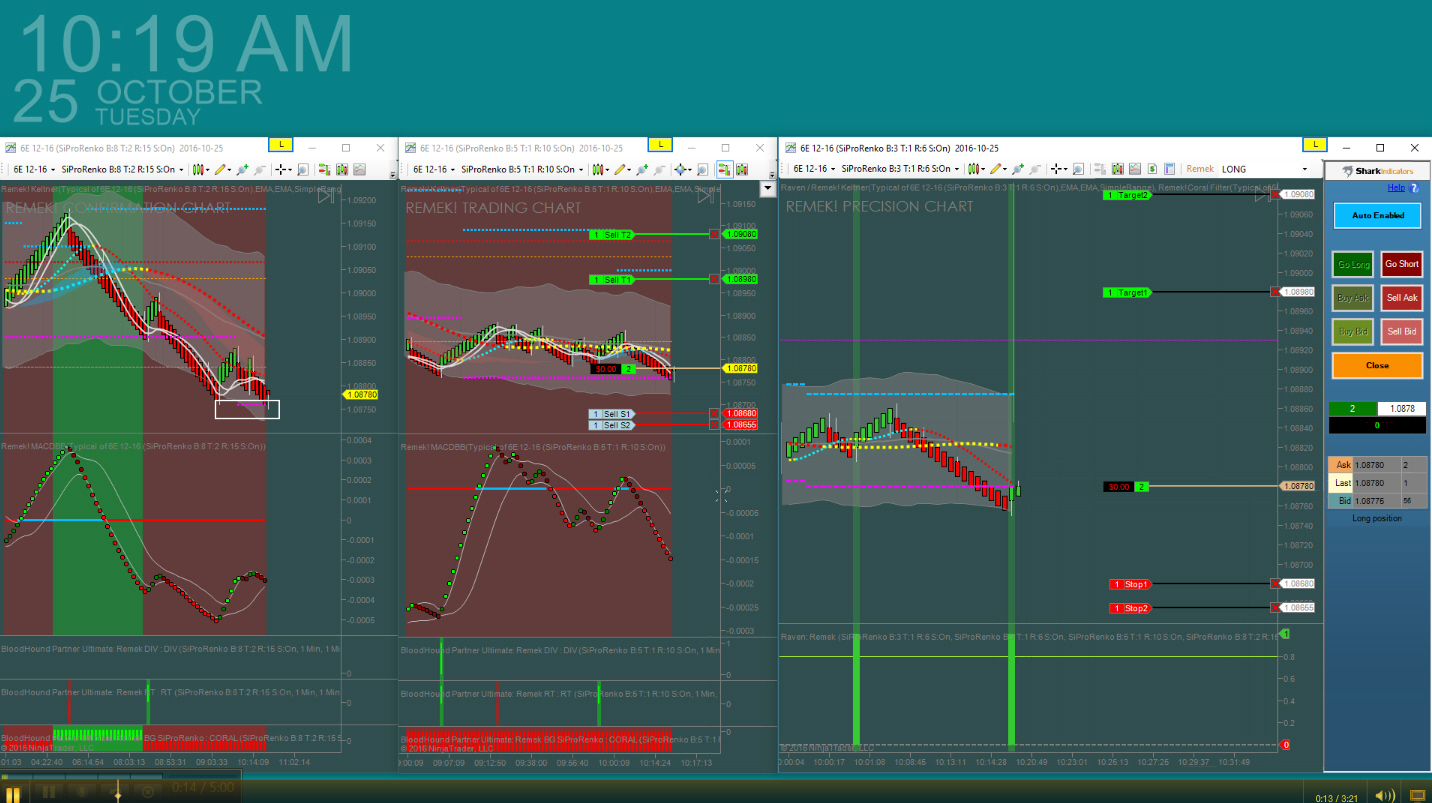

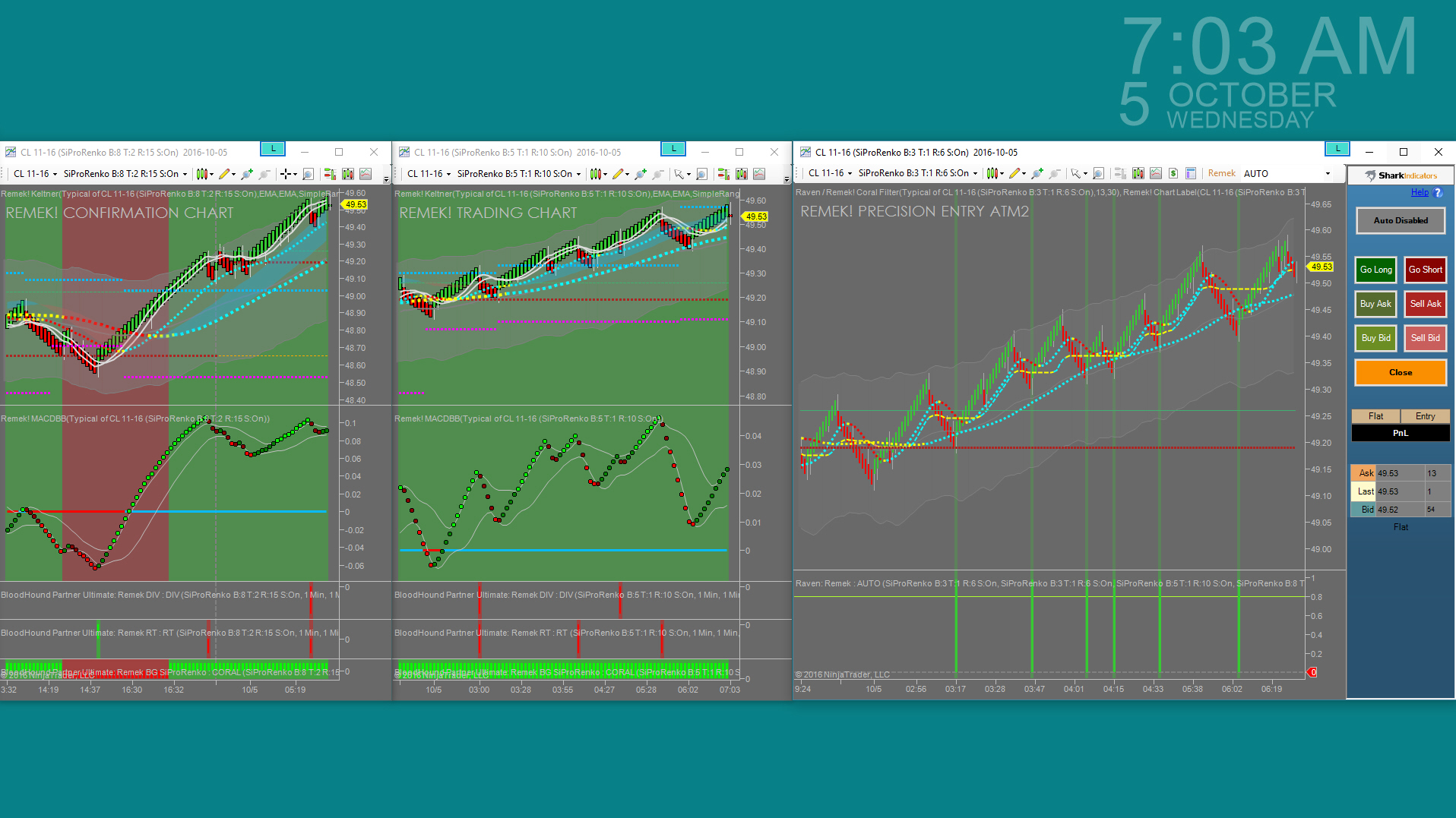

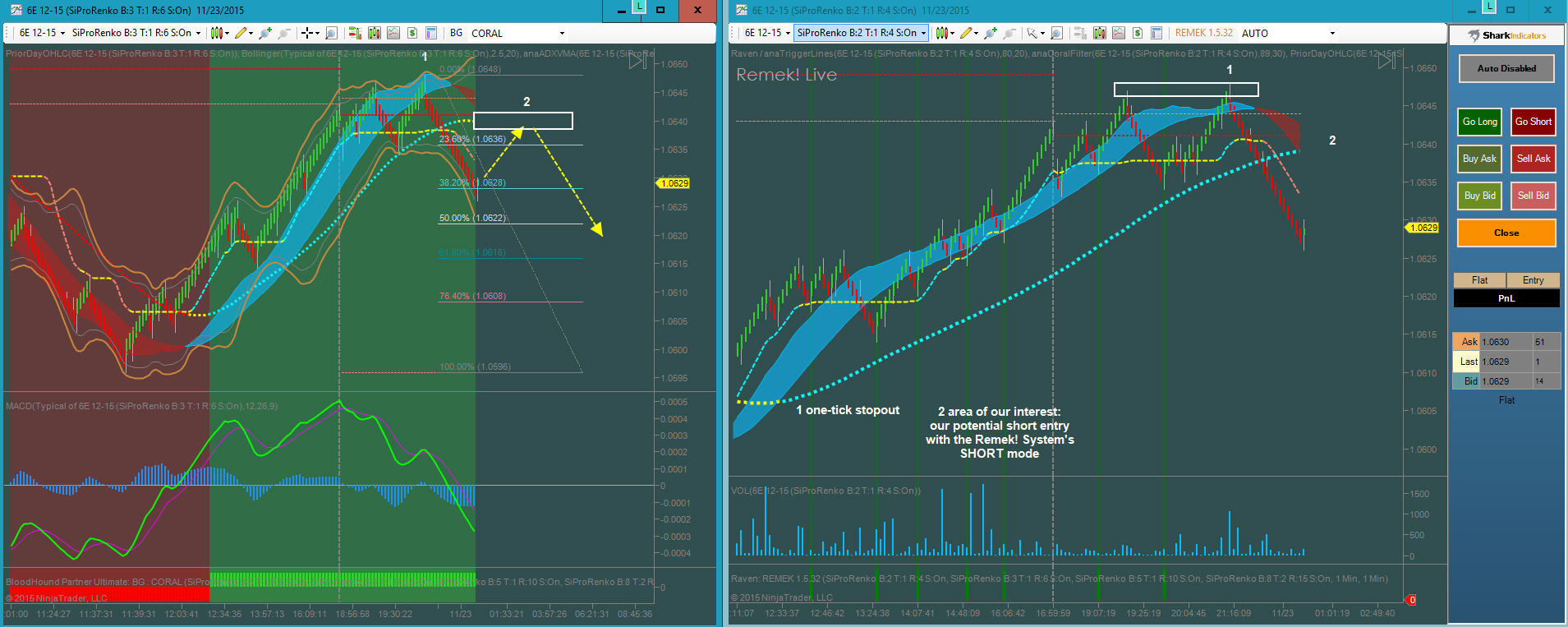

The two phases of a trade: from identifying the opportunity to executing the trade.

Further reading:

https://www.remek.ca/blog/2023/12/28/from-opportunity-to-structured-trade

https://www.remek.ca/blog/2024/4/15/the-anatomy-of-a-trade-revisitedLearning to read charts. Key concepts to master: Long Tail. Instant reversal. Failure test.

- The past week or so, historic by any measure, has been gracious to provide us with many charts especially suited for study and trading purposes.

- Daily chart reading and developing the ability to extract information from price action based on our crowd-movement-based methodology is the foundation of trading success …. but you know the story, so: get the gear, learn the craft.The daily work: grab a coffee and spend 5 minutes on your Remek! charts each day for six months. Make notes, no typing, pen and paper (or something like this). Miracle is bound to happen: that 5 minutes will soon shrink to 5 seconds if you stick to it, and what it will do to your trading skills is, you’ll learn to forecast with a reasonable probability the likely movement of the crowd.

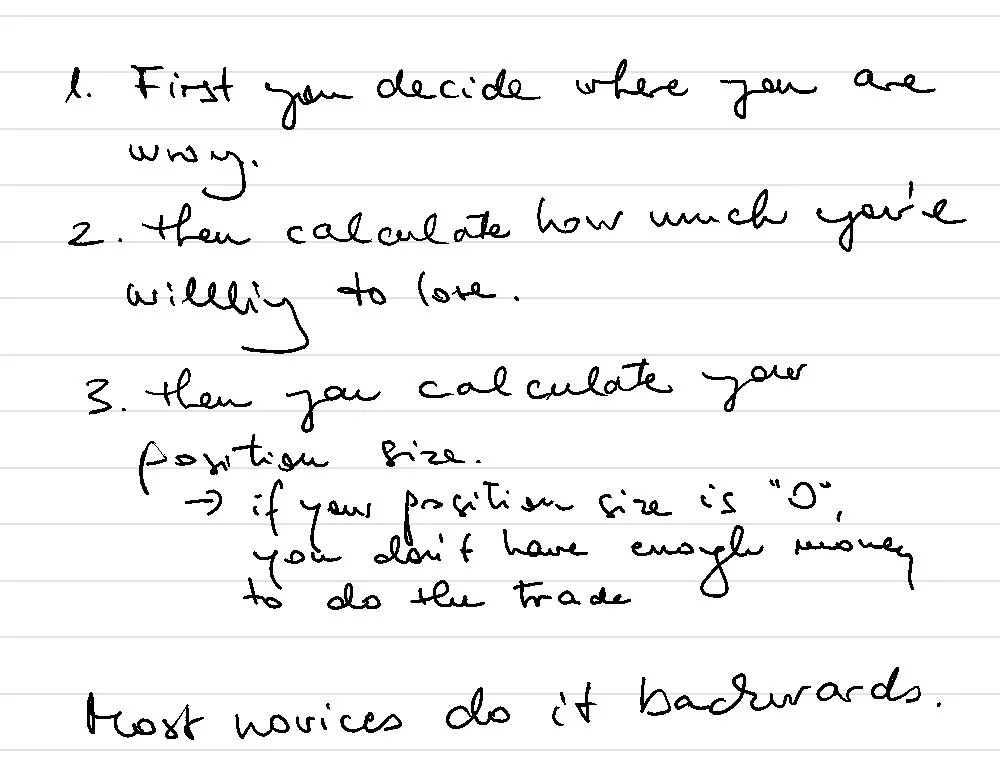

The next step is, of course, to learn what trades to put on, if any, based on your observations and forecasts. We call this structuring a trade (as in “designing a trade”). This involves:

- defining the quantity based on pre-defined risk management rules (A little math will be necessary, but nothing close to rocket science.). Note: PRO STR BT (and BTX too) can adaptively automate this, a uniquely advanced feature in the NT8 universe or at this price class in general.

- defining the entry, exit and trade management rules that will govern the trade from start to finish

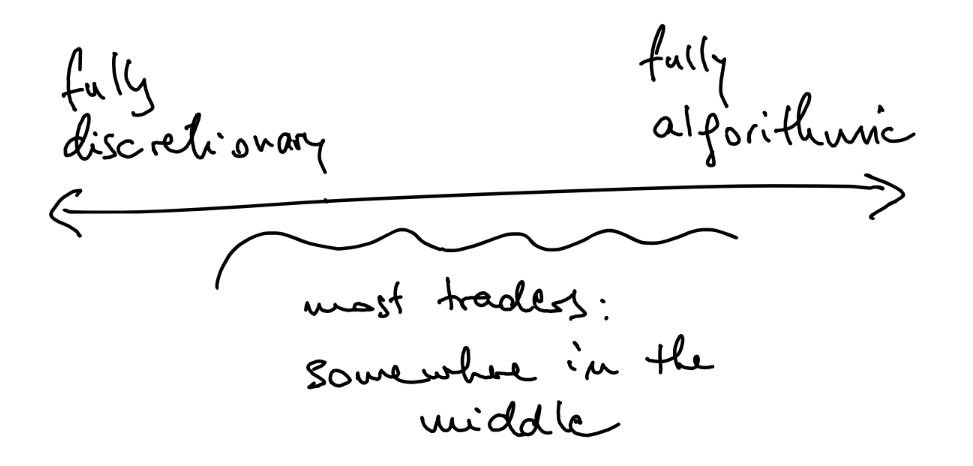

- the technology (manual/PRO STR/BT/BTX) with which the trade will be executed, including the level of automation

- any other rule as defined in the trader’s trading plan.

Further reading:

https://www.remek.ca/blog/2019/9/20/three-ways-to-enter-a-pullback-trade

https://www.remek.ca/blog/2024/2/10/the-method-the-tools

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.