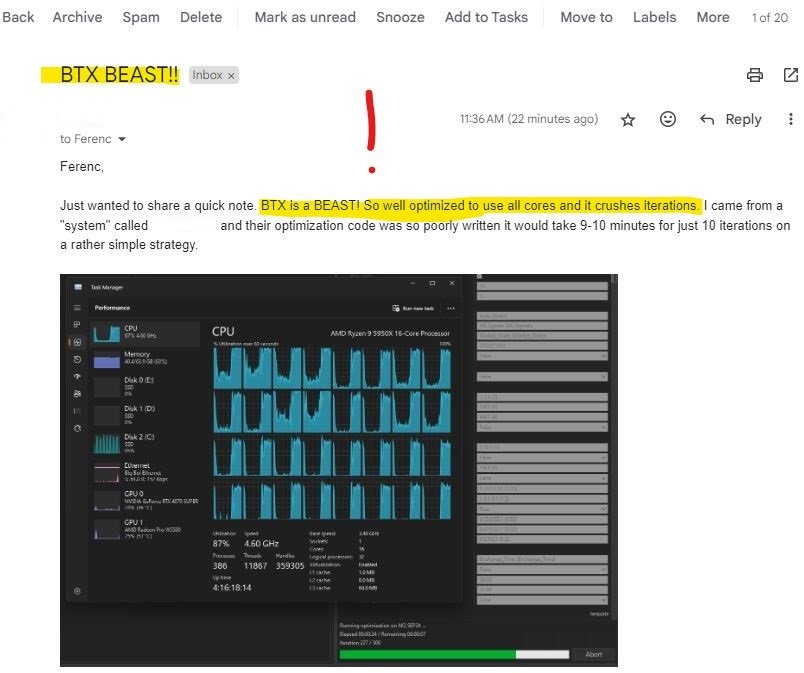

But before we get to silver: make sure you check out the Best of the Remek! Blog on the right, lots of great stuff from the past. These posts are seriously capable of putting money in your pocket. Here’s an example.

And now: time for silver!

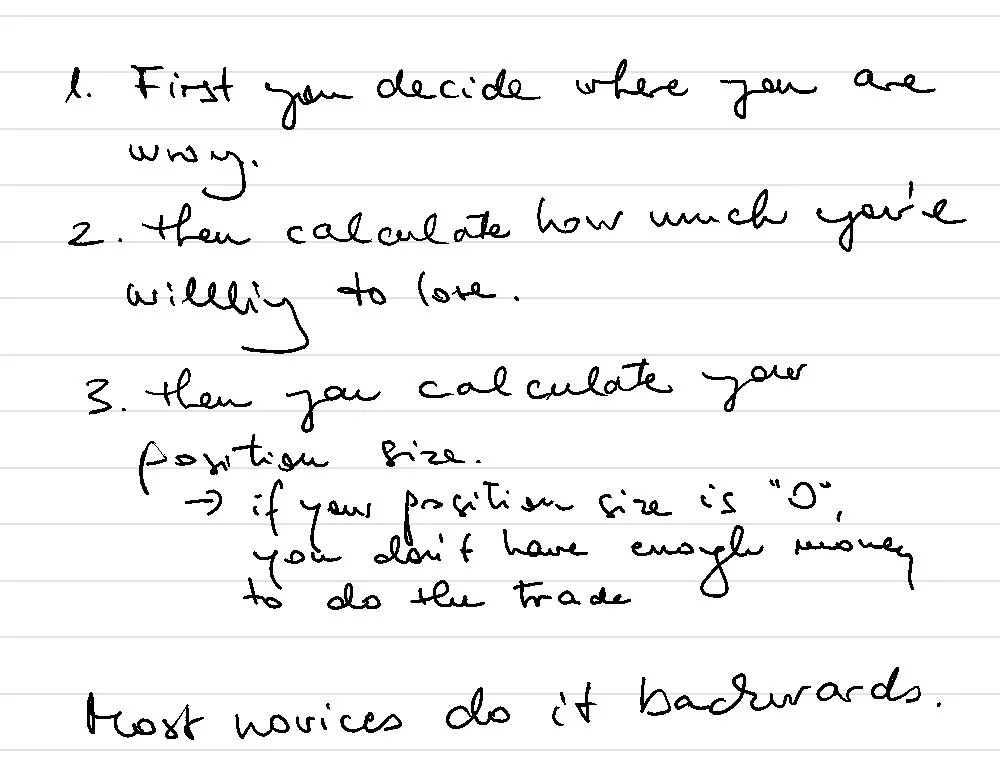

Charts speak. Learning to listen is a skill worth honing. And in case you’re wondering how our chart reading skills complement our algorithmic tools: we use our algorithms to strike. We use our chart reading skills to know when.

SIMILAR POSTS

Red Label - early morning example