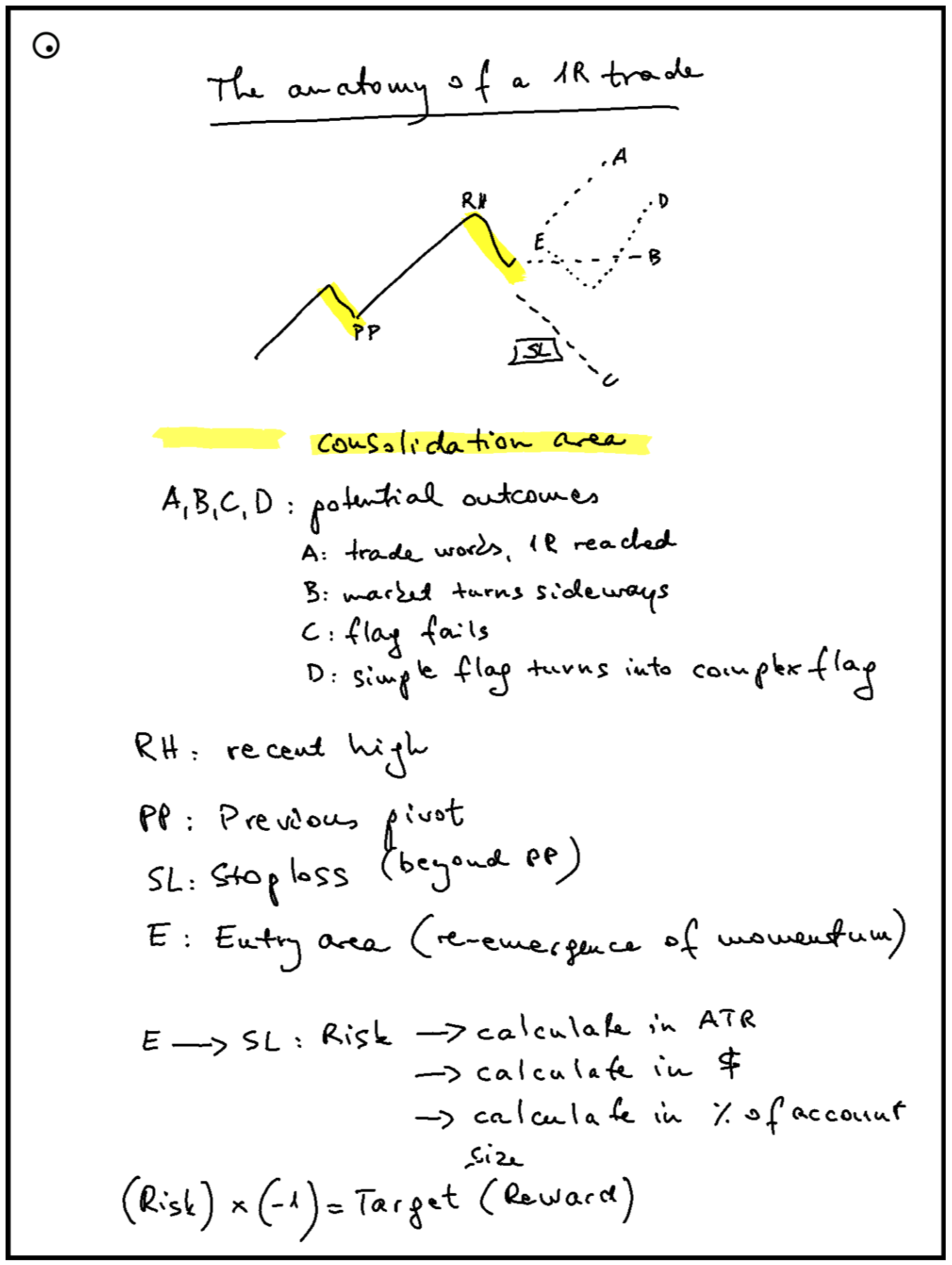

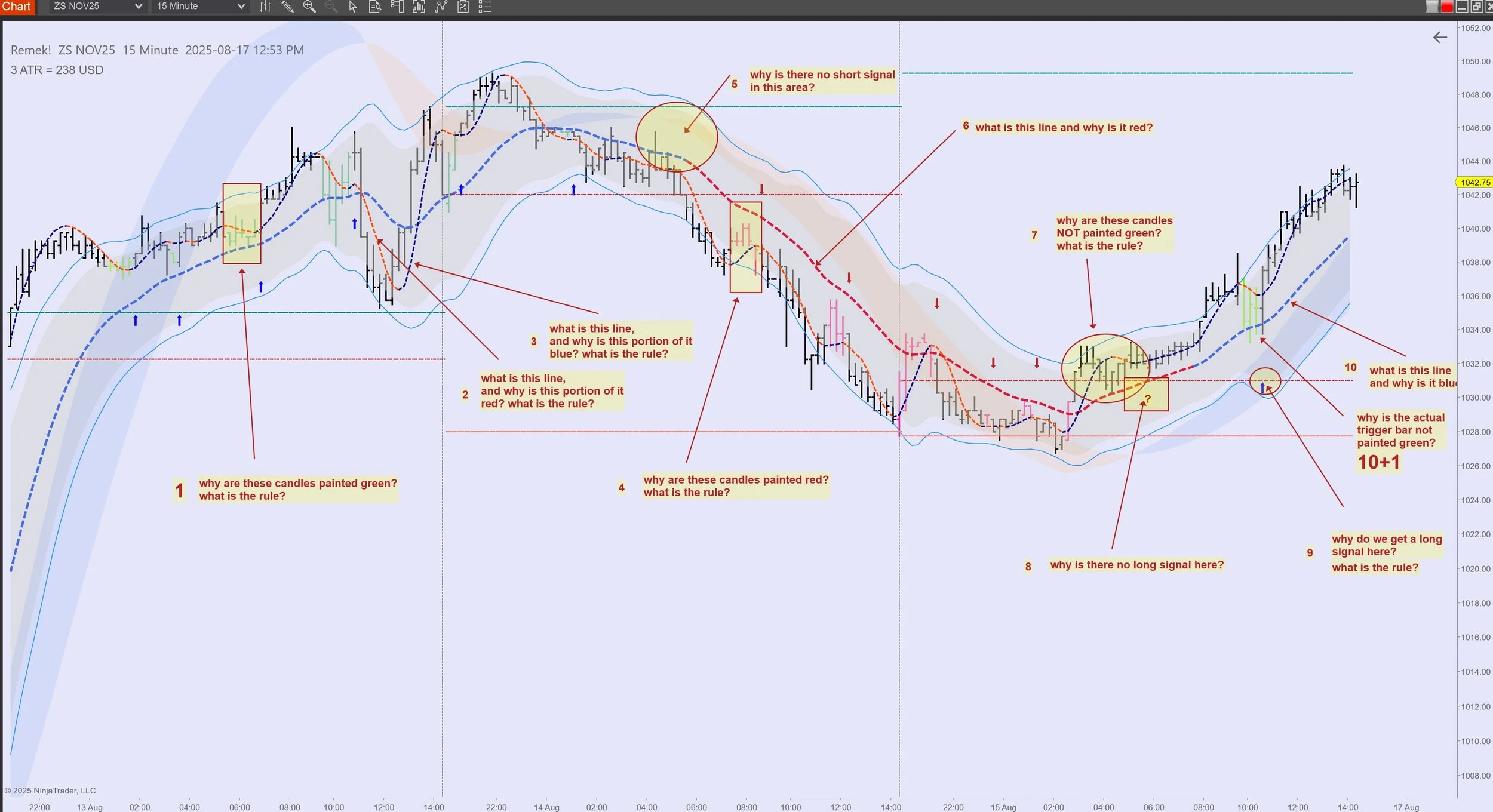

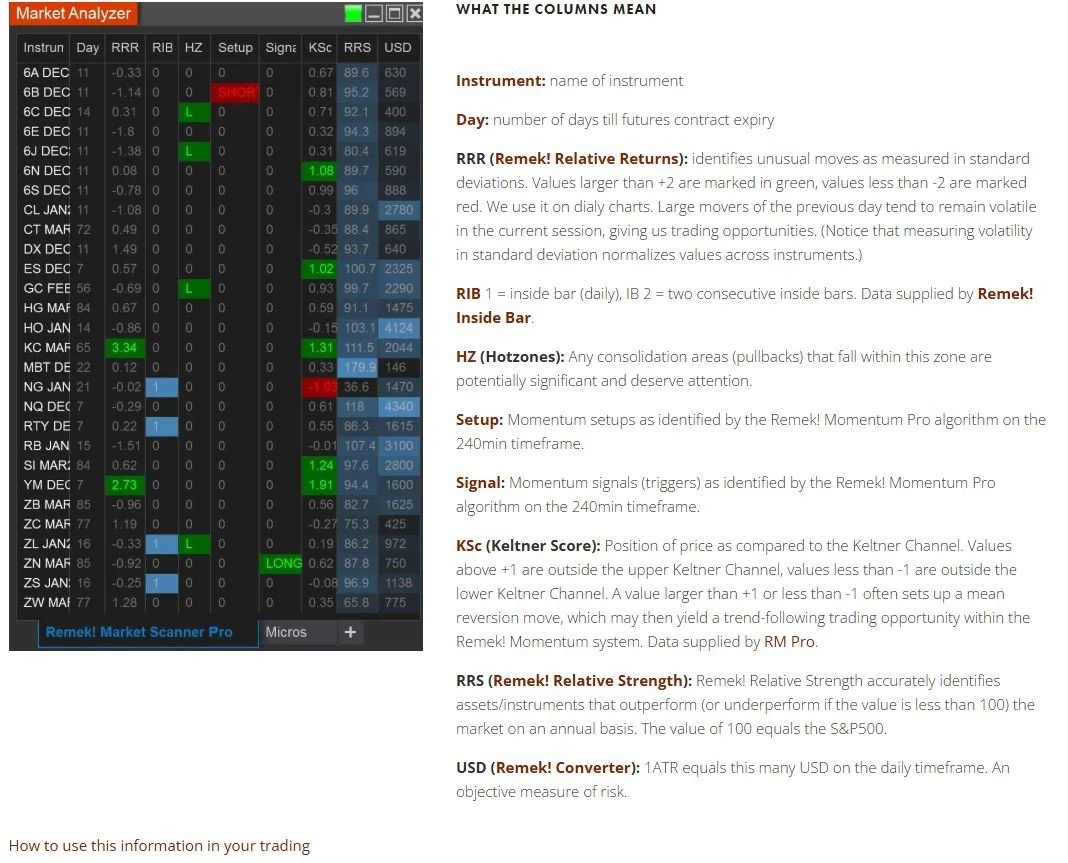

The trade below encapsulates how we see and trade the markets, so we thought we’d share it for everyone’s benefit. The series of events similar to those seen below happen way more often than to be dismissed as random. This is, in fact, what a certain aspect of crowd behaviour, i.e. the re-emergence of momentum out of consolidation areas, looks like on our charts, and this aspect of crowd behaviour can form the basis of a successful trading methodology. Get the tools and join us as we track the markets!

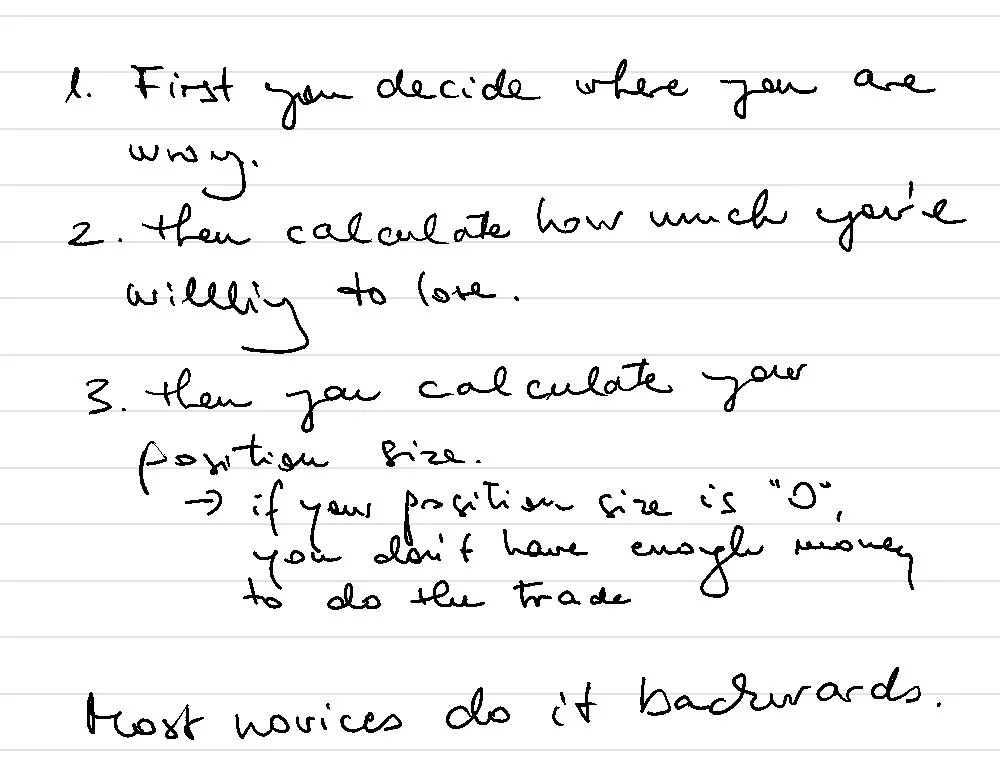

March 27, 12.27pm: we identify the opportunity, a complex consolidation, and the expected re-emergence of momentum (and share it with our Premium membership at the time, as well as in a public post at the end of the day)

A few hours later momentum re-emerges, we get triggered into the trade. We use PRO STR for the job, but the job can be done with BT as well, and can be split to smaller trades on lower timeframes. Notice our resting stop entry at the top of the red candle two candles back.

The trade is completed at 1R.