For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Terms and conditions.

Remek! Premium

Actionable market insight for technically motivated directional traders

-

I'm new to this. Where do I start?

Start with the Documentation. See link above. Then you may want to read through the documentation of our software products to see how we go about interacting with the markets.

-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We provide a morning brief for the day's trading session around 8am Eastern Time. We also post updates as necessary during the day, starting with a "Morning brief" pre-session, Eastern Time.

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. (Without an edge, there is no point in risking a single dollar on the markets.)

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

- We're often wrong. After all, we work with probabilities, and this work is all about the future. The unknown. We judge our work not by how many times we're right or wrong, but - to paraphrase one of the best traders of all time - by 'how much we make when we're right and how much we lose when we're wrong'.

fOR THE TRADING DAY OF wednesday, 2021 06 30

News at 10.30am (CL/HO).

Indexes: low-momentum grind continues. Strong candle on weekly chart points to further upside. Manage stops appropriately, the market may re-test the breakout area.

Currencies: DX bullflag in progress, short setups on 6E, 6S, 6N, 6B.

Commodities: NG continues to march. GC/SI shorts have triggered.

9am update:

fOR THE TRADING DAY OF tuesday, 2021 06 29

No new information since yesterday.

News at 10am.

Indexes: strongly bullish environment continues. Bullflag on YM.

Currencies: DX bullflag, short setups on 6E, 6S, 6N, 6B.

Commodities: NG a bit overextended, wait for pullback.

8am update:

fOR THE TRADING DAY OF monday, 2021 06 28

No News.

Indexes: strongly bullish environment continues.

Currencies: DX bullflag, short setups on 6E, 6S.

Commodities: HO working towards previous high, NG strength continues. GC/SI bearflags on daily (although we expect them to fail).

8.30am update:

fOR THE TRADING DAY OF Friday, 2021 06 25

News at 8.30am ET

Indexes: NQ 1R (new high), ES working on 1R, RTY pressing into previous high, YM 1R in progress.

Currencies: USD strength, short setups on 6E, 6A, 6N (waiting for triggers)

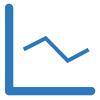

Cryptos: BTC bearish potential dissipating, waiting for first bullflag on 240m

Commodities: HO working towards previous high, NG 1R hit on daily. GC/SI bearflags on daily.

9am update:

fOR THE TRADING DAY OF thursday, 2021 06 24

News at 8.30am ET (may move markets, caution advised on smaller accounts)

Indexes: bullflags, long trades in progress. Warning: not much momentum, but sentiment is usually bullish going into the July 4 holiday.

Currencies: USD strength, short setups on 6E, 6A, 6N

Commodities: CL 1R hit, HO hit 1R and more. NG good long. GC/SI bearflags on daily.

9.30am update: adding YM to our watchlist

fOR THE TRADING DAY OF Wednesday, 2021 06 23

News at 9.45am, 10am, 10.30am ET

Indexes: on the move.

Currencies: USD strength gives us short setups on 6E, 6A, 6N

Commodities: CL 1R hit, HO hit 1R. NG triggering. GC/SI bearflags on daily.

9am update:

fOR THE TRADING DAY OF tuesday, 2021 06 22

News at 10am ET.

Indexes: we seldom see a more bullish structure. That said, the exact timing of the move up is not known.

Currencies: USD strength gives us short setups on 6E, 6A, 6N

Commodities: CL 1R hit, HO 1R in progress. Monitoring potential failure of GC/SI bearflags on daily.

Financials: ZB 1R hit.

9.30am update:

fOR THE TRADING DAY OF monday, 2021 06 21

No News.

Indexes: waiting for clues, the question is: is the selling going to continue on the Monday open or do we stabilize here?

Currencies: major shift in DX, with consequences in most asset classes.

Commodities: long setups on NG, CL/HO.

Financials: ZB further strength expected

8.30am update:

fOR THE TRADING DAY OF friday, 2021 06 18

Note: major shift in the USD (DX), which has affected most other markets (metals, commodities, agriculturals, bonds, currencies). We’ll take it from here. Focusing on BTC, RTY.

No News.

Indexes: NQ new high, RTY bullflag.

Currencies: major shift in DX.

Commodities: precious metals take a hit, long setups on NG, CL.

Cryptos: BTC long setup.

9am update: see today’s setups below. No trigger, no trade.

fOR THE TRADING DAY OF thursday, 2021 06 17

Note: some markets may be transitioning post-FOMC, we’ll be on the lookout for clues. A few excellent calls today (Financials, 6E)

News at 8.30am

Indexes: ES, NQ, RTY most likely a pullback (buying opportunity). Monitoring for clues that we’re wrong.

Currencies: correct thinking on DX/6E. Monitoring for further clues.

Commodities: NG, CL/HO long setups.

Cryptos: BTC long setup.

Financials: great call on ZN.

fOR THE TRADING DAY OF wednesday, 2021 06 16

Note: very little action on most markets, due perhaps to no new information. FOMC may be catalyst the markets are waiting for.

News at 8.30am, 10.30am ET. 2pm FOMC

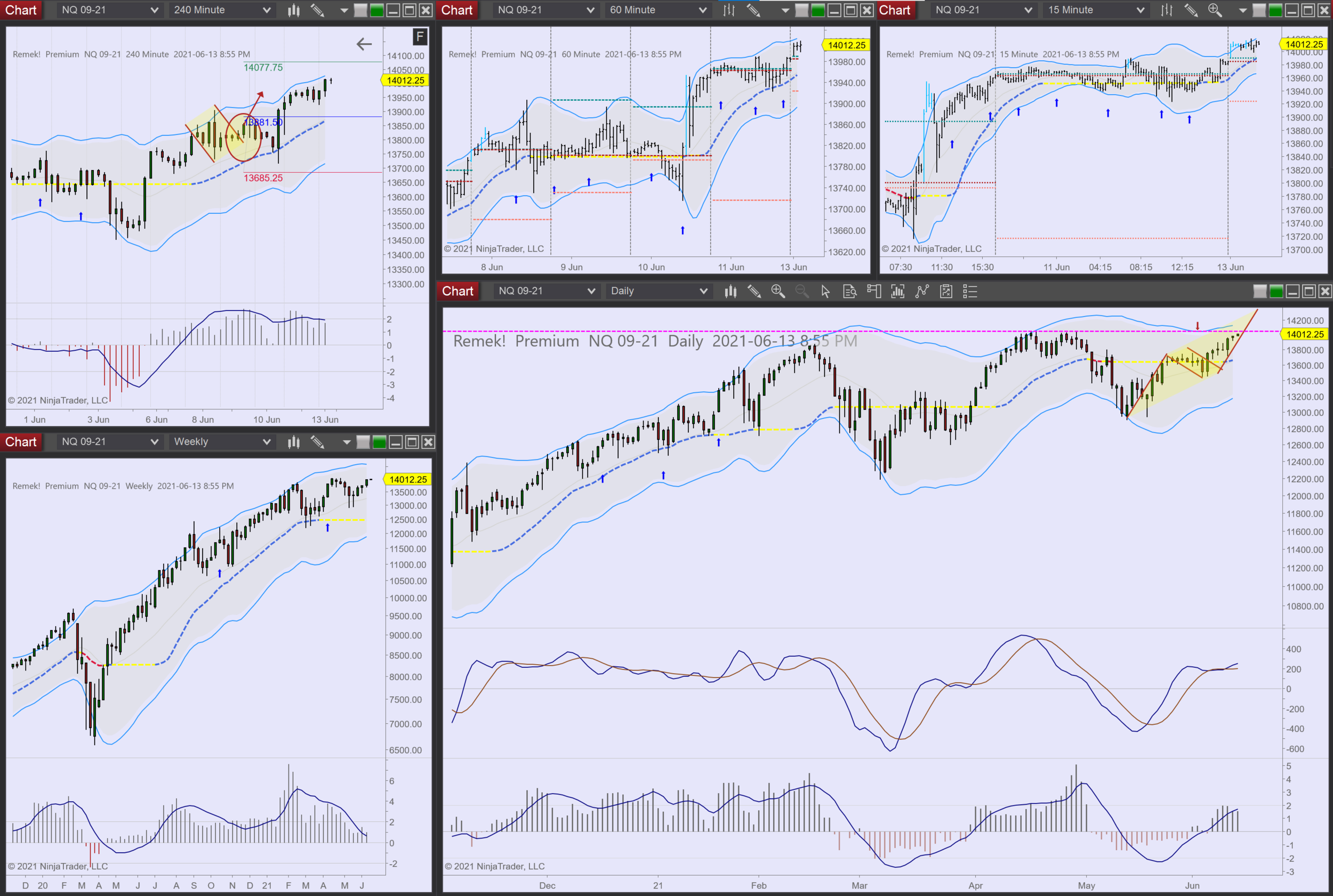

Indexes: ES, NQ at new highs. No momentum, but no rejection either. Expect little action before 2pm ET.

Currencies: standing by

Commodities: NG long in progress (but intraday selloff). HG selloff (still bullflag on weekly).

Cryptos: BTC expected to move higher.

Financials: short setup on ZN 240min

fOR THE TRADING DAY OF tuesday, 2021 06 15

News at 8.30am, 9.15am ET.

Indexes: ES, NQ at new highs.

Currencies: DX bullflag/6E bearflag on 240min.

Commodities: NG long in progress. HG has failed dramatically (but no harm done).

Cryptos: BTC long in progress.

Financials: watching weekly bearflag on ZB/ZN. Long-term opportunity (no trigger yet).

fOR THE TRADING DAY OF monday, 2021 06 14

Note: expect low volatility environment to continue on the indexes. Upward grind likely to continue.

No News.

Indexes: bulls in control. Consider being positioned. RTY looks best.

Currencies: DX standing by.

Commodities: GC/SI no momentum. NG monitoring for next long. CL/HO previous highs nearby, likely to get tested. HG long setup.

Cryptos: BTC long in progress.

fOR THE TRADING DAY OF friday, 2021 06 11

News at 8.30am.

Indexes: bulls in control. Consider being positioned.

Currencies: DX expected to more lower. Longs setting up on major pairs, e.g. 6A, 6B, 6S.

Commodities: GC/SI moving. NG has hit 1R.

Cryptos: BTC potential measured move.

9am update:

fOR THE TRADING DAY OF thursday, 2021 06 10

News at 8.30am. Also: several contracts are rolling over tonight!

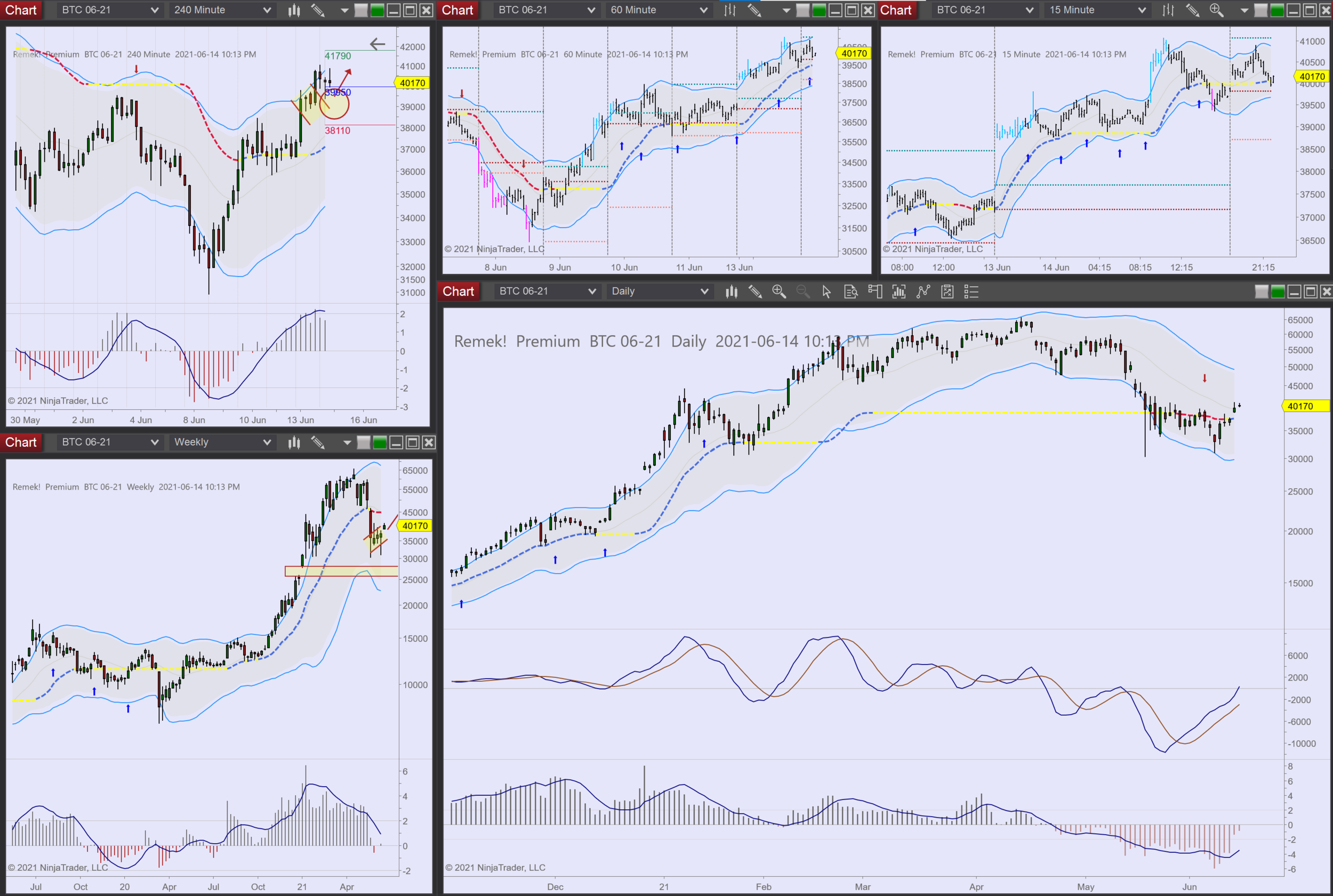

Indexes: upside pressure continues, breakout likely, question is how and when.

Currencies: standing by for clarity.

Commodities: GC/SI waiting for momentum. NG expected to move up.

9am update:

fOR THE TRADING DAY OF Wednesday, 2021 06 09

News at 10.30am (CL/HO).

Note: continue to focus on index longs. No change since yesterday.

Indexes: upside pressure continues. Potential measured move on NQ, RTY continues to lead.

Currencies: DX downmove expected on daily. Long setup on 6S.

Commodities: GC/SI waiting for momentum. NG triggered but then fall back.

9am update:

fOR THE TRADING DAY OF tuesday, 2021 06 08

News at 8.30am.

Indexes: good moves today, and more expected. RTY expected to continue leading.

Currencies: DX downmove expected on daily. Long setups on 6S, 6A.

Commodities: GC long setup. NG expecting an upside break.

8.30am update:

fOR THE TRADING DAY OF Monday, 2021 06 07

No News.

Indexes: Positioned to break new highs. Measured move potential on NQ, volatility compression on RTY. Markets don’t get more bullish than this.

Currencies: DX back’n’forth continues, with likely resolution to downside on daily/weekly. A few potential longs on the 240min on major pairs.

Commodities: GC/SI no clear momentum, a potential drift to the upside. HG bullflag on weekly. NG expecting an upside break (could develop into the ‘trade of the summer’)

Agriculturals: ZC, ZS longs completed. ZW setting up long.

9am update:

fOR THE TRADING DAY OF Friday, 2021 06 04

News at 8.30am ET.

Note: Thursday session ended where it started: selling was absorbed, which is not bearish. A slight bullish tilt going into the weekend. What could become a low volatility “boring” Friday.

Indexes: Looking for longs, but do not press trades on a Friday.

Currencies: DX continues its frustrating dance on the daily. A few quick shorts likely on major pairs.

Commodities: GC/SI selloff on Thurs, monitoring what’s next. HG a potential failure test on the 240min. NG hasn’t triggered.

Agriculturals: ZC, ZS long setups valid, but no trigger yet.

8am update: cautiously expecting a bullish session on the indexes. Be on the lookout for signs of failure. Other than that, we continue to be bullish. We also note NG’s clearing the deck both ways, perhaps a precursor to a substantial move.

fOR THE TRADING DAY OF thursday, 2021 06 03

News at 8.30am ET.

Note: what looks like quiet accumulation on the markets, it’s important to pay attention!

Indexes: A breakout likely any time now.

Currencies: Looking for longs on major pairs.

Commodities: GC/SI further upside expected. CL/HO 1R and more. NG moving up.

Agriculturals: ZC, ZS completed 1R, further upside in progress.

9am update:

fOR THE TRADING DAY OF Wednesday, 2021 06 02

News at 8.15am.

Note: Tuesday’s action showed the importance of taking partial or full profits at 1R. 1R continues to be a sound concept. Also: we’ll review Tuesday’s lessons in the video, but mostly will wait till the morning with more concrete setups: simply, not much is happening as of 10pm ET.

Indexes: Further upside still likely. RTY looks best.

Currencies: DX continues its dance, nonetheless, the ultimate resolution is likely to be to the downside. Looking for longs on major pairs.

Commodities: SI hit 1R, GC/SI further upside expected. CL/HO 1R or close completed on Tuesday. NG hit 1R, HG long setup still valid.

Agriculturals: ZC, ZS complete 1R, further upside expected.

9am update:

fOR THE TRADING DAY OF tuesday, 2021 06 01

News at 9.45am, 10am ET.

Indexes: Upside break likely.

Currencies: DX bullish measured move on 240min completed. Longs setting up on major pairs: 6B, 6S, 6C

Commodities: GC/SI expected to break to the upside. CL/HO longs in progress. NG expected to move higher. HG long setting up.

Cryptos: BTC expected to move higher, although no clear setup.

9am update: