For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Terms and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.-

I'm new to this. Where do I start?

Start with the Documentation. See link above. Then you may want to read through the documentation of our software products to see how we go about interacting with the markets.

-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We provide a morning brief for the day's trading session around 8am Eastern Time. We also post updates as necessary during the day, starting with a "Morning brief" pre-session, Eastern Time.

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. (Without an edge, there is no point in risking a single dollar on the markets.)

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

- We're often wrong. After all, we work with probabilities, and this work is all about the future. The unknown. We judge our work not by how many times we're right or wrong, but - to paraphrase one of the best traders of all time - by 'how much we make when we're right and how much we lose when we're wrong'.

FOR THE TRADING DAY OF friday, 2021 01 29

News at 8.30am ET

Note: we haven’t seen this much uncertainly on many markets in a long while. We can’t control the market. We only trade if there’s a reason. See video for details.

Indexes: sitting at 50%, waiting for clues

Currencies: DX timeframe conflict, standing by.

Commodities: SI suggests the next move is up for precious metals

Cryptos: long setup on BTC

Agriculturals: ZC, ZS long setups

8.30am ET update: being rewarded on BTC, SI. GC is expected to move. Currencies on the move.

FOR THE TRADING DAY OF thursday, 2021 01 28

News at 8.30am, 10 ET.

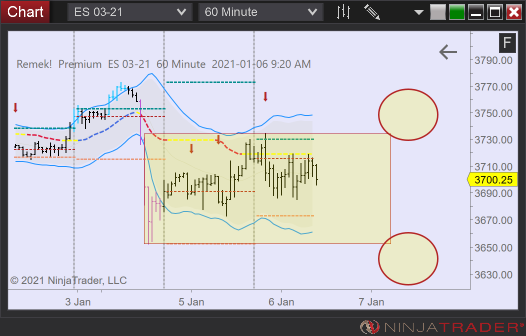

Indexes: expecting a rebound on the ES (https://tinyurl.com/yyg8o3e7) . If no rebound, a short anti may emerge.

Currencies: DX (https://tinyurl.com/yxqn59w5) standing by.

Commodities: NG (https://tinyurl.com/y2zwungb) (or its mini: QG (https://tinyurl.com/y5t43p5t) long setting up

Cryptos: long setting up on BTC (https://tinyurl.com/y4bgpzyp)

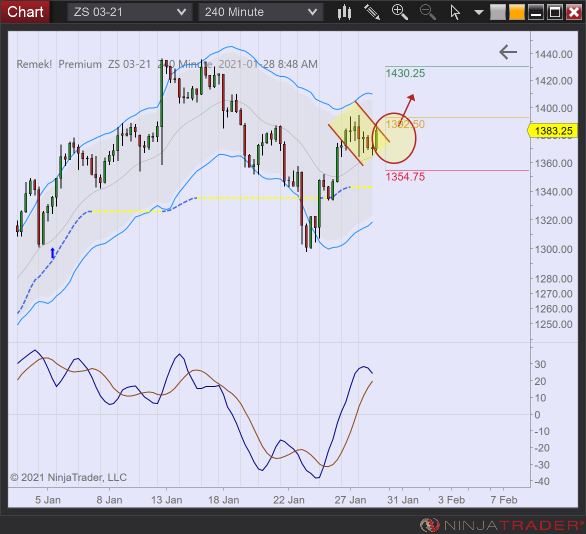

Agriculturals: long setting up on ZS (https://tinyurl.com/y5l3krpv)

2pm ET update:

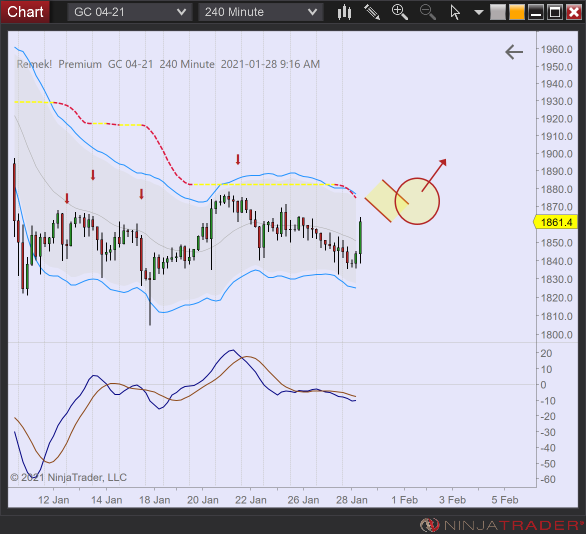

9am update: ES overnight retest suggests rebound. Long setup on ZS, BTC. GC breaks to the upside, monitoring for first pullback

FOR THE TRADING DAY OF wednesday, 2021 01 27

News at 8.30am, 10.30 ET. FOMC at 2pm ET, a potential market mover.

Indexes: standing by

Currencies: DX evolving into a bearflag on daily. Standing by on major pairs.

Commodities: GC, SI nothing to do.

Agriculturals: short setup has failed on ZW, waiting for first pullback

9am ET update: note major support levels on indexes. Monitoring if selling pressure is absorbed. DX in equilibrium, we’ll have to wait for some trending action. Waiting for 2pm FOMC’s potential effect. Grains continue to move higher.

FOR THE TRADING DAY OF TUESDAY, 2021 01 26

News at 10am ET. FOMC on Wednesday, a potential market mover.

Note: little happening, it’s okay to stand by.

Indexes: waning of momentum, market waiting for catalyst

Currencies: DX several days of tight range, measured move potential on daily. Standing by on major pairs.

Commodities: GC, SI slight upward bias, market waiting for catalyst. Expecting bullflag on NG.

Cryptos: BTC timeframe conflict: bearflag on 240min, bullflag on daily. Gap below may get filled, which may be a buying opportunity.

Agriculturals: short triggering on ZW

10am update: DX moving, long on 6E. Monitoring for a breakout on the ES and GC.

FOR THE TRADING DAY OF MONDAY, 2021 01 25

No News.

Indexes: ES, NQ, RTY a strongly bullish market: we’re long until the market tells us we’re wrong. Trying to navigate this intraday is probably not the best way to make the most of this environment. Building micro positions overnight is a valid alternative to intraday trading.

Currencies: DX expecting the 240min bearflag to start moving. On the lookout for longs on major pairs.

Commodities: GC, SI sideways for now, standing by.

Cryptos: BTC timeframe conflict: bearflag on 240min, bullflag on daily. If you go with the 240min bearflag, do not overstay your welcome if/when the daily takes control.

9am update:

FOR THE TRADING DAY OF FRIDAY, 2021 01 22

Note: less than usual certainty. Do not rush in on a Friday. Wait for clear triggers. Price action points towards consolidation (sideways) on most markets.

News at 9.45am, 10am, 11am ET.

Indexes: ES first pullback on 240min, RTY sideways, NQ leading. Wait for clear trigger.

Currencies: DX expected to move down. 6B, 6N long setting up. Wait for clear trigger.

Commodities: GC, SI sideways for now, standing by

2pm ET update: GC: Bottom tails suggest selling is absorbed. DX: Little clarity on currencies today. A reminder that "little clarity" is the market's normal state. We'll continue to be on the lookout for a potential breakdown on this chart in the next session. Hyperboles tend to end in drama. On the lookout for an anti next week.

9am update: expect consolidation on the indexes. Monitoring for a bearflag on DX 240min that may lead to a long on 6E. Do not force trades today. Monitoring for a trigger on BTC. ZS

fOR THE TRADING DAY OF thursday, 2021 01 21

News at 8.30am ET.

Indexes: ES hit 1R on daily, RTY working on 1R on 240. 4th green day on the ES in a row, a consolidation at this general level is expected. A strongly bullish environment.

Currencies: DX daily expected to become a bearflag, and in control of LTF. Bearflag on weekly. Bullish setups on major pairs confirm this scenario. This is a slow process on the DX, since ultimately this is a pattern on the weekly.

Commodities: GC, SI what seems to be bullish accumulation continued, expect some consolidation and a test of 1900 on the GC soon. HG long about to trigger.

Agriculturals: ZW bullflag intact, expecting a move to the upside.

9am ET update: expecting consolidation on the indexes. Longs setting up on 6E, 6S, 6N. Expecting trigger on ZW.

fOR THE TRADING DAY OF wednesday, 2021 01 20

Note: Inauguration Day in the US. An event that can move the market.

News at 8.30am ET.

Indexes: nothing bearish about this market. That said, political events may effect the markets, always be on the lookout for surprises.

Currencies: DX is expected to finally go lower, bullish setups on major pairs, just on the daily

Commodities: GC, SI bullish accumulation most likely, HG volatility compression expect to get resolved to the upside

Cryptos: BTC lesson that volatility compression can get resolved either way

8.30am ET update: RTY, ES, 6A setting up for intraday longs

fOR THE TRADING DAY OF tuesday, 2021 01 19

No News.

Indexes: nothing bearish about this market. That said, political events may effect the markets, always be on the lookout for surprises.

Currencies: DX is expected to finally go lower, bullish setups on major pairs, just on the daily

Commodities: bullish overall, including metals, energies

Cryptos: BTC pushing higher, volatility compression

9.30am update:

fOR THE TRADING DAY OF friday, 2021 01 15

News at 8.30am, 9.15am ET

Note: Monday is a holiday in the US, markets closed. (but we’ll have a workshop, we hope to see you there)

Indexes: sideways consolidation

Currencies: timeframe conflict on DX, 6C, 6B working, loss of momentum on 6A

Commodities: HG triggered on daily, HO 1R in progress,NG loss of momentum (for now)

Agriculturals: ZW working on 1R

9am ET update: weakness on the indexes before the long weekend. See support levels on chart below. Probably only a sideways consolidation though. Weakness on GC: potential for a measured move extension to the downside. ZW: 1R reached. DX strength creates difficult environment for longs on major pairs. Manage your positions, and respect your stops.

fOR THE TRADING DAY OF thursday, 2021 01 14

News at 8.30am, 10.30am ET (NG)

Indexes: this market is going up

Currencies: long setups on 6A, 6N, 6C

Commodities: NG, HO, HG setting up long

Agriculturals: ZW setting up for next long

9am ET update: an upside extension expected on ES, NQ. Wait for clear trigger (either breakout trade, or first pullback after breakout). “News risk” is never zero, especially in extraordinary times like this. Be ready for the unexpected. That said, any selloff, if it occurs at all, is likely to become a buying opportunity weeks out.

GC Study: see below one way flags can fail. Expect the crowd to join once 1860ish level is clearly broken. However, breaking 1820 would mean the bears won this (for now, since all this yo-yo is within the weekly bullflag, with the most likely meaning of “momentum building up”).

Currencies: daily structures (6A, 6N, 6C) have not - or in the case of 6C, just about) triggered. (Most likely you would not have entered 6C since the other two were weak.)

Focus on index longs after the open, but wait to see if initial action is constructive.

fOR THE TRADING DAY OF wednesday, 2021 01 13

News at 8.30am, 10.30am ET

Indexes: this market is going up

Currencies: DX “bearish momentum likely to re-emerge” we said yesterday, and that’s what is happening. Setups on major pairs, including 6C on the daily

Commodities: GC/SI bulls expected to regain control. No action item for now.

Cryptos: monitoring for a gapfill on daily, a potential entry point for longs if and when it happens.

Agriculturals: excellent 1R long on ZW

9am update: expecting a bullish advance on the indexes.

fOR THE TRADING DAY OF TUESDAY, 2021 01 12

No News.

Note: patience, only a few good setups right now: NQ, RTY. Others (ZW, 6A, 6N) in the works.

8.30am update: ZW triggered, longs setting up on 6A, 6N, and also on the indexes (ES, RTY, NQ)

fOR THE TRADING DAY OF monday, 2021 01 11

Always be aware of major News items (marked in red) with the potential to impact volatility on your timeframe.

Indexes: strong buying for several days. Wait for pullback on at least the 240min timeframe to participate (if not long yet)

Currencies: DX bearish momentum likely to re-emerge. Bearflag on daily. Give it a little time.

Commodities: GC major failure on 240min timeframe. Long-term bull’s case still at play, but no action item for now.

Cryptos: monitoring for a gapfill on daily, a potential entry point for longs.

Agriculturals: monitoring for a long on ZW

9am update: Expect a riskier than usual trading environment in the next week or so, for real-world reasons known to us all. It’s okay to scale back or take a week off, or turn to micro contracts just to stay in shape. Cash is a valid position. DO NOT FORCE TRADES IF THERE ARE NO GOOD SETUPS and when expected setups do not produce a trigger as in 6A, 6N.

Waiting to see where ES holds.

No longs on currencies, precious metals for now.

ZW looks good for a potential long on the daily (you may have been triggered in.)

Waiting to see where BTC holds (gap below)

fOR THE TRADING DAY OF friday, 2021 01 08

Always be aware of major News items with the potential to impact volatility on your timeframe.

Indexes: very strong buying to start the new year, what we see is probably optimism priced in. Seize any opportunity to join the trend, this market may not look back.

Currencies: DX bearish momentum fades. Still some good setups on 6A, 6N, 6C. Watching 6S, 6J for clues.

Commodities: GC waiting for clues short-term, no change in long-term bullishness

Agriculturals: ZW setting up for a long on the daily, something we’ve been waiting for.

9am ET update: no change since last night

fOR THE TRADING DAY OF thursday, 2021 01 07

News at 8.30am ET.

Note: we know political events have the capacity to effect the markets. That said, as technical traders, our job is to focus, objectively, on our proven technical setups. That, the charts, should be our focus in the days and weeks to come.

Indexes: markets continue to be bullish. For us, the next potential engagement point would be the first pullback after the breakout - if and when it comes. Excellent overnight trade on RTY, see yesterday’s chart.

Currencies: DX expected to slide further, longs setting up on 6E, 6B. Excellent 1R on 6N. Do not chase 6A. Monitoring 6J for a long.

Commodities: GC pullback on daily

Agriculturals: monitoring for next pullback on ZW

9am ET update: expecting a bullish session on the indexes and another break to the upside. Monitoring 6A, 6B, SI for longs. NG has triggered.

fOR THE TRADING DAY OF wednesday, 2021 01 06

News at 10.30am ET (CL), 2pm ET FOMC.

Indexes: awaiting clarity after GA election, FOMC. Bullish setup on RTY

Currencies: DX expected to slide further

Commodities: GC expect consolidation above 1900, SI setting up for another long.

9.30am ET update: 1R reached on 6N, RTY. 6J setting up (and then failed). FOMC, election uncertainty: we’re scaling back today.

fOR THE TRADING DAY OF tuesday, 2021 01 05

News at 10am ET.

Indexes: waiting for the resolution of the Anti on the ES

Currencies: DX expected to slide further, setups on 6E, 6A

Commodities: GC expect consolidation above 1900, SI setting up for another long. bullflags on HG, NG

9am ET update: focusing on longs on HG, NG. ZW breaking above 650. Anti on ES.

12pm update:

fOR THE TRADING DAY OF Monday, 2021 01 04

No News.

Indexes: bullish context, but do not chase

Currencies: DX expected to slide further, setups and/or longs trades in progress on 6E, 6C, 6J, 6A

Commodities: GC/SI bullish moves in progress

Cryptos: BTC likely not done yet, but don’t enter into this structure

Agriculturals: ZW long trade reached 1R

9.30am ET update: