For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Terms and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.-

I'm new to this. Where do I start?

Start with the Documentation. See link above. Then you may want to read through the documentation of our software products to see how we go about interacting with the markets.

-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We provide a morning brief for the day's trading session around 8am Eastern Time. We also post updates as necessary during the day, starting with a "Morning brief" pre-session, Eastern Time.

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. (Without an edge, there is no point in risking a single dollar on the markets.)

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

- We're often wrong. After all, we work with probabilities, and this work is all about the future. The unknown. We judge our work not by how many times we're right or wrong, but - to paraphrase one of the best traders of all time - by 'how much we make when we're right and how much we lose when we're wrong'.

NOTICE: a few subscribers wrote asking about emails. You should be getting one email in the evening (ET), one in the morning (ET), and an occasional “emergency email” during the day if there’s an opportunity not mentioned in the video. If you’re not seeing those emails, check your spam folder and whitelabel them. If you can’t find those emails, write to me and I’ll investigate. You may also want to keep this page open when you trade as these pages may get updated any time. Thank you!

fOR THE TRADING DAY OF wednesday, 2020 12 30

THIS IS OUR LAST UPDATE THIS YEAR. WE’LL BE BACK SUNDAY NIGHT. HAPPY NEW YEAR!

News at 8.30am ET.

Indexes: anti on RTY: caution!

Currencies: DX slides, setups and/or longs in progress on 6E, 6C, 6J, 6A

Commodities: GC/SI bullish pressure in progress

Cryptos: BTC likely not done yet, but don’t enter into this structure

Agriculturals: ZW long setup still valid

9am ET update: anti on RTY: no longs on the indexes until this gets resolved. Moves as expected on currencies. Long setup on ZW, GC.

fOR THE TRADING DAY OF tuesday, 2020 12 29

No News.

Indexes: ES all time high, RTY pullback in the works, Santa Claus rally in progress

Currencies: DX slide in progress, expecting a long on 6C

Commodities: GC/SI bullish pressure from HTF, bullish setups on CL, HO.

Cryptos: BTC likely not done yet, but it’s hard to go long after an overextended run

Agriculturals: ZW long setup still valid

9am ET update:

fOR THE TRADING DAY OF monday, 2020 12 28

No News.

Indexes: RTY above 2000, equity indexes strong, Santa Claus rally in progress

Currencies: DX slide in progress, look for longs on majors, including 6C which is also correlated with CL

Commodities: GC/SI extreme bullish pressure from HTF, GC at 1900. SI lagging with great long term potential. Bullish setups on CL, HO. HG moving.

Cryptos: BTC 28000 we said a few days ago. See chart.

Agriculturals: Grains on a roll, watch ZW for an upside move

9am ET update: ES trending day potential (use RemekCurrentDayOHL to guide you) GC, CL, 6J monitoring for long

fOR THE TRADING DAY OF thursday, 2020 12 24

No News. SHORT SESSION TOMORROW. Very little happening. Merry Xmas, happy holidays to all! We’ll be back on Sunday evening.

Indexes: RTY at 2000 (as expected)

Currencies: DX no new information, likely to get resolved to the downside, 6J working on a long

Commodities: GC/SI no momentum, waiting for clues

Cryptos: next leg up expected on BTC, on the lookout for a breakout

Agriculturals: ZW in first pullback after the breakout

fOR THE TRADING DAY OF wednesday, 2020 12 23

News at 8.30am, 10am, 10.30am (CL/HO) ET.

Indexes: waiting for clues

Currencies: DX surprising strength in the past two days, but weekly still likely to be in control, 6E, 6J, 6S working on moves to the upside

Commodities: GC/SI no momentum, waiting for clues

Cryptos: next leg up expected on BTC, on the lookout for a breakout

Agriculturals: ZW likely to be working on a mearured move to 650

8.30am ET update: in focus: ZW, BTC, NQ

fOR THE TRADING DAY OF tuesday, 2020 12 22

Note: expect lower than average volumes as we head into Xmas on Friday. We’ll upload a video as necessary.

News at 8.30am, 10am ET.

Indexes: buyers stepped up today, further upside expected

Currencies: DX expected to slide after big top tail, look for longs on major pairs

Commodities: GC/SI breaking out on weekly (this is, potentially, a major move)

12pm ET update:

9am ET update: watching GC, BTC for longs

fOR THE TRADING DAY OF monday, 2020 12 21

No News.

Indexes: further upside expected (wait for trigger on 240min)

Currencies: DX expected to slide, look for longs on major pairs

Commodities: GC/SI breaking out on weekly (this is, potentially, a major move)

Cryptos: BTC not much consolidation, think next long

Agriculturals: ZW triggering on 240min, do not chase ZS, 1R reached on ZC

8.30am update: uncertainty coming from the UK overnight may cause a flight to safety (i.e. into bonds). Monitoring for clues.

fOR THE TRADING DAY OF friday, 2020 12 18

No News.

Indexes: further upside expected

Currencies: major pairs consolidating after big moves

Commodities: expect further upside on GC/SI based on weekly structure

Cryptos: BTC expect consolidation

Agriculturals: ZW triggering on 240min

9am update:

fOR THE TRADING DAY OF thursday, 2020 12 17

Note: excellent trading conditions. See video for details.

News at 8.30am ET.

Indexes: further upside expected

Currencies: excellent trading conditions on major pairs

Commodities: beautiful action on HO, CL, 1R reached on both, GC/SI long moves in progress

Cryptos: BTC 22,000: we’re good at this

Agriculturals: ZW weekly bullflag, bullflag on 240min in progress, setup valid

9am ET update: long setup on ZS. Measured move achieved on SI. Expect a little consolidation on major pairs. Bullish on the indexes.

fOR THE TRADING DAY OF wednesday, 2020 12 16

News at 9.15am ET. FOMC at 2pm ET.

Indexes: breakout imminent

Currencies: long setups on 6E, 6S, 6B

Commodities: HO, CL longs setting up, GC/SI long moves in progress

Cryptos: BTC bullish advance likely to be next

Agriculturals: ZW weekly bullflag, bullflag on 240min in progress

9am update:

fOR THE TRADING DAY OF Tuesday, 2020 12 15

News at 9.15am ET. FOMC on Wednesday.

Indexes: consolidating with a breakout likely to follow

Currencies: long potential on 6E, 6S, 6B

Commodities: HO, CL longs setting up, volatility compression on GC/SI

Cryptos: BTC gap up, bullish advance likely to be next

Agriculturals: ZW weekly bullflag, bullflag on 240min in progress

1pm update: excellent opportunities intraday

8.30am update: overnight stop entry on SI. See intraday potential on 6J.

fOR THE TRADING DAY OF monday, 2020 12 14

No News.

Note: several important setups below.

Indexes: consolidating with a breakout likely to follow, RTY attacking 2000

Currencies: 6J triggering

Commodities: longs setting up on CL, HO

Cryptos: BTC gap up, bullish advance likely to be next

Agriculturals: ZW weekly bullflag, wait for next bullflag on 240min

9.30am update:

fOR THE TRADING DAY OF friday, 2020 12 11

News at 8.30am ET.

Indexes: consolidation on the indexes

Currencies: DX sliding, long on 6E, 6S, 6A reached 1R, 6J moving on daily

Commodities: GC/SI bullish move expected on 240min, 1R reached on CL

Cryptos: BTC long setup on daily still valid at this point

Agriculturals: ZW weekly bullflag, bullflag on 240min

9am update: GC, 6J longs setting up, ZW triggered, HO looking for long, BTC bullflag on daily

fOR THE TRADING DAY OF thursday, 2020 12 10

Note: index futures rolling over at midnight

News at 8.30am ET.

Indexes: “A pullback expected at this point.”, we said yesterday, and that’s what is happening.

Currencies: DX consolidating, standing by on major pairs

Commodities: GC/SI waiting for daily bearflag to, likely, fail.

Cryptos: BTC long setting up (if you trade BTC, focus!)

Agriculturals: ZW weekly bullflag

12pm update:

8am update: anti on the NQ. 6A hit 1R. ZW waiting for first pullback. Monitoring major pairs for long entries.

FOR THE TRADING DAY OF wednesday, 2020 12 09

News at 10.30am ET (CL).

Indexes: new all time high. A pullback expected at this point.

Currencies: DX consolidating, long setups on 6E, 6A, 6N, 6J

Commodities: GC/SI further upside expected

9am update: watch the ES for a breakout from the intraday range. Expecting moves on major pairs to the upside

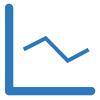

FOR THE TRADING DAY OF tuesday, 2020 12 08

No News.

Indexes: pullback expected. What we don’t know: on daily or the 240min timeframes. We’re monitoring.

Currencies: no change since yesterday. If long, manage position

Commodities: GC/SI working on more upside. Expecting 1900 on GC. SI great setup on weekly.

Cryptos: BTC long setup still valid on daily, target 22,000

2.30pm update:

8.30am update: long potential on GC, SI, CL, 6J, 6E

FOR THE TRADING DAY OF monday, 2020 12 07

No News.

Indexes: pullback expected on daily

Currencies: longs setting up on 6E, 6S, 6J

Cryptos: BTC long setting up

9am update: ES you can look a long out of this bullflag, just know that a re-test of the previous breakout level is possible. 6J, 6E, 6S expecting long to trigger. GC long entry in the works on the 240min (although daily, technically, not ready yet. Note: moves do start on the smaller timeframe)

FOR THE TRADING DAY OF friday, 2020 12 04

News at 8.30am ET.

Indexes: on the lookout for a long entry

Currencies: longs setting up on 6A, 6J, looking for pullback on daily 6S

Commodities: SI about to trigger, measured move expected on daily. CL triggered on daily NG: missed short on daily

Cryptos: BTC long setting up

9am update: no change since last night

FOR THE TRADING DAY OF thursday, 2020 12 03

News at 8.30am ET.

Indexes: bullish bias, on the lookout for a long entry

Currencies: USD weakening, longs in progress or completed on major pairs, expecting continued slide on the DX

Commodities: GC/SI monitoring for first pullback about to trigger, could be excellent entry based on weekly. Expecting long trigger on CL

9am update: an important day, we must pay attention. DX as expected, major pairs as expected, GC/SI as expected, 6N grinding, 6J daily setting up. An abundance of opportunities.

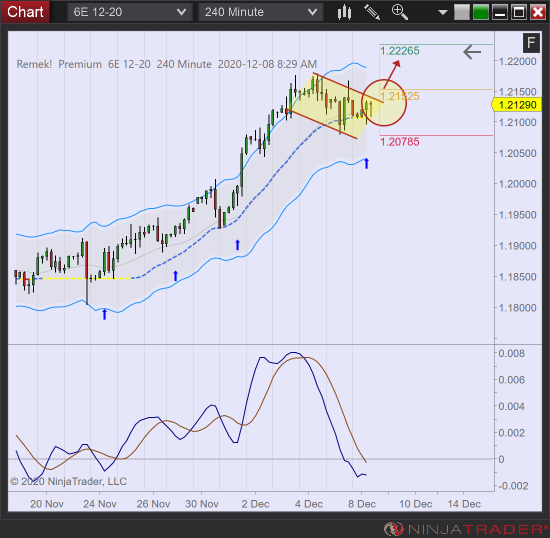

FOR THE TRADING DAY OF wednesday, 2020 12 02

News at 10.30am ET (CL).

Note: no real new information, we’ll wait with the video till the morning. Trade room open at 10am, join us then (link will be here in the morning)

Indexes: bullish move to new highs in progress

Currencies: USD weakening, longs in progress on major pairs

Commodities: GC/SI monitoring for first pullback

8.30am update:

FOR THE TRADING DAY OF tuesday, 2020 12 01

News at 10am ET.

Indexes: bullish move to new highs in progress

Currencies: expecting USD weakening, long setups on major pairs continue

Commodities: GC/SI may be in the process of putting in lows

Financials: ZB/ZN monitoring for a useable bullflag

Agriculturals: ZW long potential evaporated, for now

3.30pm update: 6E, 6S, 6N working, ES, BTC longs still valid

9am update: looking for first pullback on GC/SI, long on 6E/6S, expecting upside break on ES/RTY, 6N, BTC