For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Terms and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.-

I'm new to this. Where do I start?

Start with the Documentation. See link above. Then you may want to read through the documentation of our software products to see how we go about interacting with the markets.

-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We provide a morning brief for the day's trading session around 8am Eastern Time. We also post updates as necessary during the day, starting with a "Morning brief" pre-session, Eastern Time.

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. (Without an edge, there is no point in risking a single dollar on the markets.)

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

- We're often wrong. After all, we work with probabilities, and this work is all about the future. The unknown. We judge our work not by how many times we're right or wrong, but - to paraphrase one of the best traders of all time - by 'how much we make when we're right and how much we lose when we're wrong'.

video to follow. room open at 10am ET, join us!

for the trading day of Monday, 2020 11 01

Indexes: range-bound day expected, staying out is okay

Commodities: on the sidelines

Currencies: DX range-bound means setups on major pairs are more likely to fail, on the sidelines

Cryptos: BTC bullish breakout triggered

for the trading day of friday, 2020 10 30

Indexes: range-bound day behind us, a re-test of 3200 on the ES is in the cards, expect increased uncertainty leading up to the US elections.

Commodities: on the sidelines

Currencies: on the sidelines

Cryptos: BTC bullish breakout setting up

Agriculturals: monitoring for a long on ZW daily

9am update: monitoring for price action in first 15 min. after the open, interested in long if we break the overnight high. GC potential intraday long. Monitoring for long on BTC.

for the trading day of thursday, 2020 10 29

Indexes: this may be a shift in sentiment, will be watching the open

Commodities: on the sidelines

Currencies: watching potential setups on 6J, 6S. Be very selective with entries

Cryptos: BTC monitoring for potential long

9am update: Expect range-bound on the ES as a default. A break of the low may give us a short opportunity, until then, standing by. USD strength emerges overnight on currencies. CL, GC drops. Capital preservation and risk-off mode, leading up to the US elections: be selective.

for the trading day of wednesday, 2020 10 28

News at 8.30am, 10.30am (CL) (ET) .

Indexes: long-term still bullish, short-term: on the sidelines

Commodities: GC/SI bullflags on 240min, monitoring for first pullback on 240min

Currencies: DX complex bearflag on 240min, on the lookout for further longs on major pairs.

Cryptos: BTC good long working on 1R with more to go

9.30am update: surprising overnight action on ES. We’ll have to see if buyers emerge after the open. If not, that may be indication of a major change of sentiment. Same on GC. DX: the less likely scenario is evolving, see video.

for the trading day of tuesday, 2020 10 27

News at 8.30am, 10am (ET) .

Indexes: complex bullflag on daily

Commodities: GC/SI bullflags on 240min, monitoring for long triggers

Currencies: DX complex bearflag on 240min, long setups or triggers on several major pairs. 6J has triggered.

12pm update: BTC, 6N, 6J moving

9am update: ES - expecting a visit to the 3440 area. Once we have that, we’ll look for signs of upside pressure out of the channel, and look to participate. Major currency pairs: moving as expected, with a few having triggered. BTC: triggered, long in progress.

for the trading day of monday, 2020 10 26

News at 10am (ET) .

Indexes: bullish breakout highly probable

Commodities: GC/SI bullflags on 240min, standing by

Currencies: DX bearflag, long setups on several major pairs: 6E, 6J, 6S

Financial: potential short on ZN

Agriculturals: ZW, ZC, ZS long trend continues, waiting for opportunity (pullback) to participate

4pm update:

9am update: ES, 6E, GC: waiting for upside momentum BTC: waiting for long trigger

for the trading day of Friday, 2020 10 23

News at 9.45am (ET) .

Indexes: bullish breakout highly probable

Commodities: GC/SI bullflags on 240min, standing by

Currencies: DX bearflag, long setups on several major pairs

9am update: ES/RTY expecting a bullish session. Currencies: moves as expected, a few have triggered already (also see last night’s video)

for the trading day of thursday, 2020 10 22

News at 8.30am, 10am (ET) .

Indexes: standing by

Precious metals: bullflags on 240min, standing by

Currencies: 6E, 6S worked, standing by

Cryptos: good call on BTC, standing by

9am update: we’re watching the setups below. Note the trigger area, no entry decision is made unless the trade triggers.

for the trading day of Wednesday, 2020 10 21

News at 10.30am (ET) (CL)

Indexes: complex bullflag on the daily, expecting an upside break

Precious metals: bullflag on the weekly that we cannot ignore: upside break in progress

Currencies: DX sliding, looking for longs on major pairs, 6E, 6S, 6A moving

9am update: 6J moves overnight. ES expecting an upside break. Managing positions on metals, currencies. BTC target reached.

ES intraday game plan: a visit (and violation) to either edge is likely. Looking for intraday bullflags once in the upper half of the intraday range, aggressively pursuing longs on a breakout.

for the trading day of tuesday, 2020 10 20

No News.

Indexes: complex bullflag on the daily, expecting an upside break

Precious metals: bullflag on the weekly that we cannot ignore: expecting an upside break on 240min/daily

Currencies: DX more of the same, 6S, 6E setting up, good move on 6A

2pm update:

10am update: a visit to either edge of the range is likely. You can look for pullbacks after a convinsing move either way. Expect intraday traps along the way, and be ready to handle failures ("no follow-thoughs”). All in all, today's intraday action is expected to be in this range, with a slight bullish bias. Alternatives: 6S, 6E, BTC, ZW potential longs on pullbacks.

9am update: good trades/analyses on 6E, 6S, BTC. 6A working. Standing by on the indexes for now.

for the trading day of monday, 2020 10 19

No News.

Indexes: bullflag on the daily, expecting an upside break

Precious metals: bullflag on the weekly that we cannot ignore: expecting an upside break on 240min/daily

Currencies: DX continues to lack momentum, expecting a long on 6J and a short on 6E, 6A

Agros: strong momentum on ZW continues

1pm update:

9am update: expecting a bullish move on ES/RTY, 6J. GC, 6E, 6S move overnight. Looking for pullback on 6E (note bullflag on 6E weekly)

for the trading day of friday, 2020 10 16

News at 8.30am.

Indexes: further upside expected after a pullback

Currencies: shorts setting up on 6A/6N, 6E

Agros: good work on ZW, further upside expected

9am update: ES look for long on the breakout. Monitoring 6A, 6N for a short, GC, BTC for longs

for the trading day of thursday, 2020 10 15

News at 8.30am, 11am (CL) (ET).

Indexes: ES bullflag developing on 240min as expected. Looking for long with momentum.

Currencies: DX sitting in the middle on the daily, difficult trading environment, 6J long with secondary entry

Commodities: GC/SI waiting for a resolution of an uncertain situation

Cryptos: tracking BTC for a long

Agros: ZW long

4pm update:

2pm update: was there anything today that didn’t work?

8am update: we have the complex pullback we anticipated on the ES/RTY, looking to go long. Long setups setting up on Financials, long setups on 6J, ZW.

for the trading day of wednesday, 2020 10 14

News at 8.30am (ET).

Indexes: ES targeting previous high, see video for what we’re looking for.

Currencies: DX pattern failure, 6J long triggered

Commodities: GC/SI short-term short setting up, while weekly remains bullish

Agros: see lesson in video

11.30am update:

9am update: planning a long with an upside break on the ES. GC shakes off the bears, at least for now. Good overnight move on 6J

for the trading day of tuesday, 2020 10 13

News at 8.30am (ET).

Indexes: ES targeting previous high, but a bit overextended (see below). On the lookout at what happens there.

Currencies: DX dropping, on the lookout for longs on several major pairs: 6E, 6N, 6J look best.

Commodities: GC monitoring for long entry (see below)

Agros: long setting up on ZW

4pm update: consolidation

8am update: expect an attempt to test the previous high on the ES, but note: it’s overextended, i.e. a sharp reversal at the top is not unlikely. Long setups in the works on major currency pairs and GC.

for the trading day of Monday, 2020 10 12

No News.

Note: Columbus Day / Indigenous Peoples' Day in the US. Thanksgiving Day in Canada

Indexes: on the lookout for a pullback to go long from, targeting previous high

Currencies: DX dropping, on the lookout for longs on several major pairs: 6A, 6E, 6S, 6J, 6B (note: these potential trades are correlated)

Commodities: GC/SI on the lookout for a pullback to go long from

Agros: on the lookout for a pullback to go long from on ZW, ZS, ZC

2.30pm update: strong move on the ES

10am update:

for the trading day of friday, 2020 10 09

No News.

Indexes: upside move in progress

Currencies: DX waiting for clues, no momentum on daily

Commodities: GC/SI short technical setup evaporated, bulls in control, move in progress

Agros: pullbacks on ZW, ZS, ZC

3pm update: good work on 6J

9am update: look for bullflags to join on the indexes and GC if not long yet. Watching CL for a long. Price action on 6J point to a bullish move.

for the trading day of thursday, 2020 10 08

News at 8.30am.

Indexes: trending day behind us, expect further upside (today’s session may be one of consolidation)

Currencies: DX bullflag in the works, waiting for clues

Commodities: GC/SI short technical setup, which can easily fail. Waiting for clues

12pm update: not much movement across the board

8.30am update: expect sideways to bullish action on the indexes. No clue yet on DX. HG setting up. GC shaking off bearish potential.

for the trading day of Wednesday, 2020 10 07

News at 8.30am.

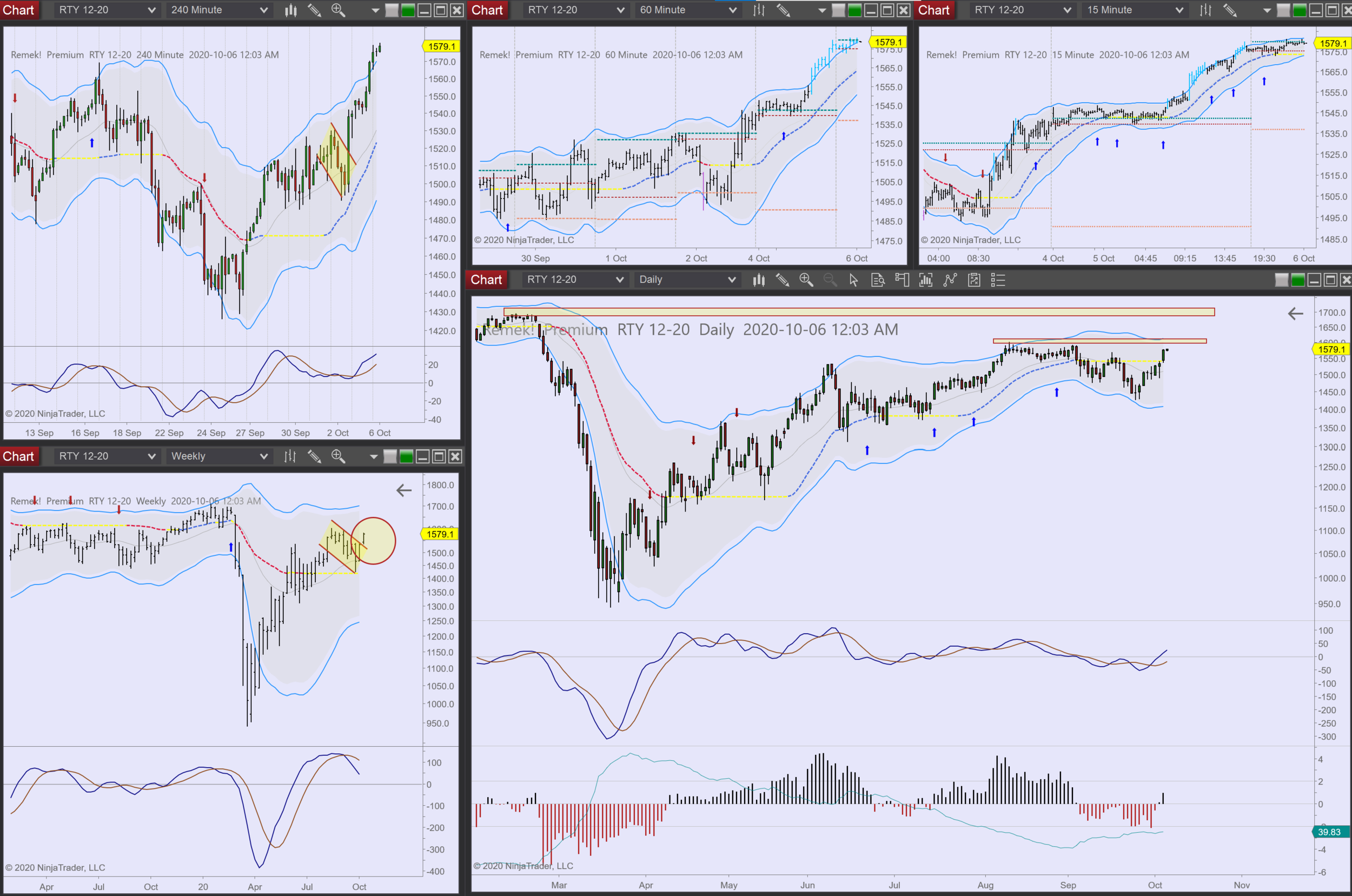

Indexes: tweet-induced drop, standing by for clues. RTY: anti setup

Currencies: USD strengthens, we have to see if it continues

Commodities: GC/SI tweet-induced selloff, probably a buying opportunity

Agros: ZW target reached

4pm update: a relatively straightforward session, see our 9am post. A day like this can pay for several years of Remek! Premium.

9am update: ES likely to retest 3400 area (strong overnight action). Wait for pullback to participate. Grains strong, but do not chase.

for the trading day of tuesday, 2020 10 06

News at 8.30am.

Indexes: ES 3400, further upside expected

Currencies: long setups on majors

Commodities: GC/SI bulls in control

Financials: ZB/ZN what risk-on mode looks like

Agros: long setups on ZW, ZS, ZC

3.30pm update: good long on ES

7.30am update: markets starting to move: GC, ES, 6E, CL all bullish.

for the trading day of monday, 2020 10 05

No News.

Indexes: ES bullish move expected. See details in video.

Currencies: DX (somewhat weak) bullflag emerging on daily. 6S triggered, monitoring for long on 6E

Commodities: GC/SI timeframe conflict, standing by. See video for details.

Agros: long setups on ZW, ZS, ZC

4pm update: ES as expected

9am update: expecting a bullish session on the ES, major pairs and GC. Focus on price action.

for the trading day of friday, 2020 10 02

News at 8.30am ET.

Note: 2am ET: The US President tests positive for Covid-19. A political news, yes, but one that is already shaping and shaking the markets: ES down, GC up. Exercise caution, but also, seize the day.

Indexes: ES bullish move expected.

Currencies: DX bullflag emerging, looking to short 6E, 6A

Commodities: GC timeframe conflict, standing by

Agros: ZS monitoring for a long

4pm update: the market has processed the news with no material change. Bullish setup on ES 240min remains. (RTY’s advance may serve as a hint for what’s to come on the large caps, we’ll see) GC practically unchanged (a fact that shows that GC ceased to act, this time too, like its traditional role as a ‘safe haven of last resort’). Caution next week: risk factors are expected in the coming weeks that we didn’t have during the easy days of summer.

10.30am update on a busy morning:

ES holding, no collapse

Bullish on major pairs

Agros moving

9am update: watch the open’s first 10 minutes to see how the market wants to process the overnight news. The setup is bearish, the question is: will buyers step in at lower prices. Quite possibly, we might end up with a range-bound day. DX: bearflag on 240min, bullflag on daily, waiting for clues. (Timeframe conflict on several major pairs, see 6S as an example below) GC: neutral, standing by.

The market has processed the news without much volatility. Most likely, today’s sessions in various asset classes will be “business as usual”. We’ll be watching for signs that we are wrong. Bullish setups on agros.

for the trading day of thursday, 2020 10 01

News at 8.30am, 10am ET.

Indexes: ES bullish move in progress, target: previous high

Currencies: 6E, 6S long in progress

Commodities: GC monitoring for long

Agros: huge moves on several markets (ZW, ZS), monitoring for pullbacks

1.30pm update: good move on GC, sideways nonsense on ES

8am update: GC, ES, 6E longs being triggered