For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Term and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.-

I'm new to this. Where do I start?

Start with the Documentation. See link above. Then you may want to read through the documentation of our software products to see how we go about interacting with the markets.

-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. We provide a morning brief for the day's trading session around 8am Eastern Time. We also post updates as necessary during the day, starting with a "Morning brief" pre-session, Eastern Time.

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade a given timeframe. If because that's where our edge is, fine. But if we want to trade a timeframe because that's what we think is the only thing we have money for, we're in trouble. We have to pick timeframe not based on our wishes, but on where our verified edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. (Without an edge, there is no point in risking a single dollar on the markets.)

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

Miscellaneous notes

- Make sure you read the Documentation, become familiar with our Market Scanner, and follow the markets every day to build intuition to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst. We also stay out of intraday trades 10 minutes before and after of major news releases.

- We're often wrong. After all, we work with probabilities, and this work is all about the future. The unknown. We judge our work not by how many times we're right or wrong, but - to paraphrase one of the best traders of all time - by 'how much we make when we're right and how much we lose when we're wrong'.

for the trading day of wednesday, 2020 09 30

News at 8.30am, 10.30am ET.

Indexes: ES complex bullflag on daily, bullish structure, if long, target 3400 as first step

Currencies: 6B long, 6C, 6N shorts setting up

Commodities: GC/SI bulls in control. CL short setting up

Cryptos: BTC long setting up

Agros: ZW long in progress

11.30am update: some days everything works. This is one of those days. Great finish for the month and for the quarter!

8am update: long on ZW. ES, GC: bullflag upside bias (but note the timeframe conflict with the daily, on which we have a doji), 6S long setting up, 6N monitoring for a short. Increased uncertainty on markets, focus on discipline, risk management!

for the trading day of tuesday, 2020 09 29

News at 8.30am, 10am ET.

Indexes: ES bullflag on weekly, trending day - one that we saw - behind us. Bulls are in control.

Currencies: DX bullflag, waiting for major pairs to move to the downside.

Commodities: GC/SI bulls took control. HO expected to break to the upside.

Cryptos: BTC hesitating, measured move has not been reached.

Financials: more of the same sideways action

12pm update: expecting bullish move on the ES, GC. Short on 6C

8am update: sideways overnight action (the default behaviour after a trending day) on the indexes: expect consolidation but be ready for a bullish breakout if and when it happens. Bullish bias on precious metals.

for the trading day of monday, 2020 09 28

No News.

Indexes: ES bullflag on weekly, a factor we cannot ignore. Bulls expected to prevail.

Currencies: More USD strength expected. Potential shorts on 240min: 6S, 6A, 6B, 6E, 6N. Potential long on daily 6J (Note: due to correlation, these are basically the same trade.)

Commodities: GC/SI another leg down likely.

Agros: ZS long setting up on daily

Cryptos: BTC “bullflag on weekly, potential measured move on 240min”, we said on Friday. Measured move now almost completed.

Financials: monitoring long potential on ZN

1pm update: clues point to an afternoon advance on the indexes

8am update: what is likely to become a trending day on the ES (put RemekCurrentDay to good use. Also: if you’re new to holding overnight positions: a large chunk of traders’ profits are made in overnight trades. Ignoring them equals forgoing some of the best trades). If you’re not long on the ES, most likely you haven’t missed anything. GC: bulls took control. Monitoring for a potential long on CL. Long setting up on BTC.

for the trading day of friday, 2020 09 25

News at 8.30am.

Note: Increased uncertainty continues. Potential catalyst at 8.30am ET. Friday: scaling back is okay.

Indexes: ES bullflag on weekly. Daily can go both ways. Will have to see if Friday ends with a selloff, or if the bulls can hold it.

Currencies: 6A, 6B, 6E shorts setting up

Commodities: GC/SI hit hard, we’ll have to see if it holds here on a Friday.

Cryptos: BTC bullflag on weekly, potential measured move on 240min

3.30pm update: a reasonable finish to an otherwise difficult week

2.30pm update: ES rally probable.

9am update: watch key levels on the ES for direction, stay out of range-bound action, monitoring 6N for a potential short (6E already triggered).

for the trading day of thursday, 2020 09 24

News at 8.30am, 10am ET.

Note: extreme weakness on equities, precious metals and major pairs against the USD. Do not chase, wait for pullbacks to participate. Weating to see what the European open does. Note also that precious metals are not behaving as safe havens (which is what they traditionally used to do in situations like this). This is important information.

Indexes: ES overnight weakness.

Currencies: USD strength means short trades on several major pairs

Commodities: GC/SI hit hard, and not done yet. Extreme strength on NG.

Cryptos: short setting up on BTC

(See below the jpg of the afternoon ES setup and trade mentioned in the video at 24:00)

11am update:

9am update: pre-open selling pressure on the ES, first time in a long time. The question: can the bulls hold this up? See potential measured move on daily. Volatility contraction on ZB/ZN with a potential upside break. Expecting consolidation on DX. Study: “The grind” along the Keltner on 6E, 6B, a pattern worth knowing, characterized by the lack of a pullback. Expecting another leg down on 6J.

for the trading day of wednesday, 2020 09 23

Room opens at 10.30am ET. Click here to register.

News at 9.45am, 10.30am ET.

Note: increased uncertainty (aka randomness) across markets. Not in a rush to get engaged unless there’s a reason to do so.

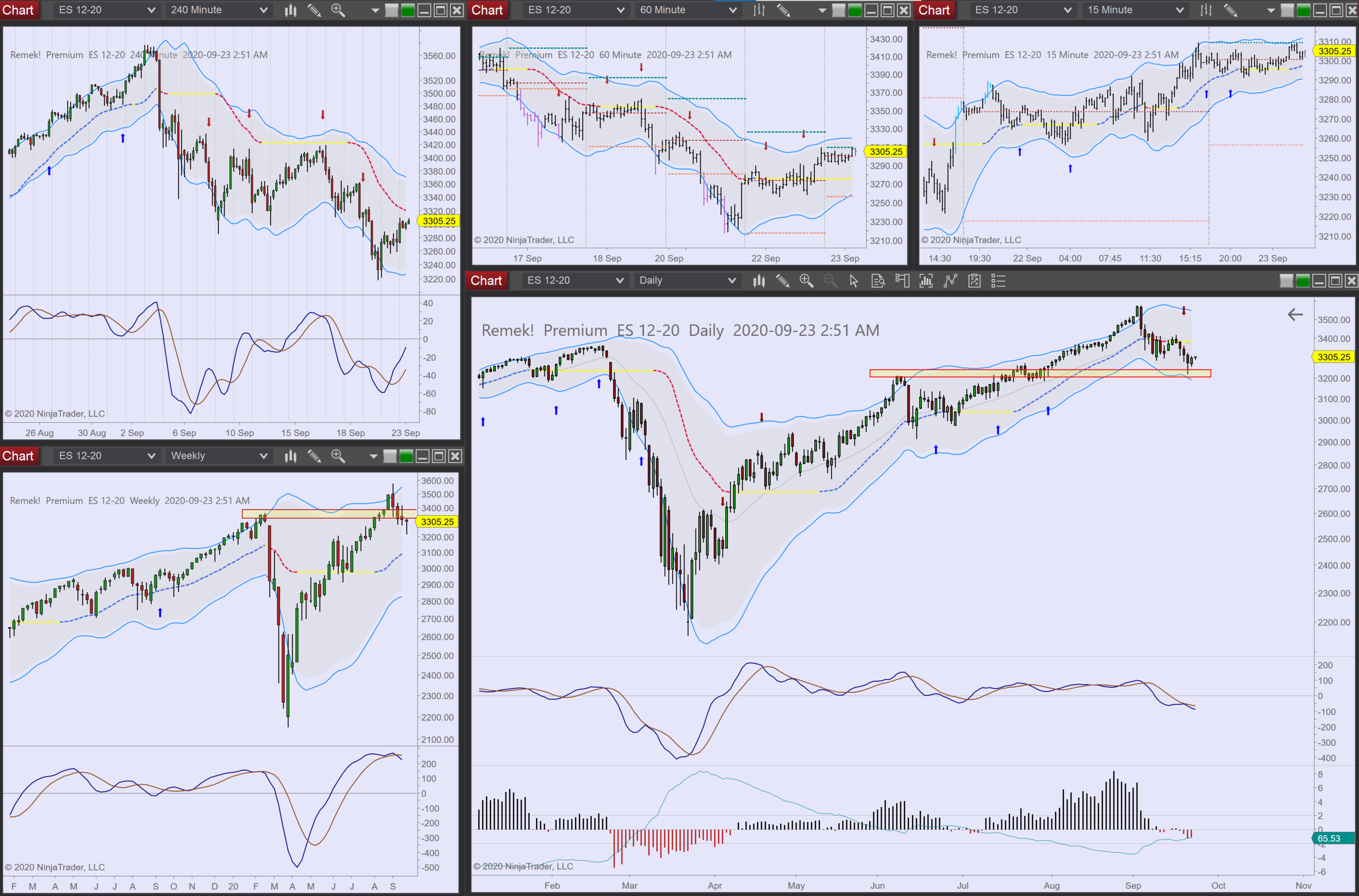

Indexes: ES measured move completed on daily. Bullflag on weekly suggests this may be a buying opportunity. Monitoring for clues.

Currencies: uncertainty on USD means, individual pairs are now less correlated.

Commodities: GC/SI hit hard, and more bearish pressure may be coming.

3.30pm update: major pairs: shorts as expected. ES: bearish scenario playing out.

12pm update: major pairs triggered.

8.30am update: 6J short triggering, weakness on major (currency) pairs (6A, 6S). Expecting a bullish session on the indexes as a default. Monitoring grains. Be selective: cash is a valid position.

for the trading day of tuesday, 2020 09 22

News at 10am ET.

Note: it’s been a while we’ve seen such a broad selloff on several markets. Major shifts across markets could be under way, with various potential catalysts in play both in and outside the US.

Indexes: ES significant-looking drop amplified by media coverage, but in fact it’s only a 0.86 on our RRR. We’ll have to see if the bears can take control from here, or the bulls will step up. If the morning session holds, expect sideways action. Stabilizing above 3300 would be seen as a bullish sign.

Currencies: dramatic strenghening of the USD made any long setups in the works on major pairs null and void. Now looking for secondary short entry on 6B and potentially on 6A/6N.

Commodities: GC/SI hit hard: we’ll have to see if they can recover from here short/mid-term. With the ES hit hard parallel, it is important to notice that precious metals are not behaving as safe havens, rather just another risk asset.

Agros: keeping an eye on potential long setups ZC.

2pm update: waiting for some clarity, and to see if the DX can reach the upper Keltner, and what it does there (before we get engaged on major pairs).

10am update: note on the ES: in the absence of a sharp rally above 3300, as a default expectation, the 3200 area will likely be retested in the following days. As always, we’re on the lookout for evidence that we’re wrong.

8.30am update:

General note: markets in transition: this environment is different from the relatively predictable conditions we’ve had for weeks. Exercise caution, follow your rules, do not trade size that’s not in your trading plan. Staying in cash for a few days is completely okay. Nobody knows where we’re going from here, and that’s true for all market participants regardless of size.

expecting further USD strength (see DX potential measured move). Looking for shorts on major pairs. (Usual warning: currency trades are correlated: do not pile up risk.) Potential shorts on CL, BTC. Also monitoring for a potential long entry on ZC.

for the trading day of monday, 2020 09 21

No News.

Indexes: ES short-term weakness. Anti on the daily. Short on further breakdown, target: measured move on daily

Currencies: DX expected to move lower. Longs setting up on several major pairs: 6A, 6E, 6N (see below).

Commodities: GC/SI bulls holding, bullish advance expected, standing by. CL long setting up on 240min.

Agros: ZC another long setting up on the 240min. ZW consolidation expected next, on the lookout for another long.

1.30pm update: dramatic dump across asset classes starting with the Frankfurt open. Even ZC, ZW suffered. Whatever the cause (virus news, etc.) this is most likely an overreaction. On the sidelines for now, but ready to act.

8am (ET) update: - USD overnight strength. No overnight triggers on major pairs.

- ES covered half the distance to 3200

- pullbacks on ZW, ZC

for the trading day of friday, 2020 09 18

No News.

Indexes: ES struggling to get back above 3400. Anti on the daily. Short on further breakdown, target: measured move

Currencies: DX (finally) moving. Good 1R on 6N.

Commodities: GC/SI bulls holding, advance expected.

Agros: ZC “370 reached, secondary entry setting up (second best potential trade for the morning session)” we said yesterday. ZC now at 380. Expecting more advancement on ZW.

4pm update: ES as expected, but not as easy as it looks. Seems like the bulls saw this level as the line in the sand (for now). ZW rather straightforward. Good week in all, we’ll take it from here!

1pm update: It’s Friday. Do not overstay your welcome.

11am update: Bold action, unfazed adherence to our rules, non-judgemental acceptance of all probabilistic outcomes: good trading.

10.30am update: A breakout from this consolidation area may give us a clue. Friday. No rush. Also: ZW, 6N look good.

9.30am update: ES watch first 15 min of session, the question: can we break to the upside. If not, a Friday selloff becomes more likely. 6N, ZW looking to go long out of bullflags

for the trading day of thursday, 2020 09 17

News at 8.30am ET

Indexes: ES anti on the daily. Short on further breakdown, target: measured move

Currencies: Secondary entry setting up on 6J (the best potential trade for the morning session), short setting up on 6B daily. Measured move potential on 6C. Excellent afternoon reading on 6E.

Commodities: GC/SI unable to hold

Agros: ZC 370 reached, secondary entry setting up (second best potential trade for the morning session)

4pm update: good work on ZW

1pm update: SI holding, good long on ZW, long on 6N. Markets in transition, looking for direction, not an easy environment, generally. More clarity on USD would be welcome, and will surely come soon. Didn’t chase CL/HO. Good potential on ZW for the next few days.

9.30am update: weakness on the indexes, potential measured move to the downside. Timeframe conflict on BTC. Looking for long on 6E and 6J (see daily context). Another timeframe conflict: 6B.

ES: Best chance for the bears to take this market lower in many weeks. But first they'll need to keep it under yesterday's close. We're short term (a day or two days) bearish, until and unless we break above 3380 and stay.

6N, ZW: looking to go long if triggered

for the trading day of tuesday, 2020 09 16

News at 8.30am 10.30am, 2pm ET

Note: FOMC at 2pm likely a catalyst. No trades planned for the morning session

4pm ET update: FOMC behind us, back to business as usual

8am update: a few opportunities (for those who trade today) Note: 6B bearflag failed as expected. On small accounts, it’s wise to exit positions/remove profits 15min before 2pm ET. (FOMC announcement most likely to affect the indexes by default, but may spill over, short term, to currencies and commodities.) Bullish pressure on financials.

for the trading day of tuesday, 2020 09 15

News at 9.15am (ET)

General note: FOMC on Wednesday. Expect limited volatility on the indexes prior to 2pm ET Wednesday

Indexes: ES bullish bias, but staying out due to “FOMC environment”

Currencies: DX expected to break down, a multitude of setups on major pairs.

Commodities: GC/SI strength likely to emerge.

Cryptos: BTC on the move

Agros: ZC 370 reached, waiting for pullback to consider another long.

3pm update: typical pre-FOMC action (or rather: non-action)

8.30am update: overnight moves as expected: GC, 6N, 6J, ES etc.

Expect a session with limited volatility and with a bullish bias on the indexes. Monitoring for pullback on RTY.

Further upside expected on major currency pairs. Look for pullbacks.

Precious metals: bulls in control.

Note: some of the best moves occur overnight, there’s data to prove it, and last night is a good example.

for the trading day of Monday, 2020 09 14

No News.

General note: a very important week ahead during which we must pay attention to all asset classes. FOMC on Wednesday.

Indexes: ES working on a rebound overnight. This market seems unable to collapse, which is a clue in itself.

Currencies: DX sideways, we’re keeping an eye on opportunities as they emerge.

Commodities: GC/SI strength likely to emerge

Financials: ZB/ZN likely to be revisiting recent highs

Agros: ZC 370 reached and more.

2.30pm update: most markets as expected.

8.30am update: ES: a range-bound session is likely, with a slight bullish bias. CL: weakness, GC: bullish advance expected, 6J: long breakout in progress

for the trading day of friday, 2020 09 11

News at 8.30am.

General note: the more-difficult-than-usual trading environment continues, both on equities (weakness on indexes) and currencies (due to USD ambiguity)

Indexes: ES unable to hold above 3400. Continued weakness possible going into the weekend, if bulls are unable to control the morning session.

Currencies: DX cannot be seen as ‘trending down’ at this point. Longs setting up on 6C, 6N, 6A. But: you may want to disregard the long on 6C due to its correlation with CL, which is setting up a short

Commodities: GC/SI no strength, but consolidation is intact on daily, at least for now. Important: precious metals in 2020 do not behave as safe havens: when stocks go down, safe havens are expected (traditionally) to go up. This is not the case now. So treat GC/SI are just like any other asset at this time.

Financials: longs setting up on ZB/ZN

Agros: ZC has covered half the distance to 370.

12.30pm update: few opportunities worth getting involved with. No point in chasing ZS. HG looks good for next week.

for the trading day of thursday, 2020 09 10

News at 8.30am, 11am ET

Note: uncertainties on most markets continues, resulting in fewer opportunities. This is normal, and as traders we have to be able to deal with whatever market regime we’re facing.

Indexes: ES, RTY rebound has occured, the bulls now have to keep tight control over this market if they want to avoid a flush. We expect the indexes to move higher.

Currencies: DX the start of a descend, potentially. Longs setting up on 6C, 6N

Commodities: GC/SI holding together, moves to the upside likely

Agros: ZC long on daily still intact

1pm update: ES range-bound intraday action fits into the 240min potential ‘measured move’. Good early morning long on GC, but so far, no follow-through. That said, bullish bias remains. Similar situation on ZC. 6N daily intact, but loses steam intraday.

8am update: ZC triggered, 6A, 6N, 6E longs setting up on the daily, GC sideways consolidation on 240min, expecting to be triggered. ES: getting ready for a bullish session

for the trading day of wednesday, 2020 09 09

No News.

Note: uncertainties on most markets continues; let’s see if the morning brings some clarity. Also: several contracts roll over in the next two days, see above.

Indexes: ES, RTY rebound likely

Currencies: DX waiting for clues, ambigous situation. 6J monitoring for long measured move

Commodities: GC/SI bears unable to take it lower, monitoring for a long on GC daily, and for potential measured move on 240min. Long setting up on HG

Agros: ZC, standing by

3pm update: GC moving, ES: bulls in control

10.30am update: long on GC daily setting up (you can think MGC on smaller accounts).

8.30am update: uncertainty on currencies continues. Monitoring indexes for a rebound (on daily). ZC long setting up. Watch for rollover days today. Potential measured move on 240m GC

for the trading day of tuesday, 2020 09 08

No News.

Note: uncertainties on most markets; we have to be patient as we are waiting for clues. Also: several contracts roll over in the coming days, see above.

Indexes: ES bullflag on the daily, waiting for more clues, and potential longs

Currencies: DX waiting for clues, ambigous situation. 6J moving

Commodities: GC/SI sideways consolidation with a bearish tilt short term. HG monitoring for long entry

Agros: monitoring for long on ZC

8.30am update: 6J moving, otherwise little clarity before the open in general. ES failing to hold.

for the trading day of friday, 2020 09 04

News at 8.30am ET (potential catalyst).

Indexes: ES expecting a small rally back to the middle (mean reversion) after yesterday.

Currencies: DX waiting for clues.

Commodities: GC/SI sideways consolidation.

Treasuries: looking for one more bullflag on ZB, ZN

2.30pm update: (First of all, in last night’s video, I ignored the possibility of an anti in today’s session, and I focused on the otherwise publicly announced “Fed support”. No harm done, but I should have considered the possibility of an anti more seriously, especially, since we’re technical traders focusing on short-term price action and not macroeconomists thinking in months.)

So the market has put in an anti in today's session, which was one of the potential outcomes after yesterday's record reading (6.14) move on our RRR. Antis do not necessarily continue, so it would be premature to call this the beginning of a downtrend. Sideways consolidation, confusion (and therefore a more difficult trading environment) are more likely on Tuesday and perhaps for the rest of next week. From there, we'll see where the market takes us, we'll process the information as it comes in. In the meantime, enjoy your holiday weekend if you're in North America, and your marketless long weekend if you're elsewhere. We'll be back Monday night on the Premium page. Take a breather, and Happy Labour Day!

Further notes:

Precious metals: GC, SI being risk assets, the fact that they have not sold off before the long weekend is constructive for the coming days and weeks.

DX hanging in, but not too convincingly. Also: a further weakening of USD (DX) would put an upward pressure on GC/SI, since they are assets denominated in USD.

Treasuries sold off, which may be interpreted in the puzzle as “faith in the equity markets (indexes)”. (We’ll see next week if that holds true.)

Notice, we never got triggered in on treasuries on the long side, proof for our good entry method of insisting on a price trigger.

Also notice that, contrary to past years, GC/SI and treasuries follow a different path and behave differently. Precious metals have behaved more like risk assets for the past 1.5 years, as opposed to ‘flight to safety’ assets, which is what they used to behave as. Markets evolve, see Prof. Lo’s excellent book.

8am update: watching treasuries for a long entry (12pm update: nothing came of this potential trade, but since it never triggered, no harm was done)

for the trading day of thursday, 2020 09 03

News at 8.30am ET (potential catalyst).

Indexes: ES stretched outside daily Keltner, not the place to go long from, normally (but what is normal these days?) RTY: targeting 1700 area.

Currencies: DX sudden break above previous support. Waiting for long opportunities on 6A, 6B.

Commodities: GC/SI sideways consolidation, so far, not breaking down. HG long setup in the works.

Treasuries: looking for bullflags on ZB, ZN

8.30am update: news may move markets. Pullback on indexes would be welcome. Looking for long no RTY on the break of 1595. Long setups on treasuries. DX strength invalidates long setups on major pairs.

for the trading day of wednesday, 2020 09 02

News at 10.30am ET (CL).

Indexes: ES the 240min pullback we’ve been waiting for, is working nicely. RTY: targeting 1700 area.

Currencies: DX sudden break above previous support, giving us good pullbacks on major pairs.

Commodities: GC/SI moving. Think long on your timeframe.

2.30pm update: a slow, grinding sideways day on the indexes. Snapback on the DX. Luckily, we can read the charts and got busy on treasuries.

for the trading day of tuesday, 2020 09 01

News at 10am ET.

Indexes: ES the 240min pullback we’ve been waiting for.

Currencies: DX expected downmove in progress. Good longs on major pairs, e.g. 6C, 6S.

Commodities: GC/SI moving. Think long on your timeframe.

4pm update:

8.30am update: pullback on the ES, GC, SI on the move, DX slides. All this as expected. Also: some of the best moves occur overnight, see GC, 6B. ZN long setting up. ZC retesting gap.