For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Term and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.-

When is this page updated?

We update this page, with our plan and outlook for the next trading day, by midnight Eastern Time prior to every trading session on the US futures markets. If you’re only trading the morning session, it’s a good idea to check in around 8am Eastern Time for the latest pre-open updates. We also post updates as necessary during the day, usually mid-day ET.

-

Your charts are too big for me

This is the most frequent comment we receive. Consider the following:

a) It's important to ask the question: why do we want to trade "small" charts. If because that's where our edge is, fine. But if we want to trade small, noisy charts, because that's the only thing we think we have money for, we're in trouble: we will most likely lose our money. We have to pick our battles, i.e. our timeframe not based on our wishes, but on where our edge is.

b) Ok, is there some good news?

Yes, lots:

- With us, you'll be trading with an edge. Without an edge, there is no point in risking a single dollar on the markets.

- Now, most of our trades are intraday trades, the 240min timeframe still being six times less than a day.

- Also, many of our 240min trade ideas can be adapted to even smaller timeframes by simply waiting for the next pullback on the lower timeframe (LTF) after the 240min trigger.

- Also, many of our trade ideas are on currency futures. On relatively small accounts, they can be executed on forex, which allows more granular risk management.

- Many of our trade ideas can also be executed on ETFs: say, GLD for a GC trade or TLT for bond futures.

- Finally, on smaller accounts trades can be executed with micro contracts (MES, MGC etc.). While some will say "that way you can't make money", our answer is: but one will learn to fish, and that's worth all the money!

It is clear our service allows the capital accumulation process to be implemented on any reasonably-sized account. -

Miscellaneous notes

- Make sure you check out the links above in order to make best use of this service.

- We tend to scale back activities on the indexes leading up to FOMC releases, while being aware that the FOMC news release can often serve as a catalyst.

for the trading day of tuesday, 2020 06 30

News at 10am ET.

Indexes: strong close indicates bulls are in control. Act accordingly.

Currencies: waiting to see what the USD is up to. Bullish setup setting up on 6A.

Commodities: CL likely to head higher. GC/SI bullish move in progress. Breakout setting up on HG

Financials: ZB/ZN bullish breakout on the 240min has occurred, consolidation in progress, likely before moving higher.

4pm ET update:

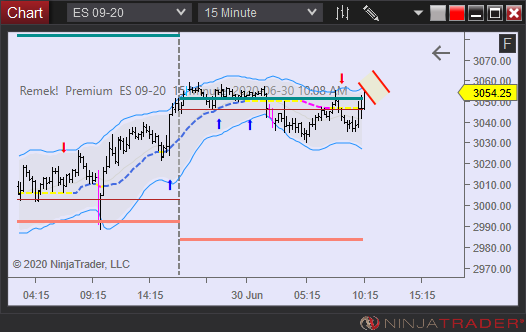

ES STUDY - Consolidation (price acceptance) above yesterday's high. Another hint that we're heading higher. Previous pivot at 3200. Important: as always we're not looking for clues that support our bullish bias. We're looking for information that would say our bias is wrong! Only in the absence of such information we continue to be bullish. This is to defend ourselves from our cognitive biases.

Measured move projection to identify potential target area. Measured moves are not magic, but simply based on current volatility characteristics of the market.

The 3.30pm pullback into the close. Warning to new users: not every day is this easy.

2pm ET update: looking ahead: measured moved expected on CL, strength emerging on major currency pairs, SI “just had to” (see last night’s video)

11am ET update: GC worked, ES working, SI, CL as expected

10am ET update:

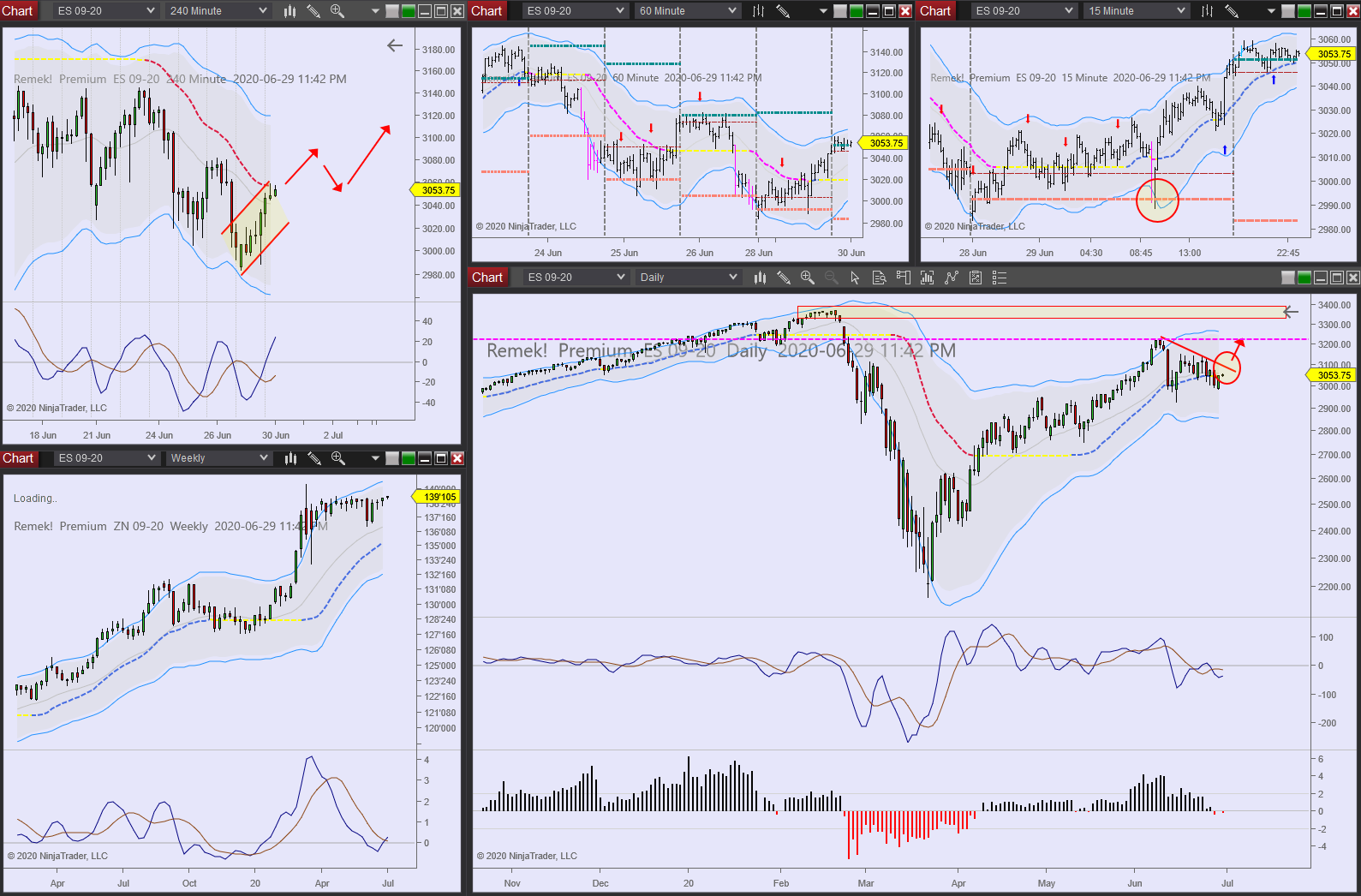

for the trading day of monday, 2020 06 29

No News.

Indexes: waiting to see if bulls can regain control. Will become bullish above 3100 on the ES.

Currencies: waiting to see what the USD is up to. Short on 6C

Commodities: CL likely to move to the upside based on daily. GC/SI bullish move in progress.

Financials: ZB/ZN bullish breakout on the 240min has occurred, expecting consolidation before moving higher.

2pm update:

10.30am update: ES bulls in control so far, CL moving

9.30am update: bullish bias on the ES, 6E moves. 6C short

for the trading day of Friday, 2020 06 26

News at 8.30am.

Indexes: strong close yesterday could be precursor to bullish pre-July 4 rally

Currencies: looking for longs on 6B, 6A, 6N

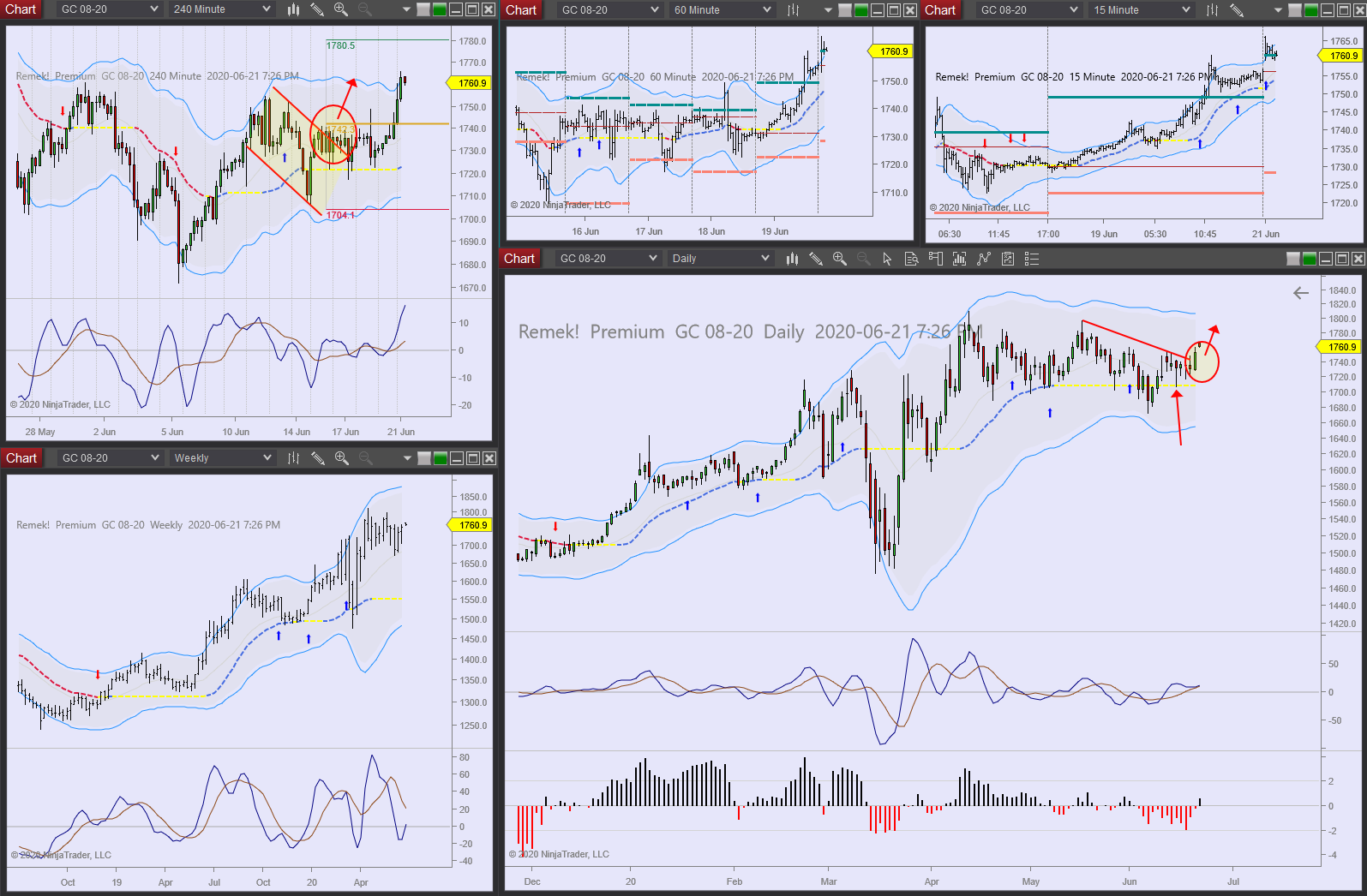

Commodities: GC/SI no change, bullish bias continues.

Financials: ZB/ZN no change, sideways action continues with bullish bias.

3.30pm update: GC bottom tail may be clue for next week

11.30am update: 6C, ZB/ZN as expected, indexes didn’t trigger

for the trading day of thursday, 2020 06 25

News at 8.30am (CL/HO).

Note: lots of surprises in Wednesday’s session. Our entry method, whereby we insist on being triggered in by price action, kept us out of harm.

Indexes: waiting to see if bulls regain control

Currencies: waiting to see if DX breakdown continues

Commodities: GC/SI difficult environment continues with a bullish bias. See video for potential entries in case of bullish breakout

Financials: ZB/ZN sideways action continues with likely bullish accumulation. See video and today’s blogpost for details.

11.30am update: ES tight range, bulls hanging in. GC sideways. CL bullish tilt. Treasuries: expected to move beyond previous high. Currencies: waiting for clarity, what is the USD up to?

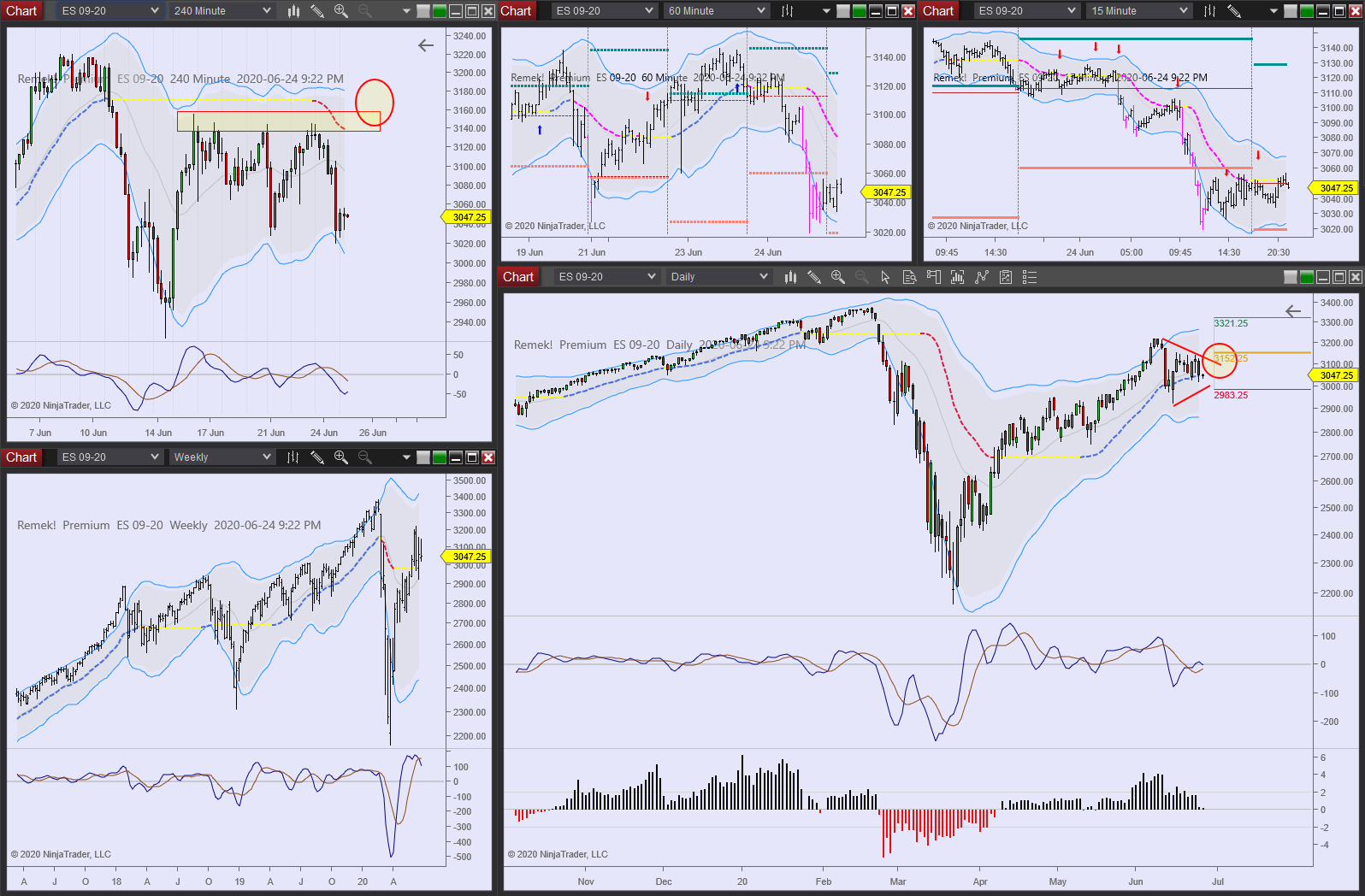

for the trading day of wednesday, 2020 06 24

News at 10.30am (CL/HO).

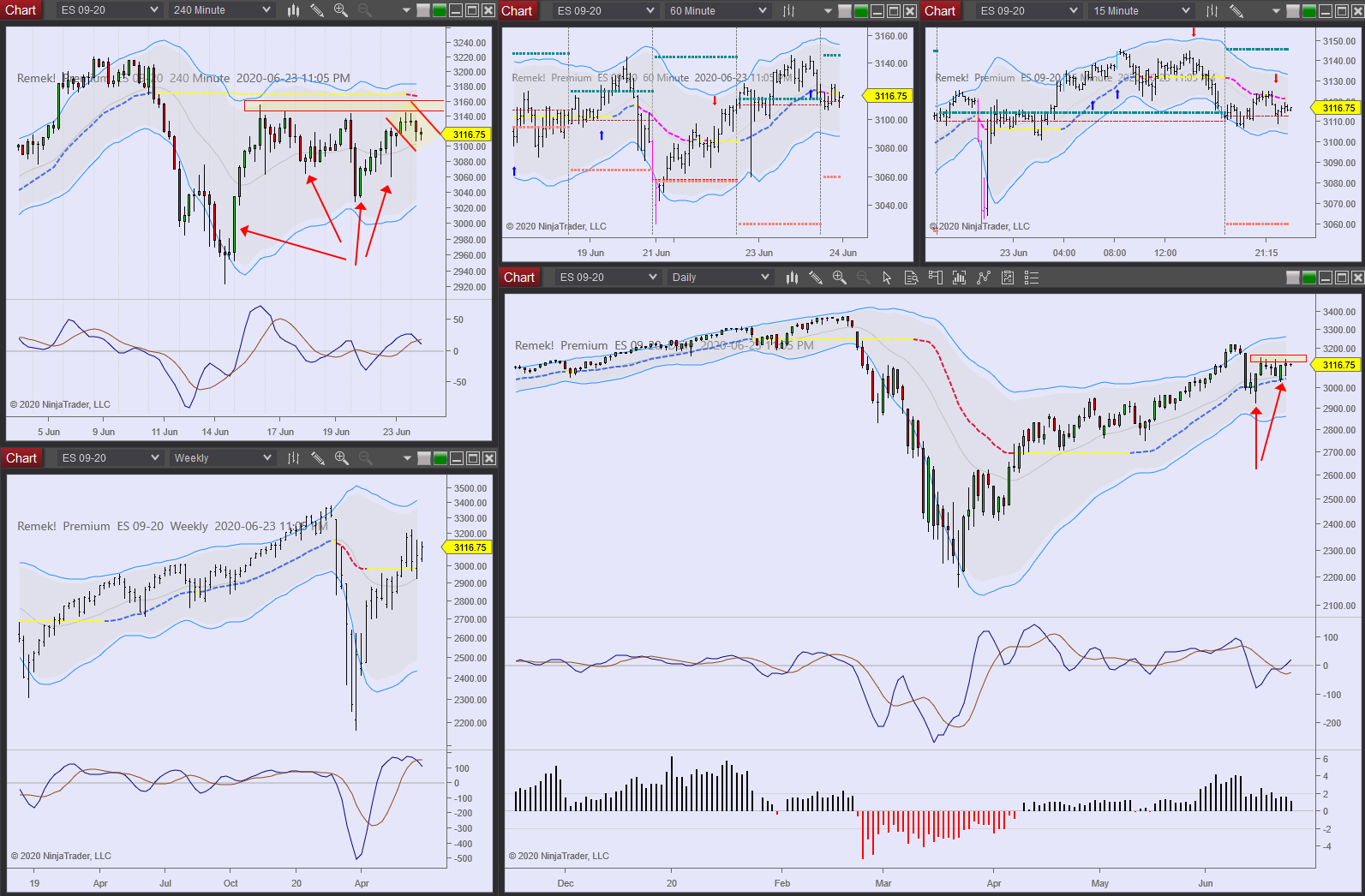

Indexes: Consolidation of Monday’s move in Tuesday’s session. Wednesday: further advance expected.

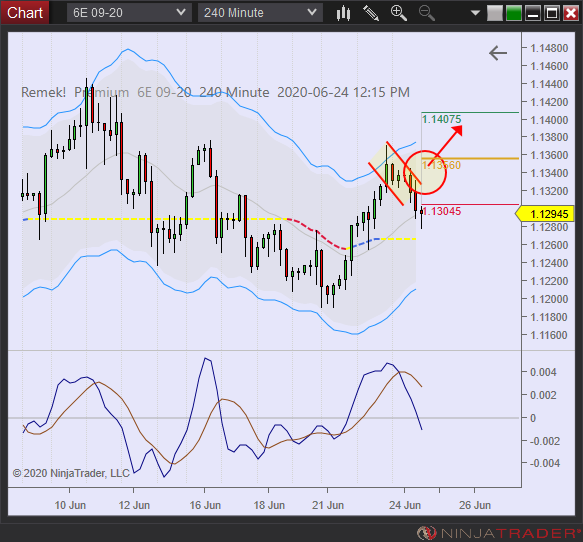

Currencies: DX breakdown in progress, long setups on major pairs

Commodities: GC/SI difficult environment continues with a bullish bias.

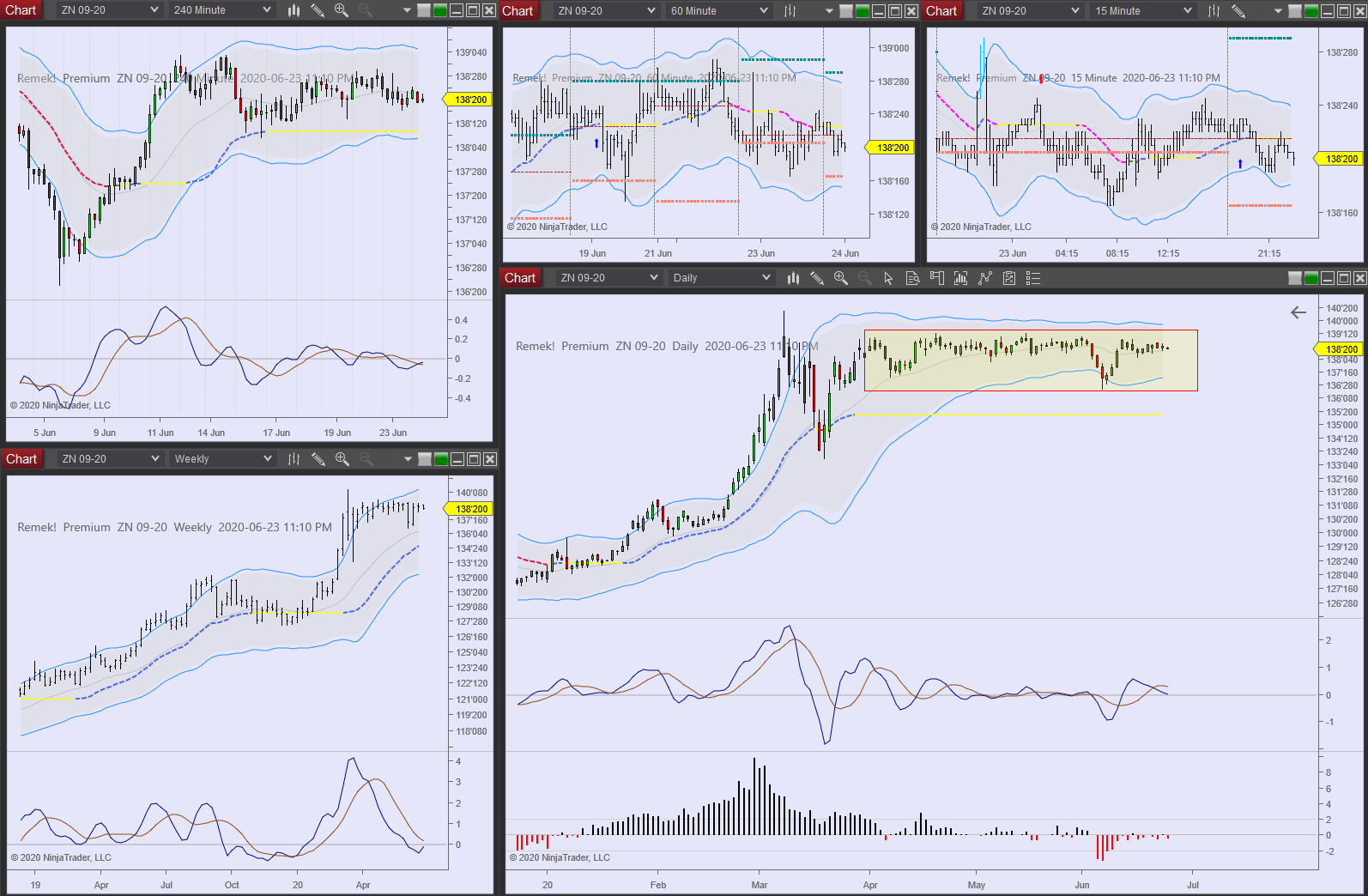

Financials: ZB/ZN sideways action continues with likely bullish resolution eventually.

12pm update: the morning session’s surprises highlight the effectiveness of our entry method: none of our entries were triggered, saving us from some trouble.

- we expected a breakout on the ES, never got triggered.

- we expected setups to be triggered on 6A, 6E, 6S (while DX breaking down), none of that happened.

While the above is not what we expected for this session, no harm was done, thanks to our trigger rule.

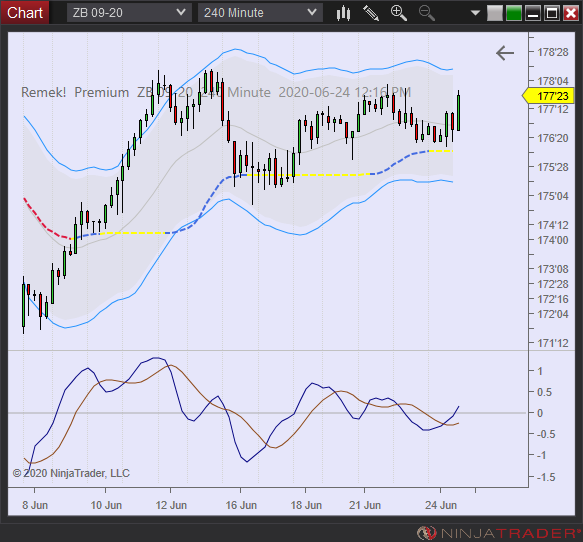

Parallel with these moves, ZB/ZN are waking up. See the whole story below.

for the trading day of tuesday, 2020 06 23

News at 9.45am, 10.00am ET.

Indexes: Strong buying into yesterday’s close. Open gap closed on the ES after the RTH open, bullish as it can be.

Currencies: DX breakdown is the likely next move, monitoring for longs on major pairs

Commodities: GC/SI difficult environment continues with a bullish bias. CL, HO upside break in progress.

Financials: ZB/ZN further upside expected, pressure into previous highs in progress.

11am update: ES, CL 6A, 6J as expected. A great day for the Remek! method. Several setups and trades, see them below for your reference.

for the trading day of Monday, 2020 06 22

News at 10.00am ET.

Indexes: Upside break likely, but watch for signs of weakness.

Currencies: bearflag on DX continues, with opportunities emerging on 6A, 6J, 6E, 6N

Commodities: GC/SI upside break in progress. CL expect an upside break, HO upside break in progress.

Financials: ZB/ZN further upside expected, pressure into previous highs in progress.

4pm update: strong buying into the close on the ES, a hint of what’s to come.

11.30am update: 6A, 6E triggered. CL, treasuries monitoring for upside break.

for the trading day of friday, 2020 06 19

Note: June 19, expect lower than usual volume.

No News.

Indexes: consolidation in a tight range. Upside break likely, but market needs a catalyst.

Currencies: bearflag on DX continues, but no triggers on majors

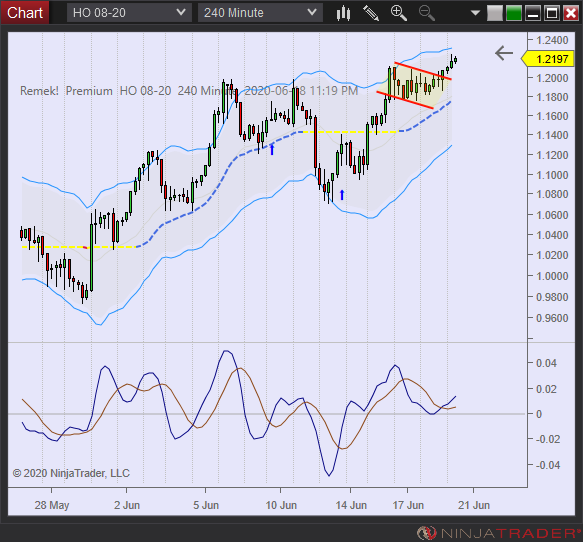

Commodities: GC/SI monitoring for upside break. CL expect an upside break, HG triggered, HO long in progress

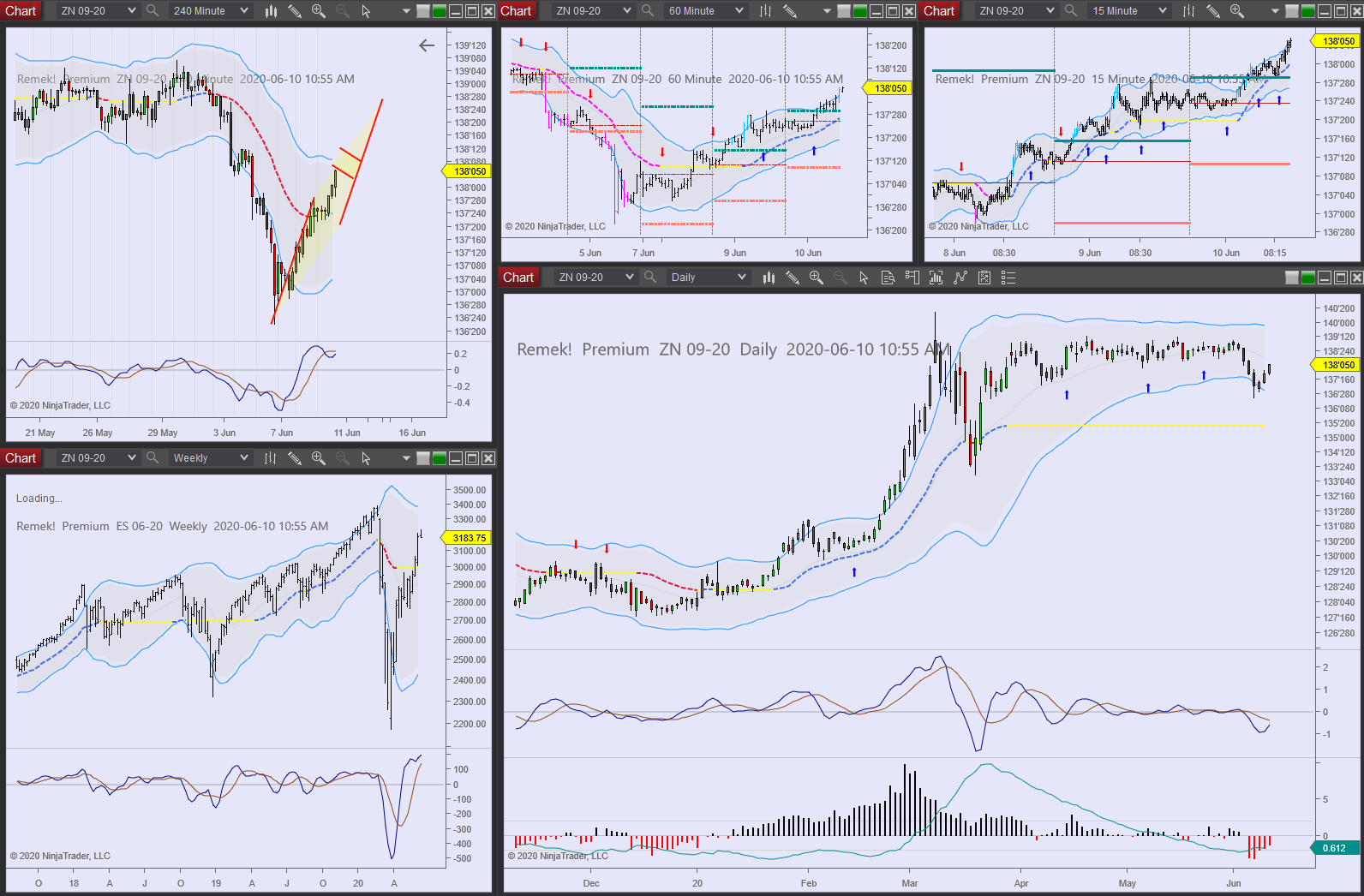

Financials: ZB/ZN “monitoring for upside break”, we said yesterday, upside break in progress today

12pm update: took profits on commodities. See ZN setup below: higher lows (pressure) against resistance on the dialy, offering entry point on the 240min. Note: technically, you can finetune your entry on a LTF, that’s fine, but your stop should be off that long tail on the 240min. An excellent setup. ZB confirms.

10.30am update: more movement than expected, but all movements as expected: HO, HG working, GC/SI and CL breaking to the upside, ZB/ZN holding/consolidating outside the channel, indexes holding. If you look back at the jpgs and videos of the past two days, everything working as expected, the market is telling us that our method works.

for the trading day of thursday, 2020 06 18

News at 8.30am.

Indexes: took a breather today, but bullish bias remains, re-test of highs likely to be in progress

Currencies: bearflag on DX, several - correlated - setups (bullflags) on major pairs, 6A, 6C etc.

Commodities: GC/SI monitoring for upside break

Financials: ZB/ZN “monitoring for upside break”, we said yesterday, upside break in progress today

9am update: eventless overnight session on the indexes (which is a slightly bullish sign, since no breakdown). Treasuries have triggered. Currencies have not triggered.

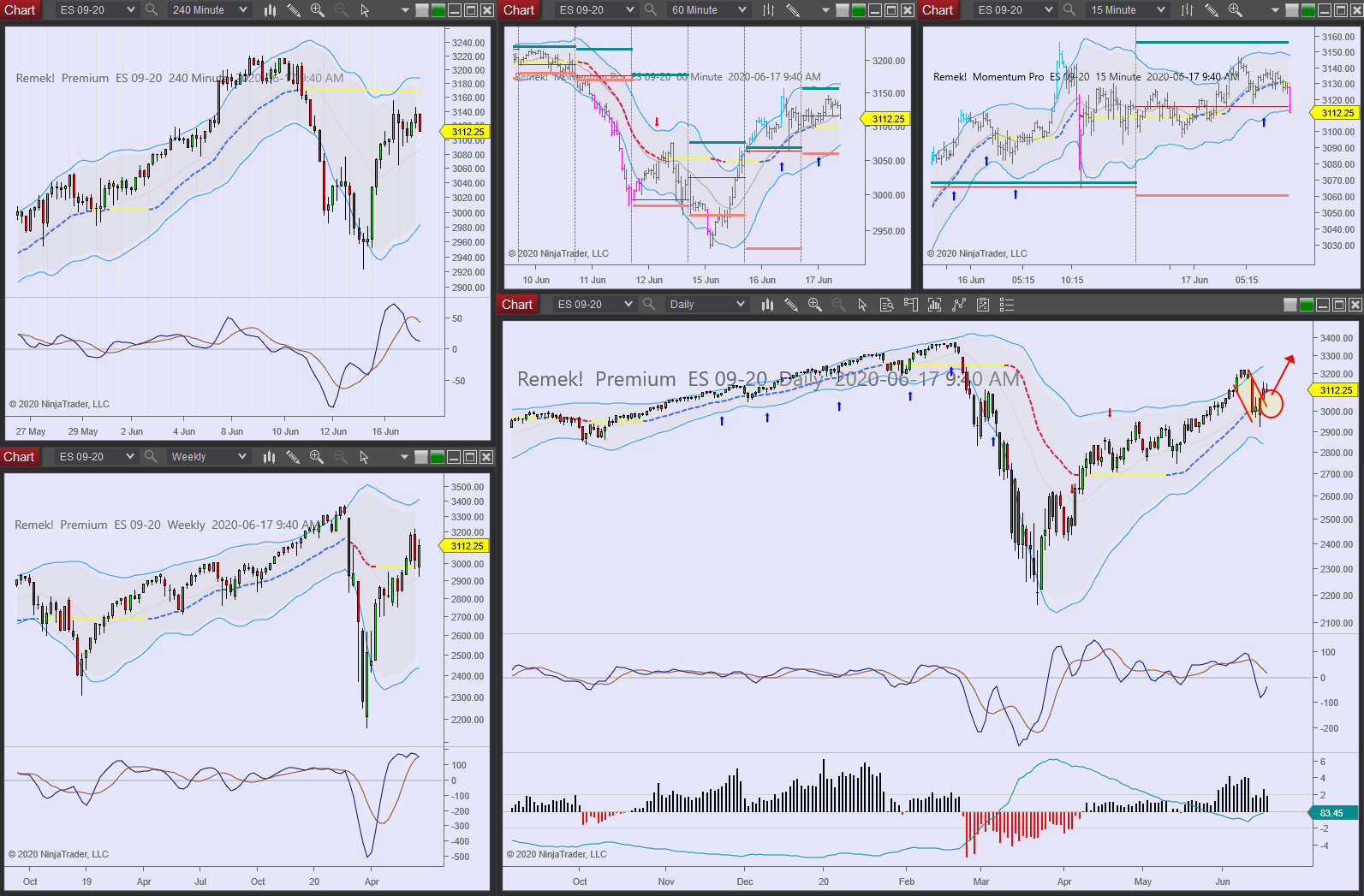

for the trading day of Wednesday, 2020 06 17

Note: no real change from yesterday. Will be back pre-open with the latest.

News at 8.30am, 10.30am (CL).

Indexes: bullish bias until proven wrong

Currencies: USD little clarity. 6E, 6C slightly bullish.

Commodities: GC/SI monitoring for upside break

Financials: ZB/ZN monitoring for upside break

2pm update: long setting up on HG

10am update: a quiet start. Potential entries on 6S, 6J, ZB (may not trigger today, see below). Watching for upside break on GC, SI.

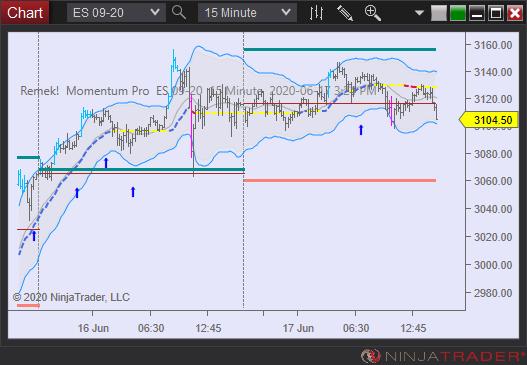

for the trading day of tuesday, 2020 06 16

News at 8.30am, 9.14am ET.

Indexes: strong bullish action in Monday’s session. Potential trend day on Tuesday.

Currencies: USD weakening yields bullflags on major pairs. 6E triggered.

Commodities: GC/SI complex bullflags expected to break to the upside

Financials: ZB/ZN bullish bias on a 3-10 day timeframe

Cryptos: BTC long setting up (see below)

3pm update:

9am update: ES as expected (see video). BTC setting up for a breakout

for the trading day of mONDAY, 2020 06 15

No News.

Indexes: waiting for clues: is any further weekness going to be bought up by the bulls?

Currencies: DX bearflag, timeframe conflicts on major pairs

Commodities: GC/SI slightly bullish bias, difficult to trade

Financials: ZB/ZN bullish bias

Room open at 9.30am, click here to join.

1pm ET update: ES working well, 6E being triggered.

9.30am update: monitoring for potential intraday bullflag on ES. Expecting a breakout on ZB with target at 180. 6E monitoring for a long.

for the trading day of friday, 2020 06 12

No News.

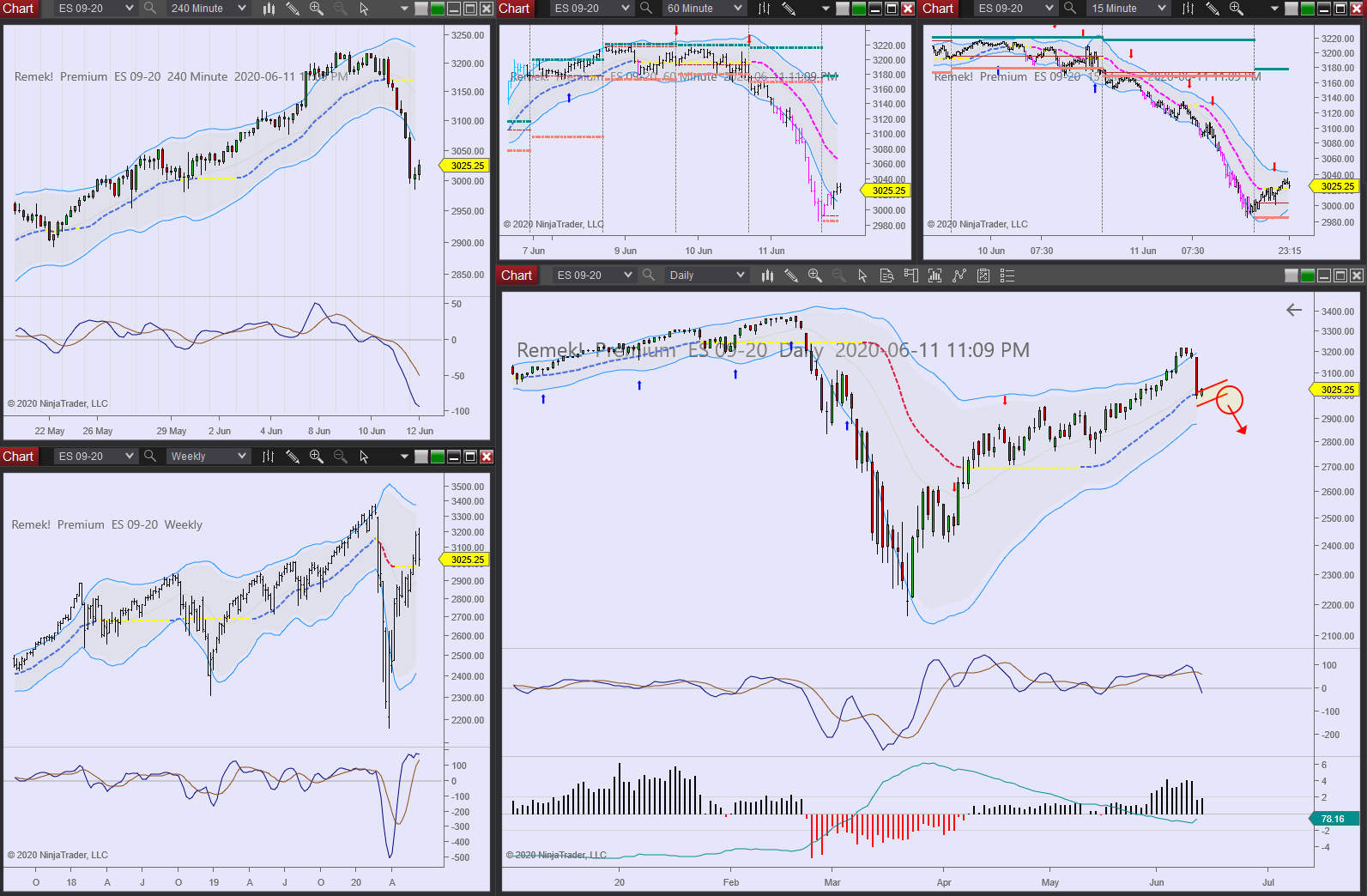

Indexes: -5.5 sigma drop on ES RRR is definitely a warning sign and is setting up an anti on the daily. (whether we’ll get engaged on the short side, we’ll see in the morning.)

Currencies: No change from yesterday. 6S and 6C setting up.

Commodities: GC/SI: No change from yesterday. CL/HO: long potential wanes.

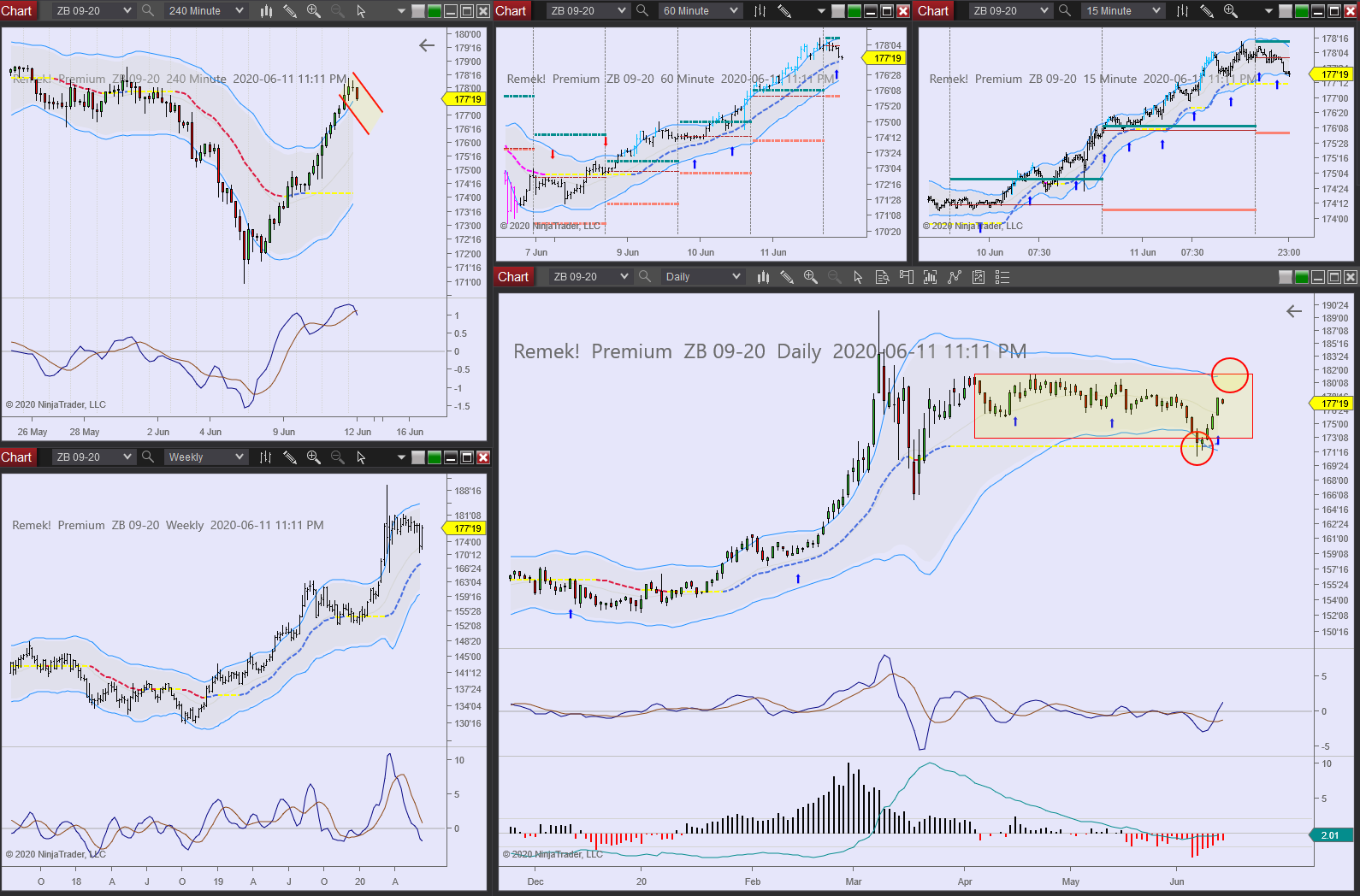

Financials: ZB/ZN waiting for a pullback on the 240min.

4.15pm update: an eventless session in all.

9.30am update:

for the trading day of thursday, 2020 06 11

News 8.30am, 11am

Indexes: NQ at all time high. Complex bullflag on the ES: 3400 likely to be tested soon. Have a plan.

Currencies: USD weakness continues. Monitoring for next bullflag on 6S. Several main pairs retracing: monitoring for potential long setups.

Commodities: SI bullflag on daily, consolidation outside the 240min bullflag, a strong bullish structure. CL, HO bullflags on 240min

Financials: ZB/ZN back in the range

4pm update:

12.30pm update: got out of SI. ES: a pullback is welcome, but this is too much of a good thing (looks like the FOMC rate announcement and the less-than-rosy rise in virus cases are affecting the market’s mood). Treasuries rally, GC fails to behave (again and still) as a ‘flight to safety’ asset. (Impossible not see GC has been behaving differently from 2011.) HO didn’t trigger, so no harm there.

10am update:

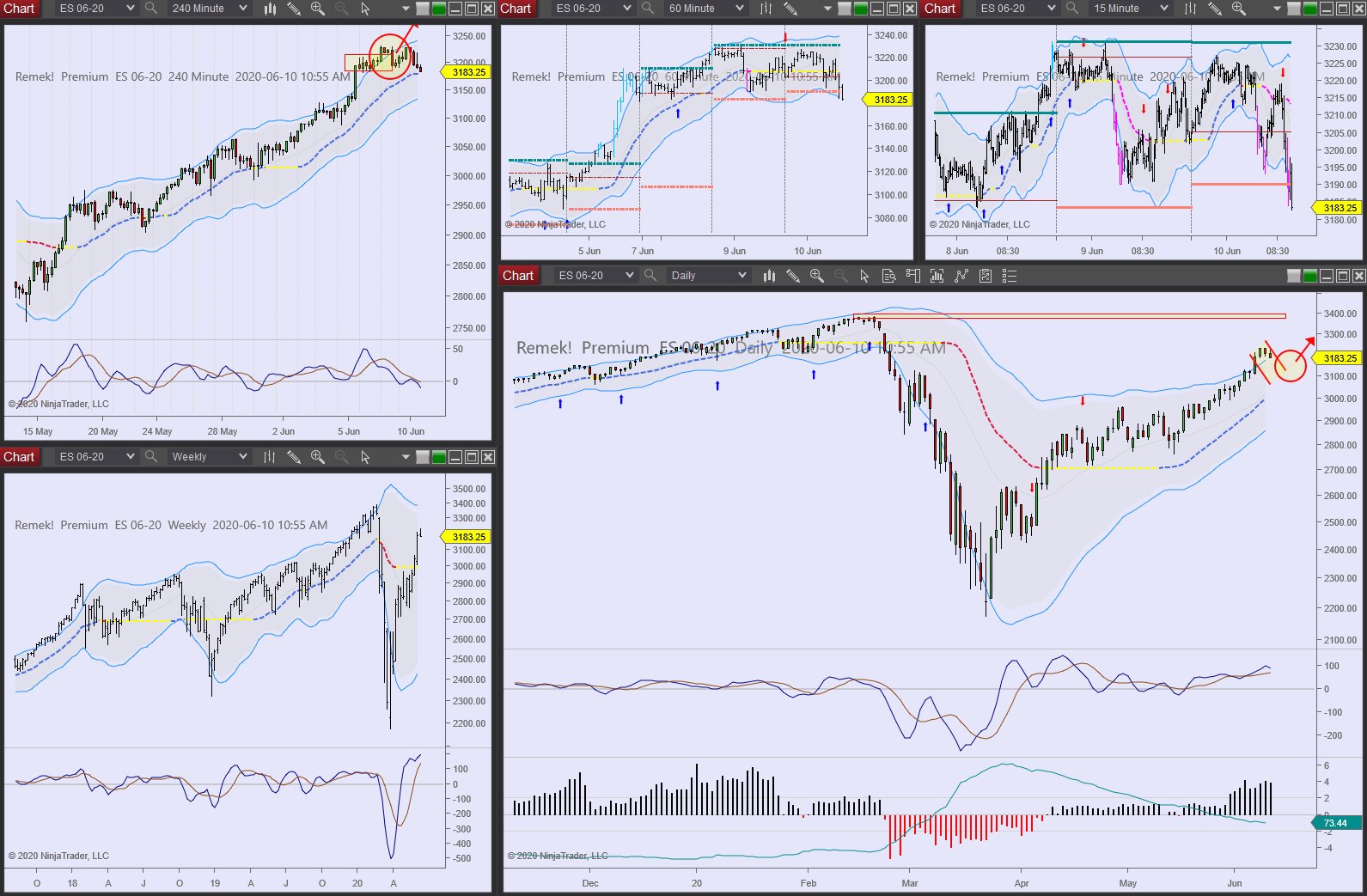

for the trading day of Wednesday, 2020 06 10

Note: we usually scale back on FOMC days, but we’ll be watching SI and CL, see below.

News 8.30am 10.30am 2pm (FOCM).

Indexes: NQ: relative strength. ES aiming at previous high (wait for pullback).

Currencies: USD weakness continues, good trade on 6S, monitoring for next bullflag on 6S

Commodities: SI bullflag on daily, wait for trigger, CL, HO bullflags on 240min

Financials: ZB/ZN bulls regaining control

4pm update: complex bullflag on the ES

1.45pm update: FOMC at 2pm. Closing position.

11am update: 6S, SI as expected. Managing HO. Expecting upside break on CL. Bullish consolidation on ES. FOMC at 2pm may move the indexes.

for the trading day of tuesday, 2020 06 09

Note: indexes rolling over in2 days

No News. FOCM on Wednesday.

Indexes: grinding higher, potentially, without a pullback. A pullback, if we get it, will be most likely a buying opportunity.

Currencies: USD weakness continues, creating opportunities on major pairs. (see e.g. 6S)

Commodities: GC, SI retreat (parallel with risk-on mode on indexes). SI: timeframe conflict

Financials: ZB/ZN daily range broken to the downside, on the sidelines

7am update: anti on several major pairs: 6A, 6B, 6C, 6N. First target reached on 6S. Monitoring for bullish breakout on BTC.

for the trading day of MOnday, 2020 06 08

Note: Slow Sunday night. back pre-market with a closer look. Get ready for an important week with indexes ripping (and potentially overheating), USD weakening, and significant outside factors (political, economic, public health) impacting markets. Indexes, CL to roll over this week.

No News. FOCM on Wednesday.

Indexes: NQ at all time highs, strong risk-on mode on the indexes

Currencies: USD weakness continues, creating opportunities on major pair. Monitoring for a bullflag on the 6E with potential target at daily previous high. Waiting for pullback on 6B daily.

Commodities: GC, SI retreat (parallel with risk-on mode on indexes)

Financials: ZB/ZN daily range broken to the downside, on the sidelines

4pm update:

9.30am update: 6S long

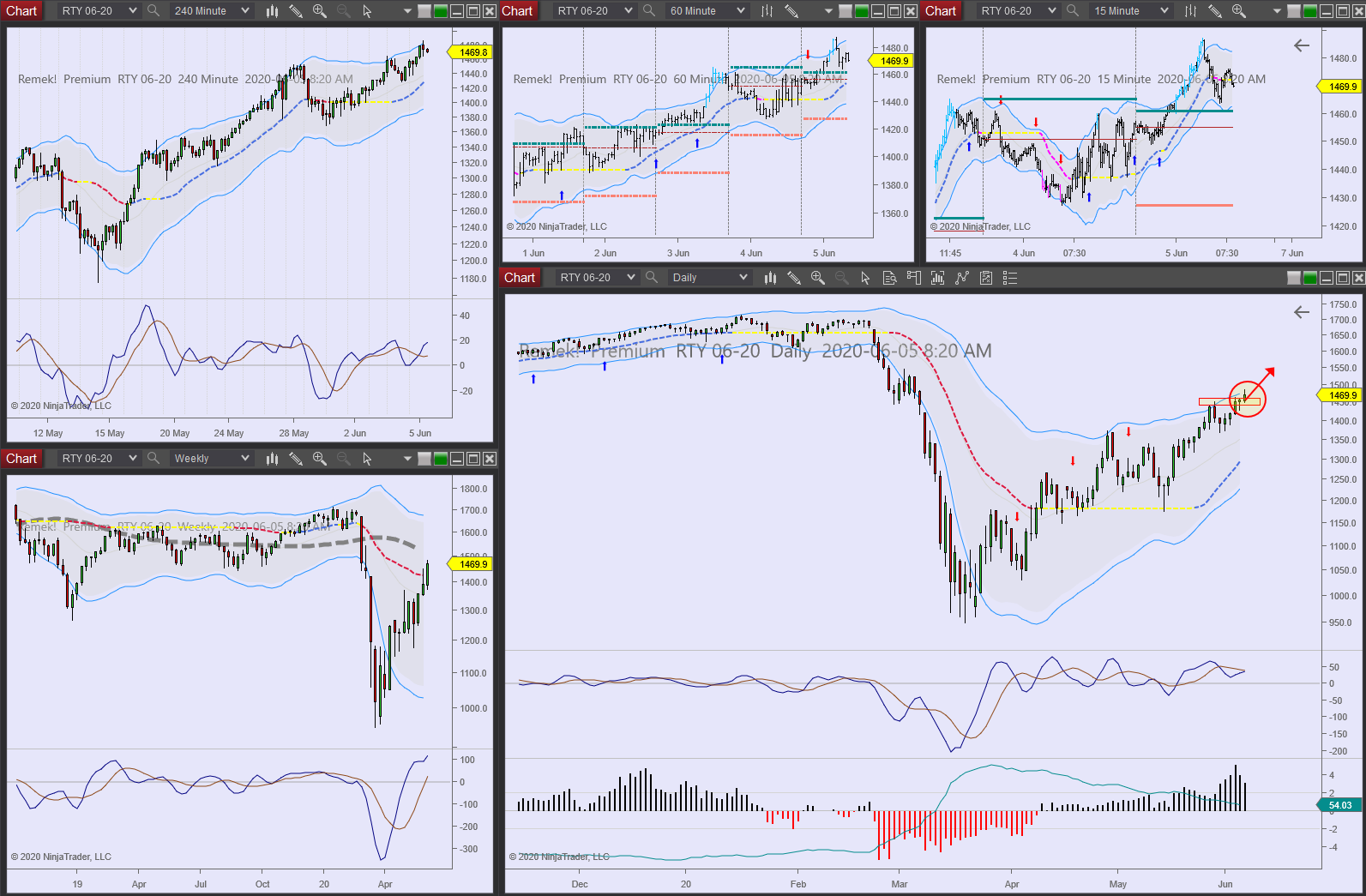

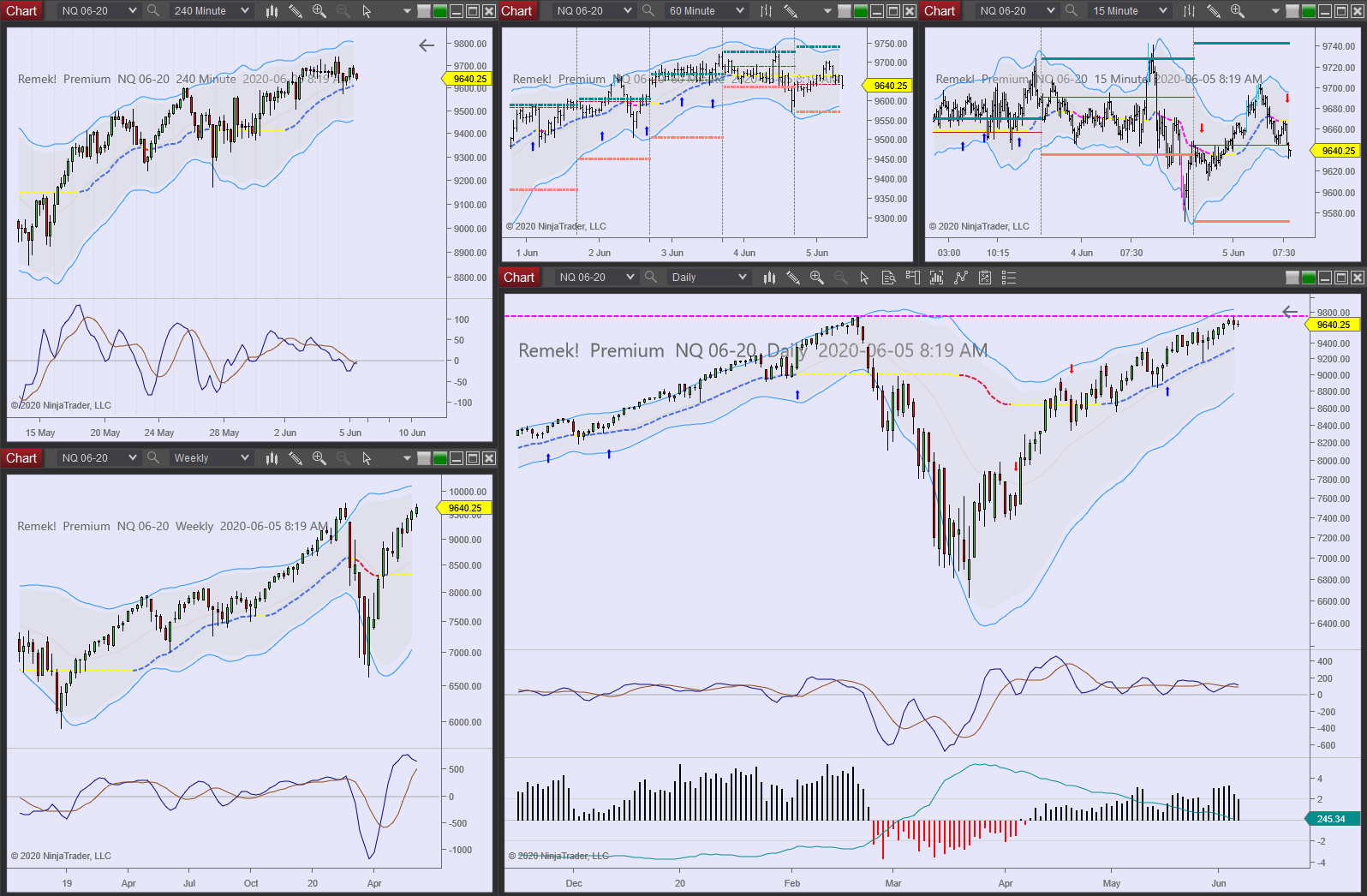

for the trading day of friday, 2020 06 05

News 8.30am ET.

Indexes: ES, RTY low volatility grind higher

Currencies: USD weakness gave us good trades. 6S setting up for next leg up, 6J short in progress, 6B triggered. 6C target reached on daily

Commodities: GC, SI expect weakness as indexes approach double top (“risk-on mode”). HO long triggered on 240min, see daily for context

Financials: ZB/ZN daily range broken to the downside

4pm ET update: great finish for the week. We rock!

8.30am ET update: the fuits of our hard work

8am ET update: HO rips (see video), RTY, ES press higher, NQ reaches previous high

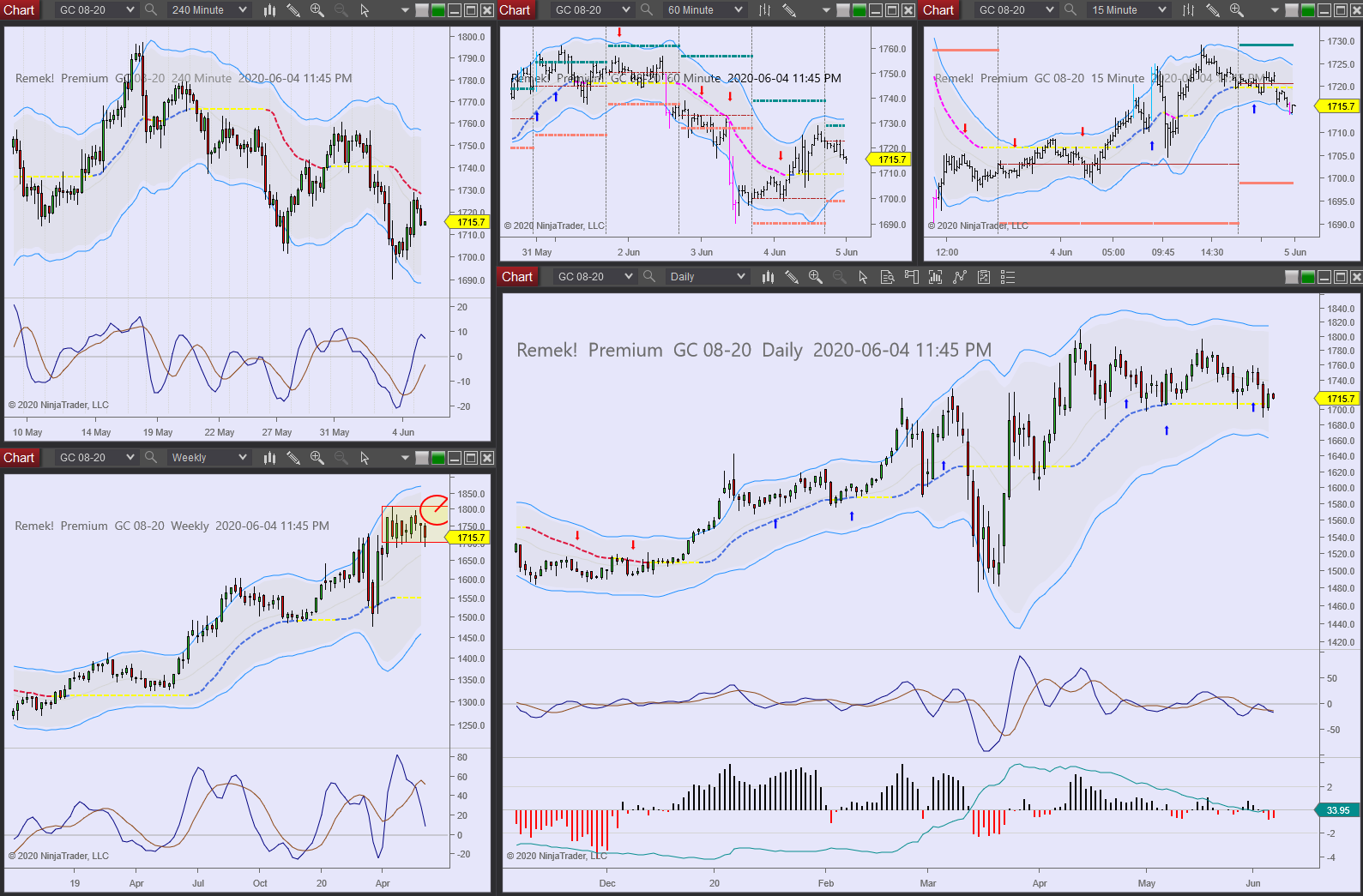

for the trading day of thursday, 2020 06 04

News 8.30am ET.

Indexes: do not chase price, wait for consolidation

Currencies: 6S long setting up, 6J in progress

Commodities: GC retests 1700, SI bullflag on daily

Financials: ZB/ZN weak performance on a risk-on day

4pm ET update: good longs on ES, 6S, short on 6J

8am update: will be looking for first bullflag above yesterday’s high after the open on the ES. 6S moves as expected.

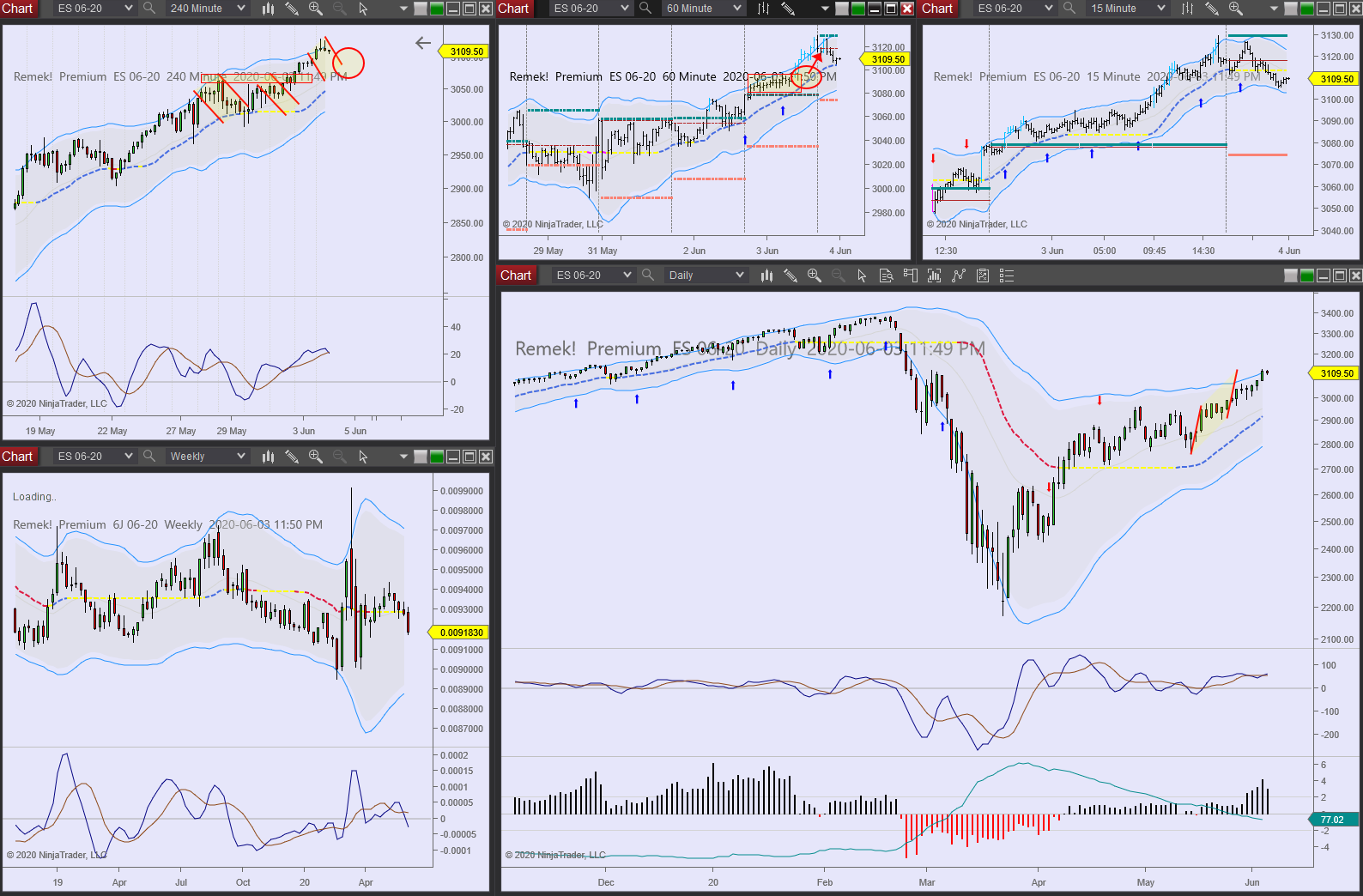

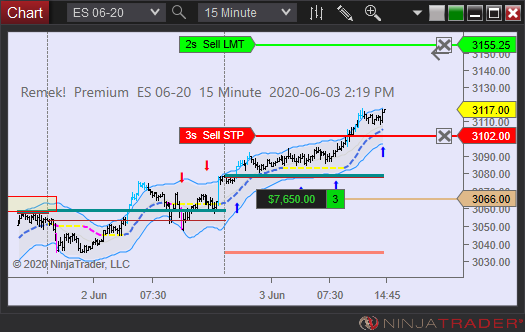

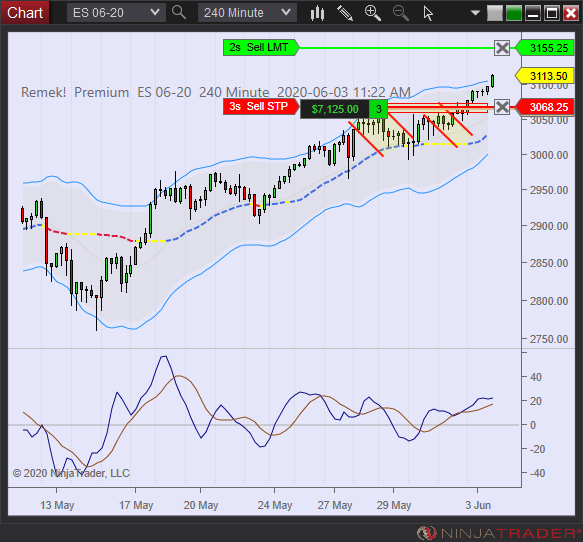

for the trading day of wednesday, 2020 06 03

Note: what we see is the markets processing information from the outside world, and markets are even more unpredictable or often strange-acting than usual (see GC, BTC, ZB). Let price action be your guide: do not argue with or try to outreason the markets. If the ES is heading to the double-top, so be it, we are not here to figure out why, we’re here to trade the chart.

News 8.15am, 9.15am, 10am, 10.30am (CL)

Indexes: as expected, breakout behind us, long on the ES

Currencies: 6C reached target, 6A, 6B rip (we didn’t get a pullback), 6E long in progress, 6S long setting up

Commodities: GC continues to be unreliable, SI target at 19 reached, pullback, technically, still intact

Financials: ZB/ZN no upside breakout for now, range-bound action continues

Cryptos: BTC untradeable on 240, consolidation on daily

4pm ET update:

8am ET update: indexes pressing to the upside. Do not chase currencies. Monitoring bearflag on 6J and bullflag on 6S. Several news releases today.

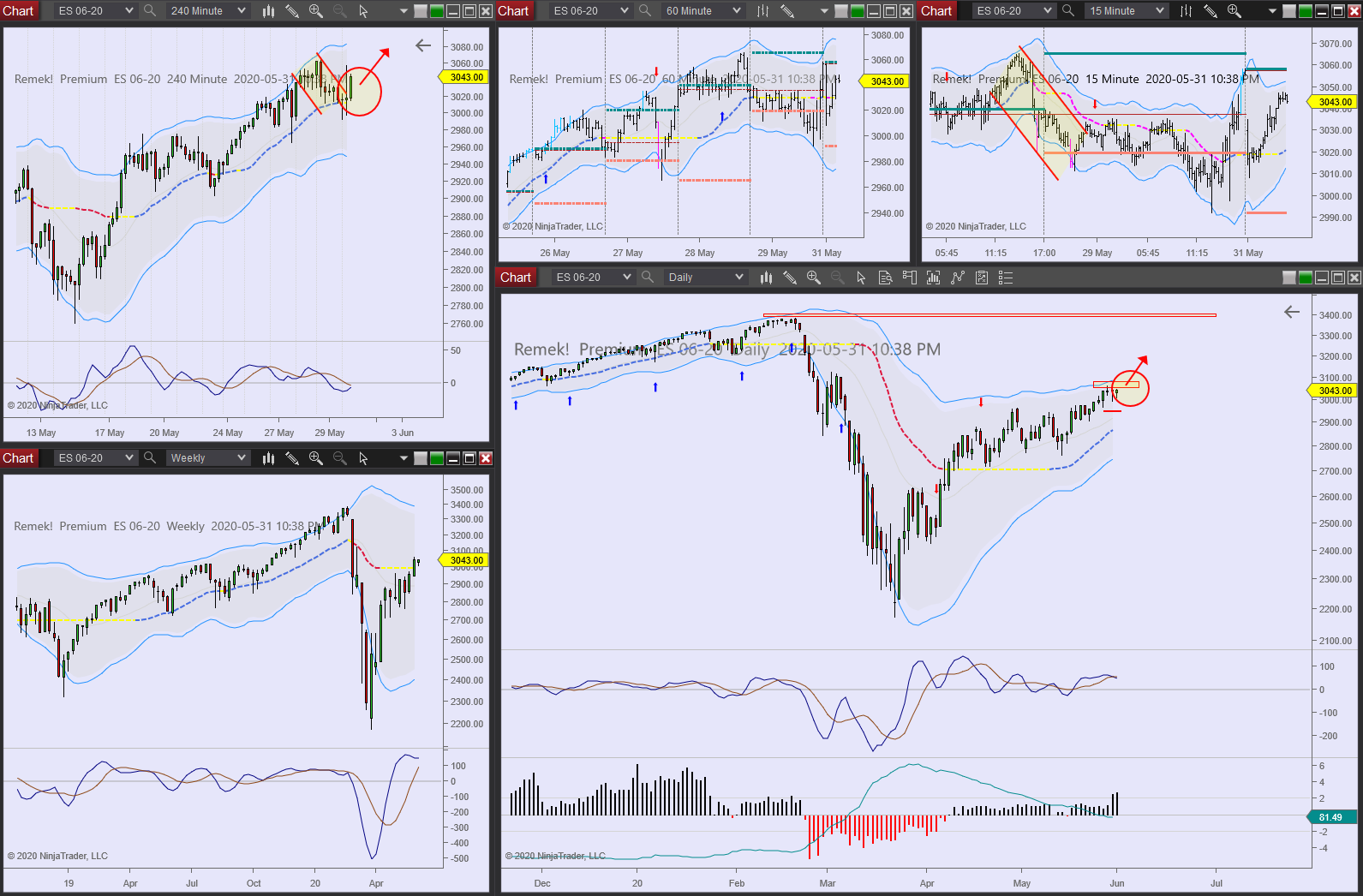

for the trading day of tuesday, 2020 06 02

No News.

Indexes: will consider longs after upside breakout on daily

Currencies: DX directional move, expecting opportunities on major pairs

Commodities: GC no new information. SI target at 19 practically reached, expect a retest of the 240min breakout level

Financials: ZB/ZN upside breakout deemed imminent

Cryptos: BTC trade on 240min triggered

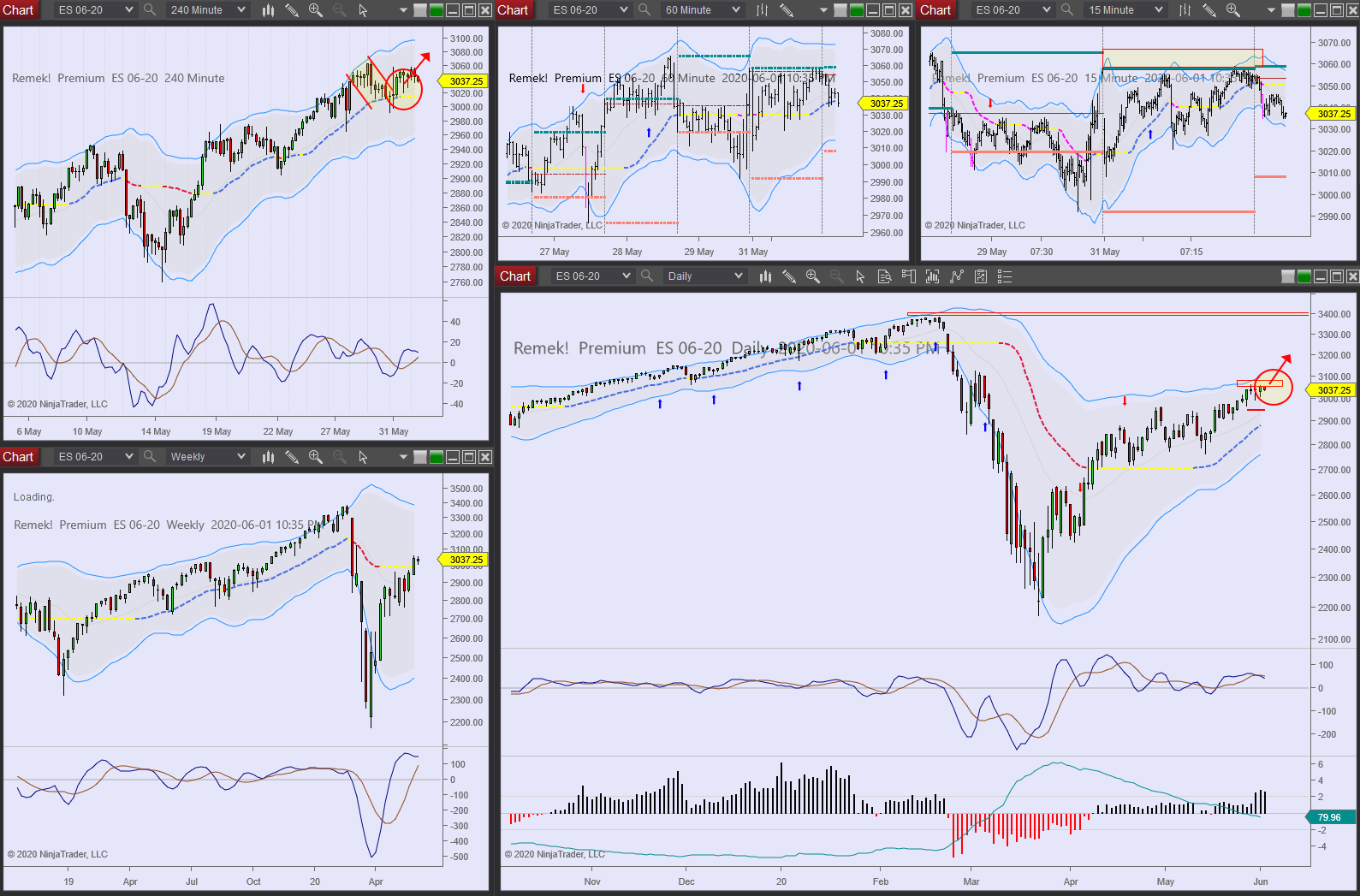

for the trading day of Monday, 2020 06 01

News at 9.45am, 10am ET.

Indexes: grinding up, upside breakout expected

Currencies: DX testing low of range, the question: where from here? 6A: target reached, 6C: target (almost) reached.

Commodities: GC, SI advance as we’ve been forecasting (new users: see previous videos)

Financials: ZB/ZN range-bound price action continues

Cryptos: BTC bullflag on 240min, waiting for momentum

12noon update: ES STUDY - This is likely to break to the upside, but do not expect an easy ride. Also, tight intraday stops are almost guaranteed to be taken out by the inevitable noise that is characteristic of low volatility environments. So proper stop is likely to be below Friday's low. MES or an ETF equivalent may be an option on smaller accounts.

10am ET update: