REMEK! Momentum Pro Standalones - Documentation

Part 1: Introduction

What is Remek! Momentum Pro?

The month in an hour NQ 2023 02 - Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

The Remek! Momentum Pro Standalones product line is the realization of a vision: a trading algorithm that captures a valid aspect of observed crowd behaviour on the markets that can be exploited with speed, consistency and precision. What you see in this product line is the result of many years of ongoing studies, coding, testing, and dialy interaction with the markets. Today, we can say, this is the tool and methodology we wish we had had when we first started trading.

PRO STR, BT and BTX use our proprietary Cheetah programming technology, thanks to which they run at lightning speeds.

We hope you’ll find these products useful for your trading. We’re here to help you make your trading business the best it can be, so we offer a 15-day, fully functional, free trial to help you evaluate, without risk or costs, if these products are a good fit for your trading business. Questions or comments, we’re only an email away.

Good luck and mindful trading!

The Remek! Momentum Pro Standalones product line comes in the following Editions:

Remek! Momentum PRO STR (Cheetah Edition, standalone, ATM-driven, built for forward-trading)

Remek! Momentum PRO STR BT (Cheetah Edition, standalone, own smart, built-in risk and trade management engines, backtestable, built for forward-trading)

Remek! Momentum PRO STR BTX (Cheetah Edition, for bulk trading and lightning-fast research, own smart, built-in risk and trade management engines, for both forward-trading and backtesting, requires no chart to run)

All Editions are based on the same trading methodology: trading the re-emergence of momentum out of consolidation areas. More broadly, our product suite can help you understand the interplay between market structure and price action, the two foundation blocks of all successful, technically motivated directional trading.

The three Editions are powered by the same algorithm: the difference between the Editions is in the technical implementation. Read the Documentation carefully to establish which Edition is best suited execute a certain trade idea. (We should add, many customers work with more than one Edition of Remek! Momentum, using e.g. one on one timeframe or asset class or timeframe, and another Edition on another. A common approach is to use PRO STR BT for small, fast charts, given its ability to self-adjust to current volatility conditions in real time and with lightning speed.) What the best choice for a certain trade depends on the trade and your particular circumstances. It is advised that you define in your trading plan, which tool (PRO STR, BT or BTX) you will use for which trades, timeframes, instruments, type of trades or personal circumstances.

So let’s dive in:

Remek! Momentum PRO Standalones for NT8 (PRO STR/BT/BTX) product suite is a group of complete automated/semi-automated trading systems built for the self-directed trader. The methodology behind Remek! Momentum Pro is based on the observed fluctuation between momentum and mean reversion and the inherent volatility characteristics of financial markets. The observation that volatility comes in clusters is backed by data: a forceful move away from market equilibrium tends to be followed by consolidation, which in turn often leads to another move, often of similar size, in the same direction.

After reading these pages, also check out our Version Tracking page for details on the latest updates to Remek! Momentum and our other products.

See below a quick summary of the features of PRO STR, PRO STR BT, and PRO STR BTX

Who are Remek! Momentum Pro STR, BT AND BTX for?

Remek! Momentum PRO STR: in this edition, the Remek! Momentum Pro algorithm drives an NT8 ATM. This allows the trader to maintain manual control over targets and stops during the trade, while still running the algorithmic trade management rules defined in the ATM. PRO STR is backtestable by running Market Replay (called Playback in NT8), since ATMs are not directly backtestable in NT8.

Remek! Momentum PRO STR BT: in this edition, the Remek! Momentum Pro algorithm drives an advanced trade managment engine (so there is no need for NT8’s ATM). It has its own built-in volatility-based trade manager, which monitors changes in volatility in real time, and adjusts its trade management decisions at lightning speed. PRO STR BT was built for forward-trading, thus it cannot be backtested on the chart, however it is fully backtestable in AUTO mode in NT8’s Strategy Analyzer.

Remek! Momentum PRO STR BTX can be used as an add-on to any Remek! Momentum Editions, or can be used on its own as a research (backtesting/optimization) tool and/or a forward-trading tool. It has the unique characteristic of not needing a chart to run on: it can run on NT8 Control Center’s Strategy tab on any number of instruments. BTX is fully backtestable in AUTO/LONG/SHORT modes in NT8’s Strategy Analyzer.

By having all three editions, you have the tools to trade the re-emergence of momentum out of consolidation areas in all types of situations. Spend some time considering which edition you’d want to use in your different trading situations (e.g. many traders prefer BT on quick intraday charts, while using PRO STR on daily chart, and deploying BTX for weekend research projects, etc.). A 15-day free, fully functional trial is available.

Remek! Momentum PRO, PRO STR and PRO STR BT also offer additional advanced functionality. These are:

The Remek! Market Scanner Pro for easy and quick identification of trading opportunities across any number of instruments

The Remek! Chop Filter, providing the ability to eliminate signals in choppy environments

The Remek! Signal Filter, the ability to identify, and optionally filter, standard and extreme momentum signals (aka simple and complex pullbacks) for better risk management and control.

The unique Auto switch-off function after the current trade is finished. Ideal for those late night trades!

Buffer zone mode: to suppress setups and triggers as soon as price action renders the trend likely to be exhausted.

Automatic volatility-based capital protection and real-time risk management (BT/BTX only)

Which Edition do I need?

The quick and simple answer is, you need them all, since they have been carefully designed to cover all important scenarios an NT8 trader may encounter. That said, consider the following:

If want to use our algorithm to drive your own ATM, and therefore maintain subjective control over targets and stops during the trade, select Remek! Momentum PRO STR.

If want to run the Remek! Momentum Pro engine, and you also want full backtestability, as well as BT’s built-in volatility-sensitive, self-adjusting trade manager, and you want objective execution, select Remek! Momentum PRO STR BT.

Select PRO STR BTX for the most efficient backtesting capabilities (including separating LONG and SHORT trades in a backtest!) as well as the ability to run any number of strategies on any number of instruments without the need of a chart.

First things first

Before we proceed to describe the system, take note of the following:

Financial markets move, mostly, randomly. Random data series are capable of producing, and will produce formations that look like patterns (setups), but are in fact random formation. (See this page.) There is no way to separate, with a high degree of accuracy, pseudo-patterns that are merely the product of random market movements, and real patterns that reflect market imbalances. (The good news is: we don’t need to.)

Market imbalances forming patterns and offering profitable trading opportunities do occur repeatedly, but they do not last and are acted upon by market participants quickly. This makes financial markets largely (but, in our view, not totally) efficient. (see this page).

Also note:

If you think you can trade without a losing trade, you're wrong. If you think you can trade with a small account, you're wrong. If you think you'll be the exception, you're wrong.

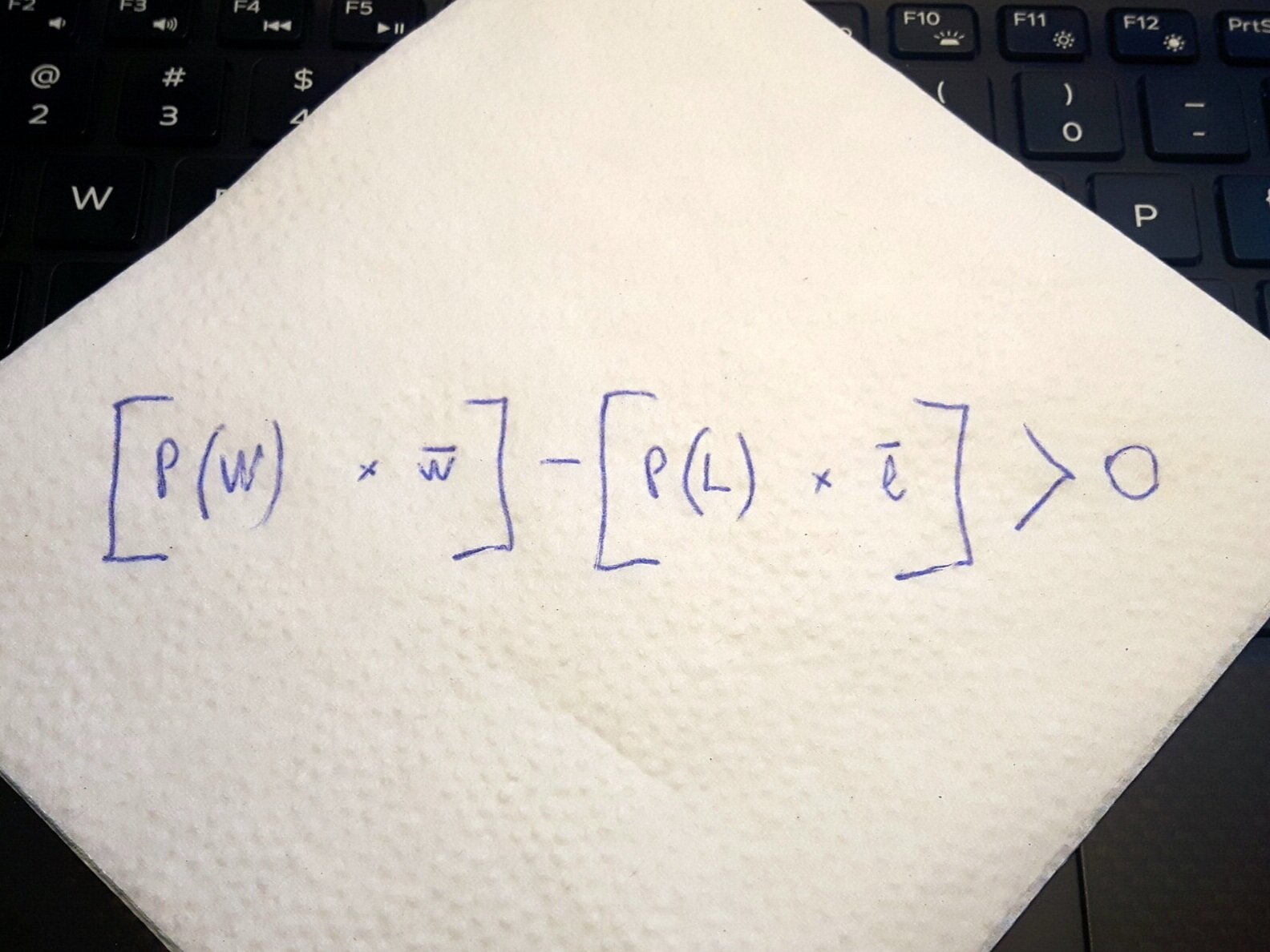

The profitability of any system will be the result of this formula:

Expectancy = (probability of wins x average win) - (probability of losses x average loss)

For a system to be profitable, its expectancy must be a positive number over a large number of trades. (And for a trading business to be profitable, it must also cover your business expenses as well.)Your result using your Remek! Momentum edition will depend on your ability to interpret the information the market is broadcasting about itself, as well as the information our system is showing to you on the charts. You’ll need to learn to identify our traded setups reliably, and to act upon them correctly with the highest level of consistency.