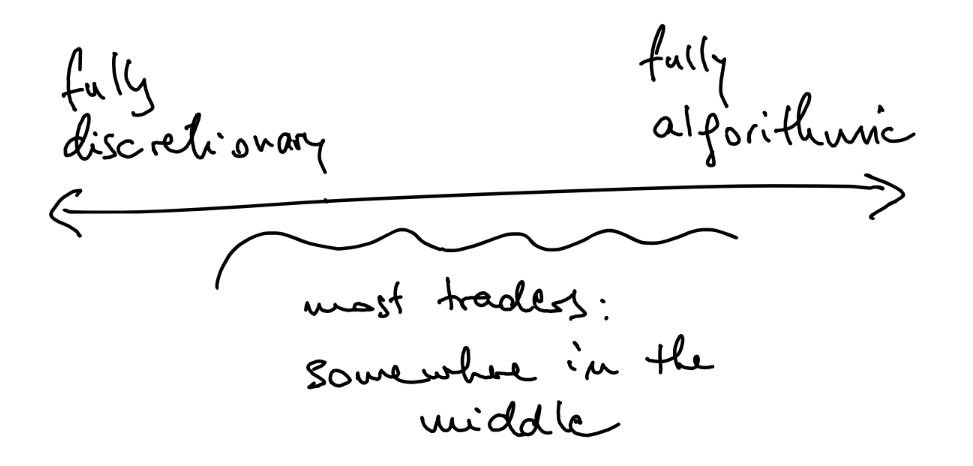

Every trader, no matter the style, the method, the timeframe or the instrument, is somewhere on what we may call the discretionary-algorithmic spectrum (although, we will see, nobody, not even Jim Simons, is at one extreme of this spectrum). See,

no one today trades without computers (and if you're new to this job, it's hard to imagine it wasn't always like this),

and no one, including the largest algo funds on the planet, is completely algorithmic (even the most algorithmic traders have an ON/OFF button on the screen). Not to mention that the algorithms themselves are written by humans.

A situation might look something like this:

Given the above, what might be a good way to think about the ideal level of discretionary/algorithmic elements of trading? While there's no cookie-cutter answer that would work for all traders, some basic principles apply:

what aspects or level of your trading you want to keep under your discretionary control and which elements you want to automate is something every trader must give thought to

every trader is somewhere on this spectrum

where you are on this spectrum is not written in stone: it may change as your trading career matures, and/or as markets change. (And yes, we do mature, and yes, markets do change.)

where you place yourself on this spectrum may not just be one spot. A trader may choose to trade more than one timeframe (preferably on more than one account), and decide e.g. for a higher level of automation on a very quick-moving timeframe, where milliseconds count (and do the job, hopefully, with the algorithmic PRO STR BT), and perhaps also trade a larger chart (daily or weekly) where milliseconds are irrelevant, and a more manual - but still partially automated - approach may work better (and pick for the job, hopefully, the more manual, but still algo-based PRO STR)

This weekend is as a good time as any for all Remek! (read: excellent) traders to consider the above, while we digest what is surely the most profitable week for us so far in 2023. Speaking of which, see a little digest of our work this week.

Although we're already half-way through 2023, it's still not too late to add the best tools (The Remek! Standalones strategies, the Remek! Essential Indicators and the Remek! Premium market education service) to your trading desk, and make 2023 your best trading year yet!

But first, may we give a hint of how we think about the right level of discretionary/algorithmic trading:

we like algo trading, and we like to do it in a discretionary context.

That's why we made industry-leading algorithmic trading bots, and we also share our discretionary trading insights with our VIP members every day. This combination of algorithmic and discretionary trading can bring measureable results, as was also discussed in our recent NT webinar.

The Remek! Momentum Pro Standalones

So why not explore our vast resources, and consider joining us on what, for many, could be a capital-accumulation journey!