For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Term and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

For the trading day of tuesday, 2020 03 31

News at 10am ET.

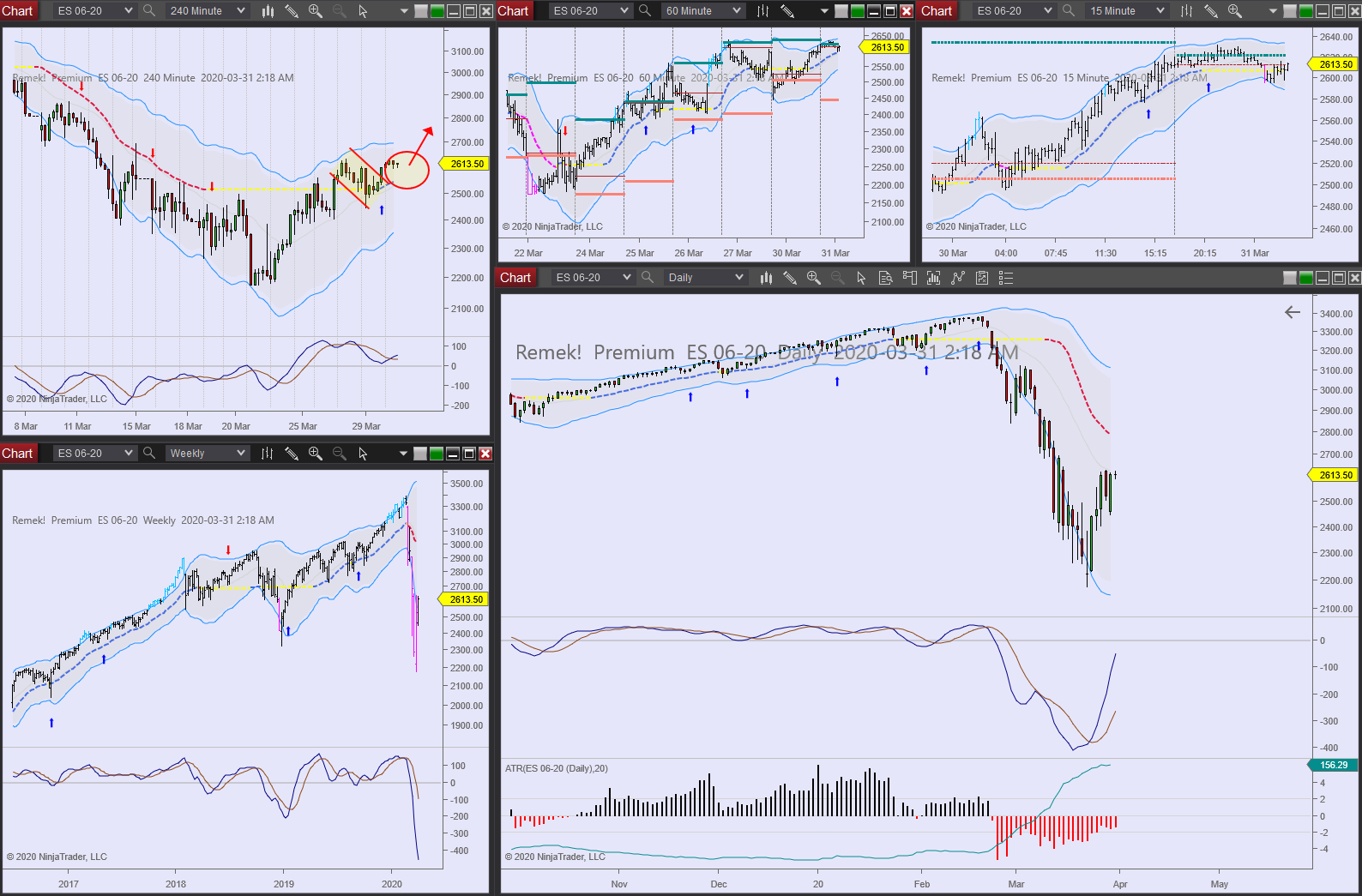

Indexes: I have a bullish outlook for Tuesday’s session

Currencies: DX bearflag on 240min, giving us several long setups on major pairs

Commodities: GC, SI what looks liek bullish pressure building up

Financials: ZB bullflag on 240min triggered

3pm ET update:

11am ET update:

For the trading day of Monday, 2020 03 30

No News.

Indexes: bearish outlook

Currencies: DX expect volatility contraction, no clear setup on major pairs

Commodities: GC, SI moving within large range-bound area, no setup, CL expect new lows

Financials: ZB bullflag on 240min triggered

1pm ET update: long on ZB, NQ

9am ET update: bullish pre-session price action on the indexes. Conflicting DX.

For the trading day of Friday, 2020 03 27

News at 8.30am ET.

Indexes: short on ES

Currencies: DX retesting previous support, 6J short setting up

Commodities: GC bullflag against resistance on 240min, CL short

Financials: ZB bullflag on 240min triggered

1pm ET update:

12pm ET update:

For the trading day of thursday, 2020 03 26

News at 8.30am ET. (Job report, potentially market moving!)

Indexes: short on ES

Currencies: DX retesting previous support, 6J short setting up

Commodities: GC bullflag against resistance on 240min, CL short setting up

Financials: ZB bullflag on 240min triggered

2pm ET update:

8am ET update:

For the trading day of wednesday, 2020 03 25

Welcome, new subscribers! Make sure you read the Documentation!

News at 8.30am ET. (new users: we don’t trade - and try not to be in an intraday position) 10 min before and after major news)

Indexes: the world talked about the ‘biggest move in history’ yesterday. It was not that big on our RRR (with a setting of 1). That means it was not unusual in the current market context (which is what matters). Our work separates us from the crowd.

Currencies: bullflag on DX, short setups on several currencies against the USD: 6E, 6B, 6S, 6A

Commodities: GC back in business: bullflag against resistance on 240min. SI waking up

Financials: ZB beautiful complex bullflag on 240min

2pm ET update: see comments in email

9.30am update:

For the trading day of tuesday, 2020 03 24

News 9.45 ET, 10am ET.

Indexes:

Currencies: short setups on several currencies against the USD: 6E, 6B, 6S

Commodities: GC monitoring for bullflag, SI waking up

Financials: ZB bullflag on 240min has triggered

3pm ET update: 6E managing short

10am ET update:

For the trading day of Monday, 2020 03 23

No News.

Notes: the crisis continues. Expect weakness and extreme unpredictability on US indexes.

Indexes: Gap down. Expect weakness on US indexes. The 10 year old bull market can be declared over.

Currencies: 6B short setting up

Commodities: CL expect further weakness

Financials: ZB bullflag on 240min has triggered, on daily about to trigger

1pm ET update: new Fed measures seem to move GC. Continued weakness on the ES.

9am ET update: indexes (ES) likely to test yesterday’s high. Overall context, though, is still strongly bearish. Potential short-term long setting up on GC. Bullflag on ZB.

For the trading day of friday, 2020 03 20

News at 10.00am ET.

Notes: DX continues to rip, monitor major pairs for shorts

Indexes: serious bottom tails indicate buying. Don’t totally dismiss the possibility of a sudden rally back to the 50%.

Currencies: monitor for shorts on major pairs against the USD (which looks like what we expected GC to look like a few weeks ago :) )

Commodities: CL a retest of the lows expected

Financials: ZB monitoring a bullflag

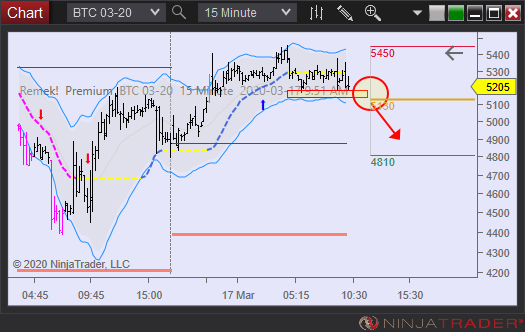

Cryptos: another short setting up

4pm ET update:

For the trading day of thursday, 2020 03 19

News at 8.30am ET.

Indexes: waiting for the ultimate bottom tail, the flush

Currencies: overwhelming DX strength, free fall on major pairs

Commodities: GC, SI continue to NOT behave like safe havens. SI at USD11

Financials:

Cryptos: another short setting up

For the trading day of Wednesday, 2020 03 18

News at 8.30am, 10.30am (CL) ET.

Indexes: expect weakness

Currencies: DX potential failure test on daily (monitoring LTF for clues), 6J long setting up

Commodities: GC, SI continue to NOT behave like safe havens. SI short setting up

Financials: ZN bullflag

Cryptos: BTC short

4pm ET update:

8am ET update: trading on the indexes halted, CL short working

For the trading day of Tuesday, 2020 03 17

Notes: increased volatility regime continues. This means you need larger stops and/or smaller or no positions. Micro contracts are an alternative as well. On the indexes, expect more downside, this is not over yet. We’ll continue to monitor for technical setups, including currencies.

News at 8.30am, 9.15am ET.

Indexes: expect weakness

Currencies: 6S long setup

Commodities: GC, SI continue to NOT behave like safe havens.

Financials:

4pm update: we’re watching for a potential failure test on the DX. and a flush on CL.

For the trading day of Monday, 2020 03 16

Notes: no need to describe the immensity of the situation, worldwide. We need to adapt and stay safe. Expect volatility, probably like not seen in recent memory. Do not bleed capital! It is okay to stay out, go to the micros, or do all-important but often neglected work, e.g. verify your edge. If you don’t have a written trading plan, do it now.

News at 8.30am, 9.15am ET. Also: FED cut rates to 0 (https://tinyurl.com/trhgu43)

Indexes: expect weakness

Currencies: 6S long

Commodities: GC gaps up, SI no move, CL weakness

Financials: ZB/ZN bullflag

12noon ET update: markets falling inspite of unprecedented FED stimulus. Historic times. GC/SI fail to function as value reserves. What remains is: ZB, for now. To be in cash is completely okay in these circumstances. One thing: stay with the markets, opportunities will arise, and you’ll want to be here when they do!

For the trading day of Friday, 2020 03 13

No News.

Notes: We’re at the end of an extraordinary week, which started with a 20-point gap down on the ES at 6pm last Sunday (See our post at the time: we noted it at the time because we hadn’t had such a gap down in many years!) That said, we didn’t and couldn’t foresee the magnitude of this week’s events. We’re now in the midst of a global public health crisis. Markets will need time to process all the unfolding information thrown at them. Plus it’s Friday, going into the weekend. Our job is not to to do something no matter what, our job is to do the right thing at the right time, so no trades planned for today, unless absolutely warranted and intraday. We’ve been doing well this year, we will continue to monitor the markets and will get involved at the right time. Stay safe.

Indexes: mean reversion

Currencies: DX strength, long setup on 6S

Commodities: GC, SI bearish, CL slight bounce

Financials: ZB retracement after overextended move

For the trading day of thursday, 2020 03 12

News at 8.30am ET.

Notes: markets under extreme stress after presidential TV speech. We are navigating unseen terrain successfully, see below.

Indexes: freefall, good short on ES

Currencies: DX weakness, long on major pairs, but be mindful of correlation

Commodities: GC not moving, SI bearflag, potential measured move (markets likely being manipulated, but we’ll deal with it), good short on CL

Financials: long on ZB

4pm ET update: This market needs a little time to build a base wherever that base will be. A major re-balancing on several markets: equities (ES, etc.), commodities (CL, GC, SI) and currencies (see DX, 6E, 6A etc.). We need to give it a few days.

For the trading day of Wednesday, 2020 03 11

News at 8.30am, 10.30am ET.

Notes: markets under extreme stress. A unique situation so past examples help little. Capital preservation mode.

Indexes: a bounce expected (bearflag) potentially setting up another short

Currencies:

Commodities: GC bullflag, long triggered on 240min

Financials: ZB bullflag on 240min

For the trading day of tuesday, 2020 03 10

No News.

Notes: markets under extreme stress

Indexes: a bounce expected (bearflag) potentially setting up another short

Currencies: 6C continued weakness, 6E, 6J, 6S reached targets

Commodities: no change since yesterday

Financials: no change since yesterday

1pm ET update: shorts on 6C, ES

For the trading day of Monday, 2020 03 09

No News.

Notes: obvious signs of markets in major transition: see our scanner below. Extreme volatility (RRR) readings on many markets (CL, ZB). Many markets outside the Keltner (signalling extreme moves).

Details: CL 7.5 RRR down, ES breaks Oct 2019 support, 100 points down from Friday’s close. ZB (the ultimate safe haven) strength unseen in recent history. GC breaking above 1700. Extreme volatility on several FX markets. Now: increased volatility is something we, generally, welcome, we need markets to move so we can make money. But this may be a bit too much of a good thing, so caution is advised. First rule: do NOT chase price. Always wait for some consolidation (pullback) on your timeframe to enter. We’ll tread with caution, and we’re confident our methodology will continue to work in this new environment.

Indexes: huge downgap, expect increased volatility, do not take a ‘free fall’ for granted, sudden snapbacks must be expected. Not a market that can be traded with small stops.

Currencies: 6C falls (CL related), 6E, 6J, 6S reached our targets and more. Waiting for what’s next.

Commodities: GC strong, SI curiously is lagging - or simply not in sync - behind GC. GC long looks safe, caution is advised on SI due to its unexpected behaviour

Financials: ZB historic rip. Sign of overall market stress not seen in many years.

3.30pm ET update: short on ES

9.30am ET update: markets under extreme stress

For the trading day of friday, 2020 03 06

News at 8.30am ET.

Notes: all our identified setups (on currencies, metals and treasuries) worked today except for 6N. Any methodology that can handle a tumultuous market environment that we are in currently deserves respect. Ours can and how! (see below).

Indexes: below the 50% retracement area, bulls not in control

Currencies: DX weakness, 6E, 6J, 6S trades worked well, targets reached.

Commodities: GC, SI in full force

Financials: ZB good long today, target reached

4pm ET update: GC, SI bullish consolidations, potential move (or gap up) Sunday on the ETH open. ES: holding on to current levels (which is not a bullish sign). And our weekly results to date in 2020.

8am ET update: our overnight trades (ES, 6E) working well, GC, 6S, 6J as expected, SI lagging

For the trading day of thursday, 2020 03 05

News at 8.30am ET.

Indexes: trying to break above 50% retracement

Currencies: DX weakness: 6E, 6J, 6A, 6S long

Commodities: GC bullflag on 240min

Financials: ZB/ZN ongoing strength, no real pullback to join

Notes: some of the setups below may trigger before the open

4pm ET update: GC, SI, 6E as expected. ES (bulls failed) as expected.

7am ET update: several of our setups triggered overnight: GC, SI, ZB, ZN and currencies against the USD. We’re rolling. See ZB below for an example of how to translate a 240min trade to smaller timeframes.

For the trading day of wednesday, 2020 03 04

News at 10.30am ET (CL).

Notes: Fed rate cut today helped GC anc treasuriers more than the indexes.

Indexes: a re-test of the lows likely. From there: who have to wait and see.

Currencies: 6E long (240m), 6N short (240min), BTC short (daily)

Commodities: GC recovering strongly, back to ‘normal’ (which is bullish)

Financials: ZB/ZN acting like safe havens, and indicative of market weakness

11.30am ET update: Higher GC prices expected. ES: bulls need to break above 3100 to re-gain control of this market. In short: transition amidst global uncertainty after yesterday’s rate cut. We’re watching closely for clues.

For the trading day of tuesday, 2020 03 03

No News.

Notes: we’ll look at the pre-market action, after the Far East and Europe opened, and will take it from there.

Indexes: we’re neutral and monitoring.

Currencies: DX weakness

Commodities: GC, SI can they come back?

Financials: ZB/ZN strong, will not chase them

3.30pm ET update: The unexpected FED announcement (basically, a cash injection into the markets to calm nerves) at 10am moved GC back to the ‘default’ bullishness, while we have to wait to see if it does what it was intended to: to calm the (equity) markets. Right now, we’re half of the halfway on the ES our long way of recovery (if that’s what’s next).

With a couple of days behind us after last week’s shock, we are now ready to tackle what the markets may throw at us next.

9.30am ET update:

For the trading day of Monday, 2020 03 02

News at 10am ET.

Notes: last week’s events are historic and unexpected in their vehemence and proportions. GC, SI’s performance is surprising. Equity markets may go anywhere from here. ZB’s move indicate a further drop in the markets is probable. We are not planning positions for Monday, but will follow the markets (equities, commodities, currencies) closely.

Indexes: waiting for clues

Currencies: 6C potential short (240min), 6S long (60min)

Commodities:

Financials: ZB/ZN hyberbolic

10am ET update: