For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Term and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

For the trading day of friday, 2020 02 28

News at 8.30am ET.

Notes: the Friday of a week of panic selling on equities. You should be careful opening new positions going into the weekend. To short from here is not advised. It will take days or (a few) weeks to find a new footing. A further selling leg down is in the cards early next week before the market can stablize. Some good moves on currencies and oil, see below.

Indexes: first signs of the bull market in trouble.

Currencies: 6C short, 6J long working, no new setups

Commodities: GC/SI “logic” says they should be moving up, but they’re not. So much about “logic” on markets. When they move, we’ll see it. SI: measured move completed as predicted yesterday. CL short working.

Financials: ZB/ZN acting like the safe havens they are.

3.30pm ET update: SAFE HAVENS STUDY - On the markets, anything can happen, traders always hear, but never really believe. Until you expect something, and the opposite happens (like ZB and GC this week). And seemingly for no reason. "Anything can happen", suddenly hits home. The best we can do (and what we did) is to get out and move on. GC was a loser this week in Remek! Premium, but that one trade will not invalidate the stats on some 4,000 trades over almost 2 years. This was not our average week, to say the least. A real fat tail, a black swan. (And SI, this week, is one of the blackest swan I’ve seen.)

Interestingly, YM and ES found some footing at last June’s and last October’s levels, respectively. Slaughter, yes, but technically, another leg down after some consolidation would not be surprising. Why GC and SI did not respond like another safe havens (treasuries) I find strange and surprising. The almighty market, we’ll have to deal with it.

10am ET update: SI is hammered, GC suffers, reasons not so clear. In technical trading, today’s SI is what ‘technical damage’ looks like. GC looks a little better, what happens there is still on the ‘pullback’ category on the daily. ES: back at Oct 2019 levels, with a potential second leg down (see weekly). With this week’s events, markets are most probably entering a new regime. Transition may take time and be characterized by bigger than average uncertainty.

For the trading day of thursday, 2020 02 27

News at 8.30am ET.

Indexes: ES if (IF) the 3100 area fails to hold, it can lead to a meltdown to 2900 or so. (We’re keeping a close eye.) Be ready to participate.

Currencies: short on 6A, daily bearflag on 6E (which we intend to pursue)

Commodities: GC/SI seem ready to go up from here. You should be positioned.

Financials: consolidating, no clear setup at this time

12pm ET update: 6C target reached, CL looking for a footing, SI technically vulnarable, ES re-tested last October’s breakout level

8am ET update:

For the trading day of wednesday, 2020 02 26

News at 10am, 10.30 (CL) ET.

Notes: As to the question: why we I didn’t short the ES yesterday: see bottom tail below at the arrow as it held at 3220. Then three bars later, another bottom tail. The probabilities tiltied towards mean reversion (a move back to the middle). That’s not what happened, and that’s okay.

Indexes: expect mean reversion from here

Currencies: short setups on 6E, 6A

Commodities: GC/SI unexpected behaviour in yesterday’s session. A move up is expected from this 240min bullflag. SI: you may want to wait for the breakout, see below

Financials:

10am ET update: GC STUDY - Re-testing yesterday's low is constructive (for bulls). ES STUDY Yes, it's a short setting up. I'll skip this because I expect consolidation today (I may be wrong, but I'm fine with that), and a bearflag on the daily, before the next potential move down (and the bearflag on the daily may take several days to develop.) However, if you're comfortable with an aggressive entry, you may want to short this on a breakdown. This is a unique situation in the world, and we can expect markets to be even more unpredictable than usual.

9.30am ET update: indexes: expect a range-bound consolidation (chop) today. Not the environment we prefer trading. However, the chart below shows one of the potential outcomes in the next 2-4 days. Watch for clues as to what may come next.

8am ET update: CL, 6A shorts working, 6S, GC intraday longs setting up

For the trading day of tuesday, 2020 02 25

News at 10am ET.

Indexes: be ready to short upon a trigger out of a meaningful pullback on 240min

Currencies: bullflag on DX, look for shorts on major pairs (6A, 6E)

Commodities: CL short setting up on 240min, GC, SI long setups.

Financials:

11am ET update:

For the trading day of Mondary, 2020 02 24

JOIN US IN THE REMEK! ROOM AT 9.30AM ET.

No News.

Notes: Our trades in safe havens have reached their targets, and we closed positions. We expect a pullback ie. consolidation in the next few days, followed by further moves to the upside, as a most likely scenario. What we see on the indexes is most likely a short-term selling and a long-term buying opportunity.

Indexes: ES opens with 20 point down gap. Short-term: be on the lookout for a bearflag.

Currencies:

Commodities: GC tests 1680, SI lagging behind gold, so we’ll keep an eye on it. We’re watching CL on the daily for weakness.

Financials: ZB breaking above 165, ZN setting up on 240min

11am ET update: short on CL, waiting for pullback on GC

For the trading day of friday, 2020 02 21

News at 9.45am, 10am ET

Indexes: waiting for clues

Currencies: 6A, 6B positions stopped out with a win

Commodities: GC/SI as expected

Financials: ZB/ZN as expected

3pm ET update: GC 1650, ZB 165, both as projected. Back on Monday, Room open at 9.30am ET, Monday!

8am ET update:

For the trading day of thursday, 2020 02 20

News at 8.30am ET, 2pm ET (FOMC)

Note: we normally do not trade FOMC mornings, although we reserve the right to do so. Expect increased intraday volatility upon the news release. An outsided move on safe havens to the upside would not be surprising (and smart money is already positioned, based on the chart).

Also see below this year’s weekly results.

Indexes: we will not trade the indexes in this session

Currencies: DX strength continues, breaking through 2017 highs (see below), 6A, 6B short

Commodities: GC/SI longs triggered, profits taken, holding positions, monitoring if they can hold on to gains (GC above 1600)

Financials: ZB/ZN bullflag triggered, ZB long, target 165

8am ET update: 6A, 6B, ZB, GC, SI as expected

10pm ET (pre-market) update:

For the trading day of wednesday, 2020 02 19

News at 8.30am ET.

Indexes: what so far look like a healthy pullback in an uptrend

Currencies: DX strength continues

Commodities: GC/SI longs triggered, monitoring if they can hold on to gains (GC above 1600)

Financials: ZB/ZN bullflag triggered, ZB target 165

1pm ET update: secondary entries on ZB, SI, GC, shorts in progress in 6A, 6B

9am ET update:

10pm ET update:

For the trading day of tuesday, 2020 02 18

No News.

Indexes: open with sharp down gap

Currencies: DX strength, 6A short, 6S/6E short

Commodities: GC/SI longs triggered, CL weakness expected

Financials: ZB/ZN bullflag triggered

4pm ET update: the best day in recent history: ZB, GC, SI broke out and we were positioned. Also good short on 6A and 6E, and an overnight short on CL.

11.30am ET update: 1) know Remek! Premium rocks 2) stay humble

7am ET update: 6A, ZB, GC, SI, CL as expected

For the trading day of Monday, 2020 02 17

No News.

Note: US Holiday. Equity markets closed. Nonetheless, be on the lookout for moves on electronic markets (especially GC, SI, ZB).

Indexes: no change

Currencies: DX strength

Commodities: GC/SI: imminent bullish move highly likely

Financials: ZB imminent bullish move highly likely

For the trading day of friday, 2020 02 14

News at 8.30am, 9.15am ET.

Indexes: another overnight bullflag

Currencies: DX broke through resistance, 6B long on 240min (bullflag on the weekly)

Commodities: CL another short, GC/SI bulls moving

Financials: ZB expect a move to previous high

12pm ET update:

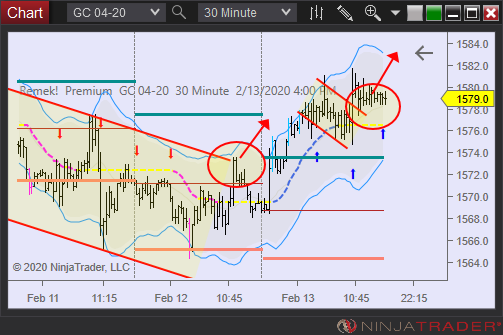

STUDY: one difficulty with trading pullbacks is to decide when to enter. It’s never risk-free, and a certain subset of our setups will fail (it’s the cost of doing business). What can help is monitoring price action on a lower timeframe. See chart below. We got what seems like a price rejection on the 15 minute chart (marked: 1), which can provide a clue as to our timing of our entry on our 240min trading timeframe. PS: it’s Friday, long weekend, so I’ll skip this trade. Regardless of the outcome of this particular sample, the concept stands.

9am ET update:

GC study: notice the move on the 240min has technically not triggered yet, but our LTF chart is making information available to us based on which we can consider being aggressive. Have clearly defined rules in your trading plan to use LTF information to enter trades on the HTF. Any questions we can discuss in the room on Monday.

For the trading day of thursday, 2020 02 13

News at 8.30am ET.

Note: expect indexes to retreat and safe havens to move

Indexes: at all time highs, liable for correction, but bull market intact

Currencies: DX breaking through resistance, textbook ‘slide’ along Keltner (we caught some of it)

Commodities: CL another short, GC/SI bulls moving

Financials: ZB expect a move to previous high

4pm ET update: ES completed move, GC is ready to move

10am ET update:

9.30am ET update: ES expect a test of the highs with potential new highs today. Note: in any overbought market like this, we have to be on the lookout for failures and reversals. (We’re bullish only until the market tells us we’re wrong.) GC/SI/ZB: the quiet before the storm

For the trading day of wednesday, 2020 02 12

News at10.30am ET (CL).

Indexes: bullish bias watch for signs of trend day (lack of pullbacks) on open

Currencies: DX at double top, expect consolidation

Commodities: GC/SI bullish case continues on daily timeframe

Financials: ZB expect a move to previous high

4pm ET update:

8am ET update:

For the trading day of tuesday, 2020 02 11

No News.

Indexes: expect range-bound action

Currencies: DX reached previous high, expect consolitation. 6J, 6S shorts setting up

Commodities: CL look for short, see below. GC/SI intraday long entries

Financials: ZB expect a move to previous high

4pm ET update: a rather eventless day, but that’s okay.

10am ET update:

For the trading day of monday, 2020 02 10

No News.

Indexes: expect strength, but wait for setup

Currencies: DX strength, watch double top. 6E short working, 6A/6J short setting up

Commodities: CL look for short, see below. GC/SI intraday long entries

Financials: ZB expect a move to previous high

8am ET update: watch 6A, SI, GC, ZB, 6C

For the trading day of friday, 2020 02 07

News at 8.30am ET.

Indexes: new highs, continuing strength. Never argue with the market (but be on the lookout for a failure test).

Currencies: DX strength, short setups on major pairs (6B, 6E, 6A)

Commodities: GC, SI back in range, bullish structure intact

Financials: ZB bullflag on daily, look for longs on LTF

12pm ET update:

9.30am ET update:

8.30am ET update: what looks like ‘risk-off’ (risk aversion) after the news: bullflags on SI, ZB. Sharp reversal on the indexes as we head into the weekend.

For the trading day of thursday, 2020 02 06

News at 8.30am ET.

Indexes: new highs, see if new support holds, no rush with new longs

Currencies: DX strength, short setups on major pairs (6B, 6E, 6A)

Commodities: GC, SI back in range, bullish structure intact

Financials: ZB bullflag on daily, look for longs on LTF

4pm ET update: we’re not here to trade just to trade. We’re here to make money.

11am ET update:

For the trading day of wednesday, 2020 02 05

News at 8.30, 10.30 (CL) ET.

Indexes: risk-on mode, strong rebound, highs likely to be tested

Currencies: bullflag on DX intact, 6E, 6C short

Commodities: GC, SI in range, CL weakness continues

Financials: ZB retreats, a sign of risk-on mode

4pm ET update: watch for a failure test at the highs. Remek! Premium results for January.

8.30am ET update: Short 6E, long ES, 6C setting up

Next update at 7am ET.

For the trading day of tuesday, 2020 02 04

No News.

Indexes: the weakness, it seems, is being bought by the bulls

Currencies: bullflag on DX intact

Commodities: GC, SI in range, CL weakness continues

Financials: ZB bullish, no change

2pm ET update: trend day on the indexes.

ES STUDY - See chart for details

Today we correctly identified a trend day on the US indexes, and early, pre-session. The importance of this skill cannot be overestimated. These are the days when you can GROW your account. The characteristics of the trend day jump off this chart: starts at the low, ends at the top, no real hesitation in the middle. I hope you've come along for the ride. Stay humble, just another day in the life of Remek! Premium. See you tomorrow!

7am ET update: what looks like a trend day on the indexes. Bullflag on DX, short on 6E.

For the trading day of monday, 2020 02 03

News at 10am ET.

Indexes: expect range-bound action

Currencies: bullflag on DX intact

Commodities: GC, SI in range, CL tested low of Aug 2019.

Financials: ZB long setup on 240min

8pm ET update: expect the negative sentiment to strengthen in the days and weeks ahead as the global impact of the virus becomes more obvious worldwide. This is likely to have a direct effect on the markets. Since developing a vaccine will take at least a year, it it likely that the virus issue will be staying with for the rest of the year. Also, if the health situation gets worse, it is reasonable to expect that safe havens (GC, ZB) will gain importance and may rally. With all that said, remember: the Remek! Premium charts are all we need, and are leading indicator as we navigate the markets in 2020.

3pm ET update: a relatively eventless day. A good long on ZB, a potential late rally on the indexes.

9am ET update: long on ZB