For educational purposes only. No information on this page constitutes investment advice. By accessing this page you agree to the Term and conditions.

Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

For the trading day of friday, 2020 01 31

News at 8.30am.

Indexes: weakness we haven’t seen in a while

Currencies: pullback on DX

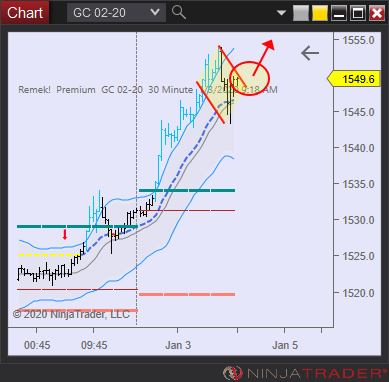

Commodities: SI bulls to re-take control, GC move to the upside expected

Financials: ZB/ZN bullish

2pm ET update: there are days when everything works. This is one of those days.

11am ET update:

10am ET update: Long GC, ZB, short ES

For the trading day of THURSDAY, 2020 01 30

News at 8.30am.

Indexes: weakness we haven’t seen in a while

Currencies: pullback expected on DX, short on 6A, monitoring for long on 6J, 6S, short on CL, anti on SI expected to fail, and bulls to re-take control, GC held together well, move to the upside expected

1pm ET update:

8am ET update:

For the trading day of wednesday, 2020 01 29

News at 8.30am.

Notes: I do not tend to trade on Fed days, especially intraday: before 2pm, volatility tends to be limited, at and after 2pm volatility can be extreme, and no intraday stops are safe. Managing open position on 6E.

Indexes: gap closed, trading back in the range. The market still emotional, and can be vulnerable in this environment.

Currencies: strength on DX. Short 6E, 6A setting up for next leg down.

Commodities: long term trend valid, but surprising daily damage on SI. GC held better, which suggests, price action on SI may have been an abberation.

Financials: ZB/ZN healthy pullback, getting ready for the next leg up

9.30am ET update: Managing short on 6E. See analyses on ZB, SI, 6J (which latter we discussed a few days ago).

For the trading day of tuesday, 2020 01 28

News at 8.30am, 10am ET.

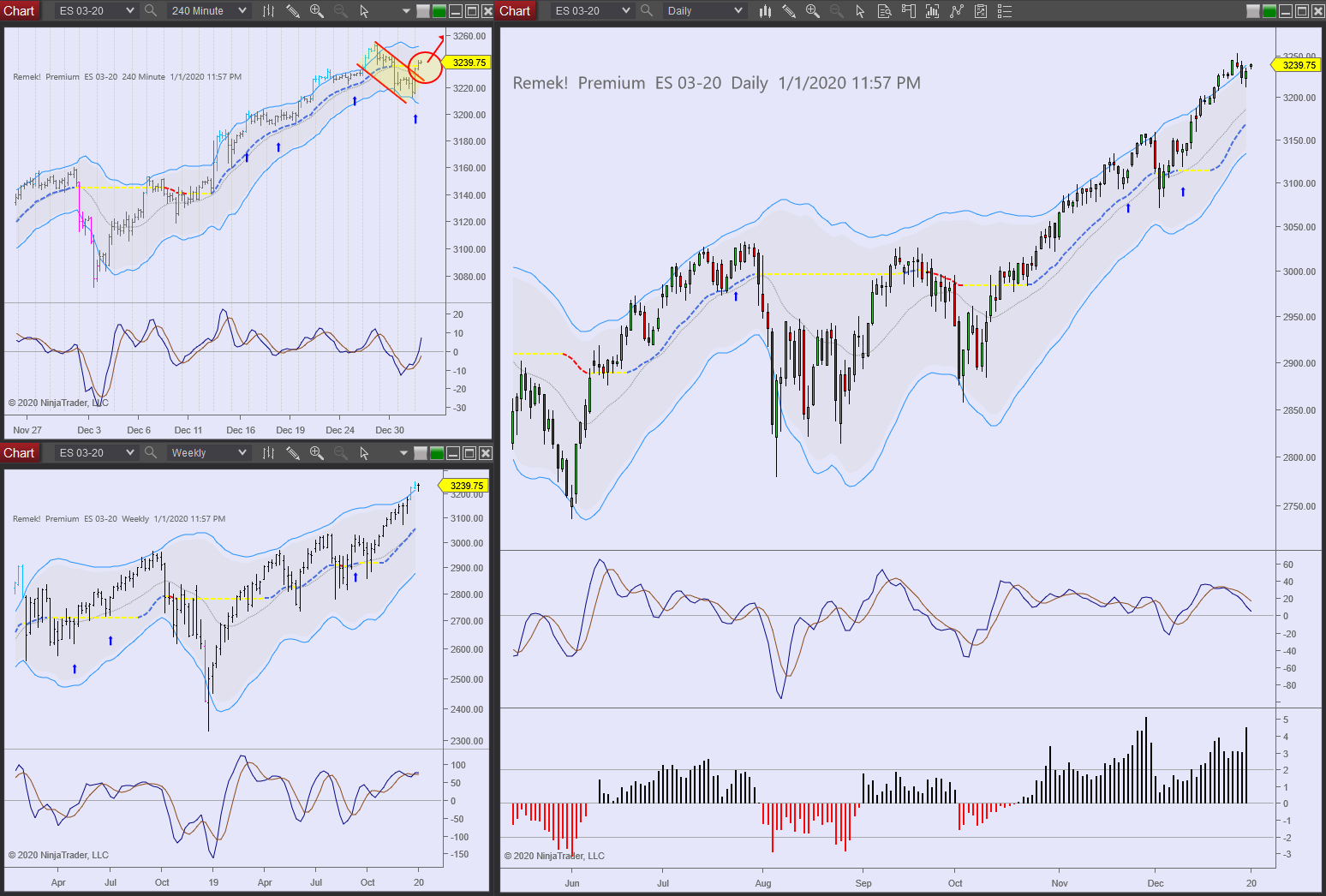

Notes: whether it’s the virus or the political events in the US, or other factors or the extended bullish run followed by profit-taking or - most likely - some combination of all these and other factors, equity indexes have become vulnarable since last Friday. Unlike previously, the pullback was not vehemently bought by the bulls. Parallel to this, capital has been slowly flowing into precious metals and treasuries (something we have known for weeks). A retest of the 3000 area on the ES would not mean ‘the end of the world’, it would actually be technically constructive (do not be influenced by the hype in the financial news industry). We will continue to do what we do, all we need is on our charts. The case for gold and silver continues to stand for this year.

Indexes: FOMC meeting Tuesday/Wednesday (news release Wed 2pm ET): expect limited volatility and follow-through until Wed 2pm, and increased volatility upon the news release. Markets failed to bounce back in today’s session (or test Friday’s close), which is a sign of weekness. We’re ready to short.

Currencies: strength on DX. Short on 6A, 6E

Commodities: GC expected to pass 1600 and not look back (Wed 2pm may become catalyst)

Financials: ZB strength, expect 165 (previous high) soon

12.30pm ET update: ZB: retesting breakout area is healthy. 6B: target reached. 6J: see our discussion yesterday about skipping pullback on 240min. ES: see post pre-open. SI: This action is unexpected and not constructive for the bulls. 6E/6A: in progress

8am ET update: Indexes: Monitoring action on the open. Expecting an attempt to close the gap or at least break above yesterday's high. Watching for failure, which may in another leg down. With all that said, expect range-bound action before tomorrow's Fed release.

For the trading day of Monday, 2020 01 27

News at 10am ET.

Indexes: opens sharply down after Friday’s downday, wait for clues of stabilizing or another leg down

Currencies: expect strength on DX. Short on 6A, 6E, 6J for short

Commodities: GC/SI upgap, move as expected (you should be long and trail it, wait for pullback if not)

Financials: ZB strength as expected, wait for pullback if not long

2pm ET update: we’ve been telegramming safe haven (ZB/GC/SI) strength for weeks. Today, the news is catching up, with us. Such is the strength of our evidence-based technical analysis. ES: this is not what strength looks like. This market is vulnerable.

12noon ET update: 6A, 6E short, GC holding onto gains. ZB: wait for pullback, next target 165

For the trading day of friday, 2020 01 24

News at 9.45am ET.

Indexes: within range, no new information

Currencies: short on 6E

Commodities: GC/SI no change

Financials: ZB expect further strength (triggered on weekly)

1pm ET update: excellent analysis of the interplay between equities and safe havens, good execution today: indexes, safe havens and also on 6E.

8.30am ET update: 6E working, 6A, CL waiting for trigger

GC STUDY - Nothing new, except, in this strong environment that equities are in (ES/NQ/YM), for gold to NOT break down is a sign of strength.

SI STUDY - We know this by now: a pattern failure (in this case, of the bearflag), is a sign of strength in the other direction. SI is moving, GC is likely to follow soon.

ES/NQ STUDY- Some signs of fatigue on the indexes. Steady strength on safe havens (ZB, GC, etc.). Scaling back is okay, no surprise if not much happens today as we head into the weekend. Be mindful of potential global catalysts (political, health or otherwise) that can have the potential to suddenly move this market.

For the trading day of Thursday, 2020 01 23

News at 8.30am ET, 11am (CL).

Indexes: a bit of a pullback on the daily would be healthy for the trend (see below)

Currencies: short on 6E but not much follow-through

Commodities: GC/SI no change in my outlook since yesterday. CL short working well.

Financials: ZB long working well

4pm ET update: ES stayed in range, GC/SI waiting for catalyst, ZB breaking out on daily

9.30am ET update:

8am ET update: monitoring 6C for short, 6B for long, nice work on ZB

6J STUDY: Evaluating context:

See charts below: price at Keltner on the 240min, and we can anticipate a breakout above the Keltner, followed by a pullback. The question is: how interested are we in that pullback if it happens? The answer is on the HTF charts and is based on context: we would be very interested if price were in the rectangle on the daily and the weekly. But it is not. We’re rather wait for price to reach the rectangle area on the daily and THEN look for a pullback on the 240min. In the current situation, any pullback on the 240min is more likely to fail, due to the HTF’s shorts’ potential to take control at any time.

6B STUDY - See chart for details Price steps outside the Keltner on the 240min. This is where we note the emergence of "momentum". Next: monitoring for a pullback, then look for re-emerging momentum OUT OF the pullback channel, in the context of a) HTF market structure b) our own risk and money management plan. Always know: a) price movement within the channel tends to be rather random b) know what is a simple pullback and a complex pullback, plan for both possibilities. After the entry: a) move fails, must get out b) price flat (momentum lost), get out c) second leg works fine. All three scenarios are managed by a pre-defined plan executed with precision, detachment and discipline. What we do here, in a nutshell.

For the trading day of wednesday, 2020 01 22

News at 10am ET.

Indexes: We need to treat this market strong as ever until proven wrong. Watch for failures tests, otherwise look for the slightest intraday pullback to participate. Note: an overbought market like this can be upset by a sudden catalyst: use trailing stops.

Currencies: USD strength: look for shorts on major pairs: 6A (daily), 6E (see potential target on daily), 6J

Commodities: GC/SI expected to move when the ES stops galloping. CL monitoring for breakout.

Financials: bullish structure on ZB/ZN. These will shine when the indexes (sooner or later) halt.

4pm ET update: pullback on the daily ES as expected, CL short working. No follow-through on currencies. ZB working as expected. GC/SI setup still valid.

9am ET update: little new information on the indexes, a pullback on the daily would be a sign of a healthy trending market. DX/Currencies: lack of follow-through. CL: short setup on the daily

For the trading day of Tuesday, 2020 01 21

No News.

(New users: refer to the link above on how to read the Market Scanner Pro.)

Note: A slow start on the markets this morning. ZB looks best. Short on CL. Bullflag on the 240min ES.

1pm ET update: GC/SI tested recent lows, now showing strength. ZB/ZN expect strength on the daily (bullflag on weekly). Indexes consolidating at this level. Tread with care in the current geopolitical (Davos, Middle-East) and domestic (US) political environment. The markets are liable to be moved by a news catalyst (regardless of what the content of that news may be).

8pm ET update: GC, SI on the move, ES retracing. ZB/ZN weekly bullflag in control.

For the trading day of Monday, 2020 01 20

No News: MLK Day. Markets close at 12noon.

Room open at 9.30am.

11pm ET update: ES the upward grind continues, GC being triggered on daily. USD strength, short setting up on 6E

For the trading day of FRiday, 2020 01 17

News at 8.30am ET. Monday: MLK Day in the US. Short session.

Indexes: ES will continue until it stops. When it does, we will notice.

Commodities: GC/SI: breakout from daily bullflag expected

Currencies: DX bullflag on daily in progress, look for shorts on major pairs. 6E, 6J short.

6J - See chart for details. An example of the power of our method: ALL THREE short entries identified superbly by our algorithm (see short signals). Note on the failure test (the top candle) a few days ago.

Financials: ZB/ZN fell back in the range. Weekly bullish structure still intact.

8am ET update: 6J removed profits, GC/SI long as expected, 6E, 6A short as expected

For the trading day of thursday, 2020 01 16

News at 8.30am ET.

Notes: no change since yesterday. Indexes in low volatility environment pressing higher. Precious metals’ move higher is, based on the daily bullflags, imminent. Treasury bills (ZB, ZN) under bullish pressure. Good move on 6S.

Indexes: no change: pressing to new highs

Commodities: GC/SI: breakout from daily bullflag imminent

Currencies: Long on 6S, short on 6J

Financials: ZB/ZN long setting up

1pm ET update: Today we have three important market lessons in real time:

ES STUDY - See chart for details

What is known as 'the grind'. Outside the upper Keltner on the weekly, slow grind along the Keltner on all LTF charts. What do we know about this structure?

a) it is very difficult to trade since there are no pullbacks: the market is short-circuited b) it can go on much longer than we'd think c) when it ends, it ENDS. Consequently, if you're in it, trail it. If not, either risk it, or let it be.

SI - Two pullbacks within the daily pullback: consolidation into resistance, as bullish a structure as it can get.

6A - Potentially a powerful measured move on the daily, into the previous low!

For the trading day of Wednesday, 2020 01 15

News at 8.30am, 10.30am (CL) ET.

Indexes: in range, which is bullish. 3300 is ‘built into’ the ES, in my reading. What happens there, we’ll see. The only way to make money on the ES is to go long and trail it under the previous day’s low. The risk? Nobody knows when it ends. Right now the end is not near, based on price action.

Commodities: GC completed its 50% retracement since its Dec move and held. A lot of upward pressure on this chart: this could be the move of the year. (add to that what ZB is doing, and you’re watching Wyckoff’s ‘smart money’ in real time.)

Currencies: we have to wait for DX to move. Long on 6S

Financials: ZB woke up

Note: Nobody knows what the market will do tomorrow: we work with probabilities. There are tremendous opportunities on these charts. GC looks historic. (Any of you remember 2011?) If we welcome opportunities, we must also welcome risk. These two are two sides of the same coin. The task is, for each trader, to do the math and manage risk on any given account. “A winner? Who cares, move on. A loser? Who cares, move on.” - I heard recently, and how true. Mindful trading!

4pm ET update: ES at 3300 and no sign of weakness, GC/SI also no sign of weakness, currencies: no clear direction, ZB bullish structure

8am ET update: hesitation on currencies (except 6S), bullish on the indexes, monitoring GC/SI for the failure of the bearish pattern on the 240min. Managing (overnight) longs on 6S, ZB. 6J short setting up. 6A short triggered.

For the trading day of Tuesday, 2020 01 14

News at 8.30am ET.

Indexes: strongly bullish with a potential overnight move

Commodities: GC/SI retreating (a sign of ‘risk-on’ mode on equities)

Currencies: several short setups against the USD: 6J as expected: consolidation against support followed by a break, 6A re-entered short, 6C short setting up. But: 6S long setting up (bullflag on daily)

Financials: no change

4pm ET update: a) indexes failed to collapse into the close b) GC failed to collapse into the close c) DX stuck in range

1pm ET update: an eventless, low volatility morning session with a potential breakout on the indexes and no follow-through on currencies so far

For the trading day of Monday, 2020 01 13

No News.

Indexes: bullflag on 240min, bullish until proven wrong

Commodities: SI bullflag on daily

Currencies: USD strength, 6S long triggered, 6A, 6E, 6B, 6J, 6C shorts in progress or setting up

Financials: bullflag on weekly ZB/ZN, monitoring

12noon ET update: doing well on 6S, ES

4pm ET update: good longs on 6S, ES (in progress). Got out of 6A based on the daily candle (but ready to re-enter short if warranted)

12noon ET update: doing well on 6S, ES

6am ET update:

10pm ET pre-market:

For the trading day of Friday, 2020 01 10

News at 8.30am ET.

Indexes: overnight move expected

Commodities: CL monitoring for next leg down, GC bullish move ended in parabolic extention on the 240min, standing by.

Currencies: strength on USD, looking for shorts on major paird. Watch 6J for breakdown

Financials: ZB the bulls are back

4pm ET update: nothing extraordinary today: GC holds (which is bullish), ES within range. Back Sunday night!

12noon ET update: strength on safe havens (GC, SI, ZB/ZN), indexes flattening out as we head into the weekend

6am ET update: closed last nights longs in indexes. GC: 50% holding, bullish bias, wait for evidence, looking for short on 6E, 6J

For the trading day of Thursday, 2020 01 09

News at 8.30am ET.

Indexes: imminent breakout to the upside likely

Commodities: CL structural damage to the daily long trend, GC 50% retracement since the Dec 15 breakout

Currencies: short triggered on 6A, 6J monitoring for short

Financials: ZB monitoring for short breakout

4pm ET update:

For the trading day of Wednesday, 2020 01 08

News at 10.30am ET (CL).

Notes: manage/trail open positions. Embrace for short-term unpredictable volatility, due to the obvious international situation. FOCUS on the chart. Everything we need is on the chart. The market (price on our charts) is the leading indicator. Mindful trading!

Indexes: quick recovery from last night. Bullish bottom tail on daily. Monitoring for upside breakout

Commodities: GC digesting 1600, CL back in the range with bullish bias,

Currencies: USD re-gaining strength, bullflag on weekly

Financials: ZB/ZN bullflag on weekly, similar to GC of a few weeks ago (signs of accumulation).

4pm ET update:

12noon ET update:

7pm pre-open update: CL (commodity), GC, SI, ZN, 6S (safe havens) move. With the appropriate humility: we are handling this acceptably.

For the trading day of Tuesday, 2020 01 07

News at 8.30am ET.

Notes: a day with potentially several excellent setups, but also increased volatility! Warning: due to the recent political developments in the Middle East, the market is liable for increased unpredictability in both directions. Practise risk management ruthlessly in this environment. (No need to leave the market - we need to stay in shape! - but it’s okay to take trades half size and/or on the micros and/or, for currencies, on forex.) Keep in mind: these are trade ideas that you need to adapt to your own situation, risk and money management rules, individual trading psychology, etc, in other words: fit into your own trading plan. (Yes, you MUST have a written trading plan. Your trading plan is an evolving document that should be reviewed, enhanced, fine-tuned and updated at regular intervals.)

Indexes: monitoring for upside breakout

Commodities: CL likely to move to 67 area, GC/SI consolidating, further upside expected

Currencies: 6A, 6B longs setting up. (if 6A is not moving soon, setup’s potential wanes.)

Financials: ZB monitoring pullback for next leg up.

2pm ET update: ZN (so far) non-performing. SI intraday long working. GC lagging. CL 240min bullflag.

8.30am update: ZN ‘perfect storm’, meaning, two HTFs are in support of the trade on the trading timeframe (in this case: 240min). Usual trade management rules. Will it work? We’ll see. GC/SI: consolidation in this area would be a bullish sign before the next leg up. (Large moves must be “digested”.) 6A clearly failed overnight (but we never got triggered, so no harm done.)

For the trading day of Monday, 2020 01 06

Notes: The first full week of trading starting in 2020! As to today’s ETH open (Sunday 6pm ET), we must say we’re not always this right, but today major markets (CL, precious metals, ZB, currencies) are unfolding - or in the case of the CL: have unfolded) as we predicted days ago. You can see now: even if you’re an intraday trader, it is crucial for your success to understand the processes on the higher timeframes, because what you do intraday has a much better chance of success if it is in sync with the larger moves and shifts.

For new members: at the start of the year, this is good time to rewatch the videos at https://www.remek.ca/remek-premium-videos, you may find some good nuggets (trade management, etc.) in them.

No News.

Indexes: retracing, sideways, standing by

Commodities: CL 63 we said two weeks ago, and 63 it is. GC/SI: what can we say? sometimes we’re right, and this is one of them

Currencies: 6C, 6S longs setting up.

Financials: ZB behaving as expected. See this post: https://www.remek.ca/blog/tag/ZB. An important multiple timeframe lesson.

4pm ET update: Watching 6A, 6B for long entry

11.30am ET update: long term trends may be intact, but embrace for increased intraday volatility in the current international situation. (See SI as an example for intraday volatility today.) On small accounts, it’s okay to stay out, scale back or go micro contracts.

For the trading day of friday, 2020 01 03

News 10am ET, 11am ET (CL).

Indexes: If long, manage it. Bullish until proven wrong.

Commodities: GC/SI as expected. You should be long and trailing it.

Currencies: pullbacks in progress on 6A/6C/6E, looking for longs. 6C looking for breakout

Financials: ZB bullish pullback on 240min after successful retest on daily (bullflag on weekly).

3pm ET update: What we’ll be watching in the next session:

9.30am update:

For the trading day of Thursday, 2020 01 02

News 8.30am ET. (To new users: we don’t analyze the content of news items, we simply consider its effect on volatility (and is, mostly, of significance to intraday traders). A possible rule for intraday traders: close all positions, and do not trade 10min before and after the news release. You should have your own well-defined rules to handle the potential effect of news releases on intraday positions. As to Econoday’s news page: we only list news items marked in red.)

12noon ET update:

2020 01 01 10pm, ETH open:

Notes: strongly bullish sentiment on US markets expected to continue, and we’ll continue to have a strong bullish bias until the market tells us otherwise. The best way to take advantage of this market environment is probably not by doing tiny intraday trades in the noise, but to trail the position under the previous day’s low. Much of the intraday price action is expected to aim at shaking out weak hands from the best 3-5 day and longer moves.

Indexes: long trade on 240min triggered. A break of previous high is expected. This may turn into a slow grind up along the daily Keltner Channel. If that’s what happens, the best way to trade it is by trailing under previous day’s low, until stopped out. Other scenarios are possible of course, and we’ll deal with those as and if they surface.

Commodities: GC most likely heading to 1560 area. The question is: how. a) bullflag on 240min and no looking back b) retracement on daily first and then head up. In either case, watch for the break 1528 on the daily. This is a historic move, with great potential (see weekly chart.) Similar on SI. CL: healthy retracement before the likely move to the 63 area. Monitoring for long trigger on 240min.

Currencies: DX bearish, next leg down likely. Consequently bullish on major pairs (6E, 6B)

Financials: ZB: waiting to see if 155.20 area holds or breaks.