Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

Note: As part of the service, emails about setups may arrive in your inbox any time during the day. It is advised that you direct your Premium emails into a separate folder in your email program, so they do not interfere with your other activities during the day, allowing you to look at them at your convenience.

FOR THE TRADING DAY OF friday, 2019 11 29

Note: a short session today: expect limited volume and increased chance of ‘no follow-through’. It’s okay to stand by.

Indexes: at highs, standing back for now, a little correction would be healthy

Commodities: bullish on CL, waiting for setup

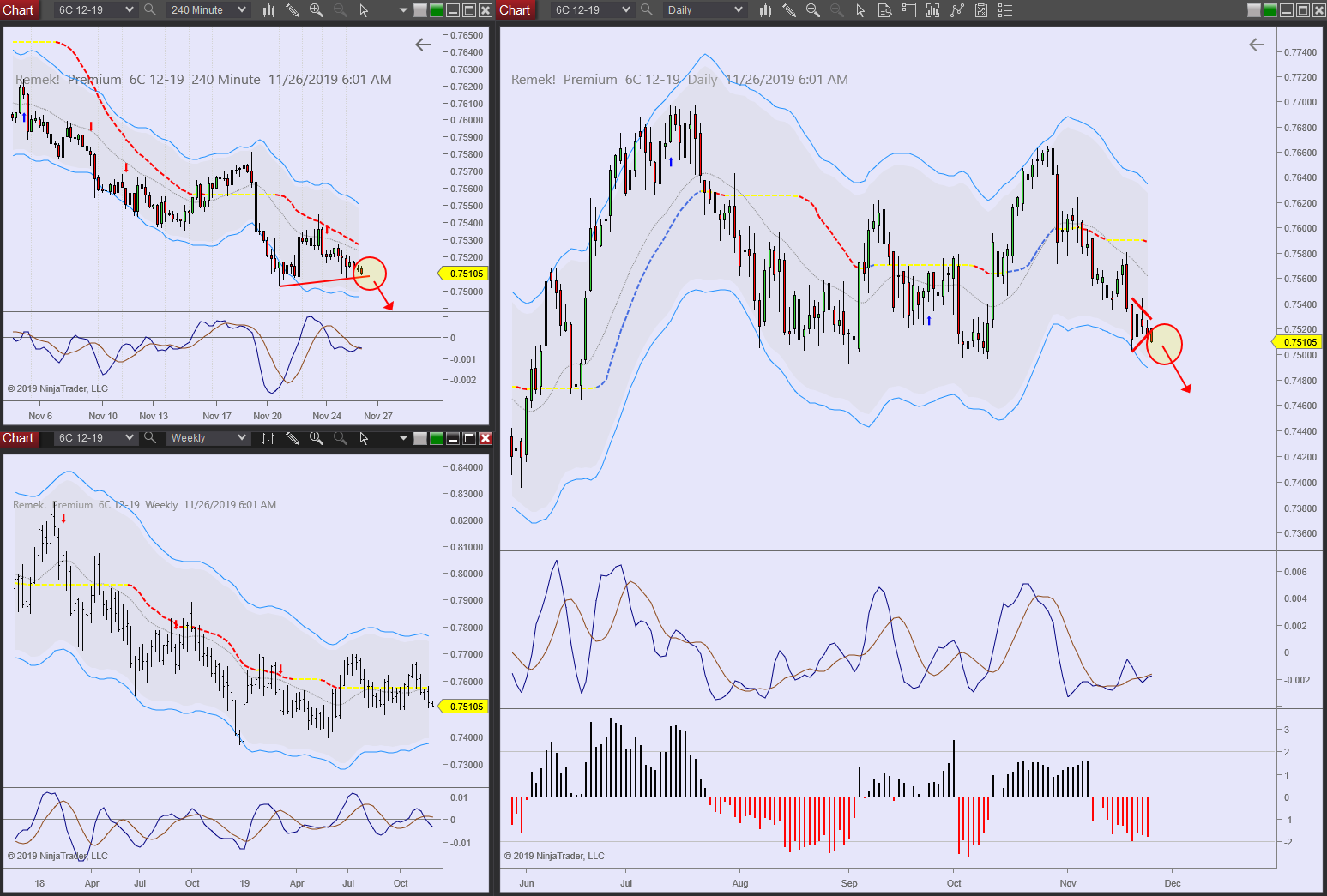

Currencies: USD strength, shorts setting up or in progress on several majors (6J, 6E), 6C short in progress, 6B monitoring for long

Financials: ZB consider long on further strength

Agriculturals: ZC as expected

Notes: a few potentially significant events happened today. Let’s review them:

GC/SI STUDY: We've been talking about the bullflag on the weekly GC/SI for weeks. See the daily chart: there's room to go. This is what "the train is leaving the station" looks like. Note: it's okay to scale in, start small, add on pullbacks as you trail stops. This, being a weekly structure may go on for weeks/months. Warning as always: no one knows the future. We're working with probabilities. Always cover your back, as you look ahead.

6B STUDY

Our complex bullflag waking up. See daily.

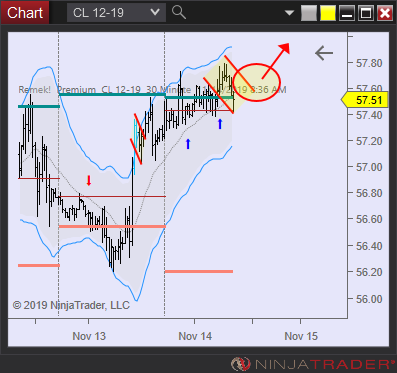

CL STUDY: A spectacular failure of a potentially bullish pattern. This is what "low volume day warnings" and "increased chance of no follow-throughs" look like. But: it also highlights why our 'price trigger/momentum' entry method works so well. We never got triggered, so we suffered no harm. See this post: https://www.remek.ca/blog/2019/9/20/three-ways-to-enter-a-pullback-trade.

ZB STUDY: Bullish structure. Make a plan to enter on further momentum. Or wait for first pullback after the breakout. Room to go on daily.

FOR THE TRADING DAY OF thursday, 2019 11 28

US Thanksgiving. Markets closed.

FOR THE TRADING DAY OF Wednesday, 2019 11 27

News at 8.30am, 9.45am, 10am, 10.30am ET.

Notes: last session before US Thanksgiving (markets closed tomorrow, short session on Friday). Expect low volume and limited follow-through. Manage open positions.

Indexes: at highs, standing back for now, a little correction would be healthy

Commodities: CL long, GC/SI have refused so far to break down

Currencies: 6E short, 6B long

Financials: ZB consider long on further upside strength

Agriculturals: ZS setting up for another short, ZW: a bullish breakout expected

Notes on GC: this could be a decisive moment in GC’s journey: if it refuses to break down from here (see 240min) and the 240min bearflag fails, that would indicate the bullflag on the weekly prevails. This could start a flood of new long entrants, as well as the re-entry of weak hands shaken out recently, leading, potentially, to a long lasting move to the upside (towards the highs of 2011). Potentially a wealth building opportunity, but expect also increased volatility. MGC and GLD are viable alternatives to GC. Similar scenario on SI. (The usual disclaimer and risk management rules apply.)

PS: a breakdown from here, however, would cause technical damage (from the bulls’ point of view) to the weekly chart, one which would probably take a long time to recover from. Also: clues on SI: this is NOT what an imminent breakdown looks like.

SI 2019 11 27

FOR THE TRADING DAY OF tuesday, 2019 11 26

News at 8.30am, 10am ET.

Notes: US Thanksgiving week. Markets closed on Thursday. Expect limited volume as the holiday approaches. Friday: early close.

Indexes: at highs as predicted, pullback in progress, further upside expected

Commodities: CL long setup on 240min, supported by daily

Currencies: 6B long potential. 6E, 6C short setting up

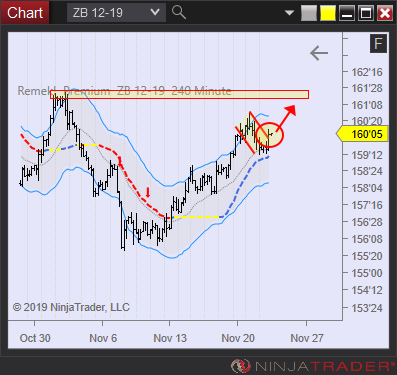

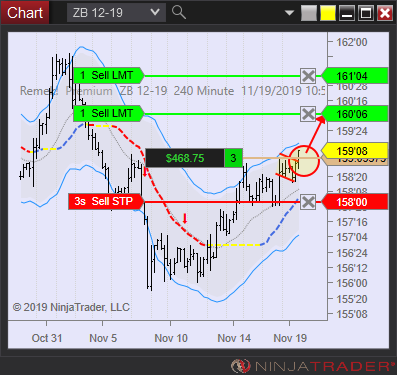

Financials: ZB strong bullish setup, see weekly/daily/240min

12noon ET update: good insight on ZB, NQ, ZS. Excellent insight on GC/SI. Note: we were planning a few trades on currencies, but they haven’t triggered.

FOR THE TRADING DAY OF Monday, 2019 11 25

No News.

Notes: US Thanksgiving week. Markets closed on Thursday. Expect limited volume as the holiday approaches. Friday: early close.

Indexes: potential overnight breakout to previous high

Commodities: CL pullback on 240min. GC: timeframe conflict, waiting for clues

Currencies: 6B daily pullback in trouble, but not done yet; skipping short on 240min due to conflict with weekly and daily structure. 6J short triggering on 240min

Financials: ZB: complex pullback on 240, good potential

1pm ET update: our trades are working well today

pre-RTH update: several potential shorts against the USD, see below. Be mindful of correlated risk.

ETH (previous night) update:

FOR THE TRADING DAY OF friday, 2019 11 22

No News.

Indexes: pullback on daily, bullish bias

Commodities: CL pullback following breakout

Currencies: 6A short in progress, 6B long in progress

Financials: ZB: long in progress to previous high

12noon ET update:

8am ET update:

FOR THE TRADING DAY OF thursday, 2019 11 21

News at 8.30am, 10am ET

Note: FOMC came and went. Business as usual.

Indexes: bullish outlook, pullback on daily (consolidation)

Commodities: GC(SI) Monitoring for intraday long entry (potentially into weekly bullflag)

Currencies: 6A short in progress, 6B long in progress

Financials: ZB: long in progress to previous high

Agriculturals: I’ve started following corn, soyabeans and wheat. I’ll be sharing what I see as we move forward.

11am update: CL long, 6B long, monitoring precious metals

FOR THE TRADING DAY OF wEDNESDAY, 2019 11 20

News at 10.30am ET (CL), 2pm ET FOMC

Note: We do not usually open new positions on FOMC days, but continue to monitor markets.

12noon ET update:

FOR THE TRADING DAY OF tuesday, 2019 11 19

News at 8.30am ET

Indexes: expect some consolidation (pullback). We’re bullish until the market tells us otherwise.

Commodities: GC we expect the 240min bearflag to fail. That done, we can look for longs. SI breaking out on 240min

Currencies: 6B Long in progress. Consolidation into previous resistance: a very bullish sign. Consider long if not in yet. 6A short in progress

Financials:

11am ET update: GC: intraday long ZC: dropped. 6B: long ZB: long

1am ET update:

FOR THE TRADING DAY OF Monday, 2019 11 18

No News.

Indexes: strongly bullish market. (That doesn’t mean it is easy to trade.) Waiting for retracement before we get involved.

Commodities: CL monitoring bullish breakout, (back in the range for now)

Currencies: 6B Long in progress, further longs expected as 6B is likely to be heading back to 1.35 area

Financials: monitoring daily bearflag

4pm update:

Notes to ZC chart:

I've added a few agriculturals to my list, a class I haven't traded much before. Testing to see how they respond to what we do. Expect to see a few of these in the future. (They, too, have a micro contract that can be considered on smaller accounts.) Note to those who are working on becoming consistent: micro contracts can be an important step towards success: using them a) we can learn to manage our emotions b) we can learn to trade for real while not blowing accounts.

This will create a positive feedback: right action > good results > self-confidence > right action. For each trader, establishing and maintaining this positive loop is more important than a few random lucky trades. Become a trading factory: produce consistent output every month! When you've achieved that, you can start to size up.

FOR THE TRADING DAY OF Friday, 2019 11 15

News at 8.30am, 9.15am ET

2pm ET update: Today, everything worked. Not every day will be like this. Focus on risk management at all times. On small accounts, consider micro contracts and, on currencies, forex. Also: never lose sight of your risk management plan, the focus of which must be: surviving a “worst-case scenario”: https://www.remek.ca/capital-requirement-calculator. Fill out the data for your situation, and pay special attention to the ‘Max. likely losing streak’ and 'Capital required to trade strategy’ fields.

9am ET update:

GC STUDY - See chart for details. Ref: yesterday's note on potential bearflag failure on GC and the significance of recognizing pattern failures.

This here is what a (potential) pattern failure looks like. Note: price action is the only leading indicator. The Momentum short signal is late (hasn't caught up yet), but this is normal and expected, since all data, by definition, is past data. It will catch up as data becomes available. So: right now, we do nothing. But we're monitoring for the first pullback to the long side. As short term traders, we must read price action. Any 'indicator' can only be a crutch. (And Remek! Momentum is a very good crutch.)

11pm ET update:

Indexes broke out as expected (see below). 6B: long. 6A: short setting up.

FOR THE TRADING DAY OF thursday, 2019 11 14

News at 8.30am ET

Indexes: low volatility environment continues. Bullish pressure makes breakout to the upside increasingly likely (see bottom tail on daily candle)

Commodities: GC/SI : bearflag on 240min, in the process of failing (see yesterday’s analysis)

Currencies: 6A: waiting for pullback to go short. 6E short breakout

Financials: daily bearflag expected to fail

3pm ET update: notes on 6B: a) complex pullback, momentum signal on daily b) breakout on the 240m c) look for pullback to enter on LTF into the HTF move. Note: just because timeframes line up, there’s no guarantee that the trade will work. Apply your usual risk management rules.

7am ET update: 6A, 6E, see last night’s email and chart below

FOR THE TRADING DAY OF Wednesday, 2019 11 13

News at 8.30am ET

Indexes: low volatility environment (daily candles are very small): extremely hard to trade intraday, “capital preservation” mode. (See ATR on chart below.)

Commodities: GC/SI down sharply, looking for support

Currencies: 6A, 6J monitoring for short, 6B monitoring for long

Financials: standing by

4pm ET update: another tight-range day on the indexes, little movement on other instruments. Quiet markets.

8.30am ET update:

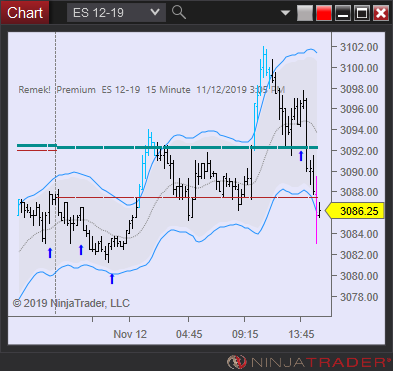

FOR THE TRADING DAY OF Tuesday, 2019 11 12

No News.

Indexes: yesterday’s session was another signal of strong bullishness. This is a very strong market until the market tells us otherwise. That said, we’re waiting for some pullback on the daily, preferably, before we act.

Commodities: GC/SI down sharply, looking for support

Currencies: USD strength with pullback on 240min, expected to yield shorts on major currencies (e.g. 6E, 6A, 6C) in the next session.

Financials: standing by

3pm ET update: ES back in yesterday’s range. GC at 1460. 6B bullish pullback on daily.

8am ET update:

Indexes: I expect range-bound action intraday today. I’d prefer a pullback on the daily for a few days before taking up long positions.

Currencies: strong DX. Look for shorts on the 6E today.

Commodities: GC: waiting to see where it finds support

FOR THE TRADING DAY OF Monday, 2019 11 11

No News. US Holiday: Veterans Day, Canada: Remembrance Day. Expect limited action

Indexes: our bullish bias has been correct. This is a very strong market.

Commodities: GC/SI down sharply, looking for support

Currencies: USD strength re-established

Financials: standing by

12noon ET update:

9.30am ET update: expect mean reversion mode on the indexes. Pullback likely on DX before next move up. Bearflags on 240min GC, SI.

FOR THE TRADING DAY OF Friday, 2019 11 08

News at 10am ET. Monday: markets closed.

Indexes: strong push to the upside on indexes and USD; commodities, financials are taking a hit

Commodities: GC/SI down sharply, looking for support

Currencies: USD strength (bearflag failure), shorts setting up on majors. 6C: short in progress.

Financials: ZB sharp move down, looking for support

FOR THE TRADING DAY OF thursday, 2019 11 07

News at 8.30am ET.

Indexes: do not chase it, strong open, wait for retracement, firmly above previous support on daily

Commodities: GC/SI bullflag intact on weekly, but short Anti setting up intraday. Monitoring if selling pressure of yesterday has been absorved. Update: took short Anti on SI, see below.

Currencies: 6E short intraday, monitoring long setting up on daily 6A

Financials:

1pm ET update:

10.30am ET update:

FOR THE TRADING DAY OF Wednesday, 2019 11 06

News at 10.30am ET (CL).

Indexes: indexes held above the breakout area of two days ago, giving us a pullback on the 240min (see below)

Commodities: GC/SI bullflag intact on weekly, selling pressure on LTF. Standing by. CL: ready to move higher

Currencies: failure of bearflag on DX highlights the importance of avoiding ‘correlated risk’ when trading currencies (i.e. not piling up similar positions on different currencies in relation to the USD). 6C: short

Financials:

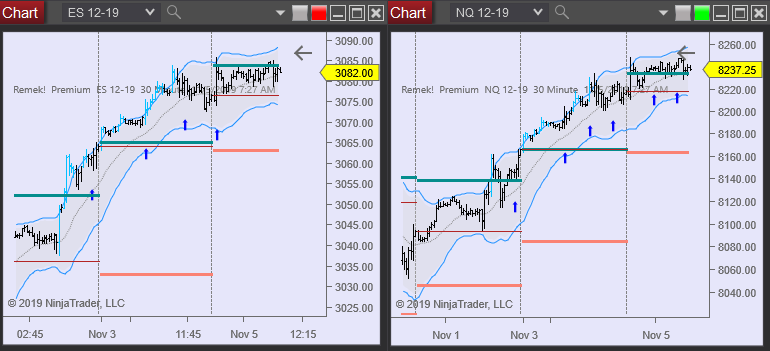

FOR THE TRADING DAY OF tuesday, 2019 11 05

News at 8.30am ET.

Indexes: further upside expected, monitoring for potential breakout above yesterday’s high (see below)

Commodities: GC/SI bullflag intact on weekly, selling pressure on LTF

Currencies: bearflag on hold for now on DX. Waiting for clues. Short 6C.

Financials:

11.30am ET update:

FOR THE TRADING DAY OF Monday, 2019 11 04

No News.

Indexes: bullish until proven wrong, look for pullback on open

Commodities: GC/SI bullish bias, on the lookout for intraday pullbacks

Currencies: bearflag in progress on DX. Look for longs on major pairs (6A, 6E, 6B etc.)

Financials:

11am ET update:

FOR THE TRADING DAY OF Friday, 2019 11 01

News at 8.30am, 10am ET

Note: waiting for the open for clarity and concrete setups

Indexes: pressing againsts highs, no sign of bearishness

Commodities: GC/SI: (long-term) longs

Currencies: 6A long in progress (overnight)

10am ET update: