Remek! Premium daily analyses

Actionable real-time market intelligence for short-term investors

Designed to remove the obstacles between you and successful trading.(If you see a red logo to the right, you are on a page only visible to Premium members.)

Note: As part of the service, emails about setups may arrive in your inbox any time during the day. It is advised that you direct your Premium emails into a separate folder in your email program, so they do not interfere with your other activities during the day, allowing you to look at them at your convenience.

FOR THE TRADING DAY OF Monday, 2019 11 04

No News.

Indexes: bullish until proven wrong, look for pullback on or before open

Commodities: GC/SI bullish bias, on the lookout for intraday pullbacks

Currencies: 6A long in progress (overnight)

Financials:

FOR THE TRADING DAY OF Friday, 2019 11 01

News at 8.30am, 10am ET

Note: waiting for the open for clarity and concrete setups

Indexes: pressing againsts highs, no sign of bearishness

Commodities: GC/SI: (long-term) longs

Currencies: 6A long in progress (overnight)

10am ET update:

FOR THE TRADING DAY OF thursday, 2019 10 31

News at 8.30am.

Indexes: FOMC didn’t shake the market, bullish consolidation intact. Note: a retest of the 3000 area (ES) would not mean the violation of the uptrend, see daily chart.

Commodities: GC/SI: long, weekly bullflag, long-term bullish potential intact,

Currencies: 6E, 6A, 6B longs in progress (this is the same trade, against the USD, be mindful of correlated risk: if one fails, all will likely fail.

12noon ET update:

8am ET update:

FOR THE TRADING DAY OF Wednesday, 2019 10 30

NOTE: FOMC 2pm ET. No trades on indexes today.

News at 8.30am, 10.30am (CL), 2pm ET.

Indexes: all time highs reached. Next few days will provide clues as to what may come next.

Commodities: GC: weekly bullflag, long-term bullish potential intact. CL: long breakout setting up

Currencies: 6E, 6A longs in progress. 6B long setting up

8am ET update:

9am ET update:

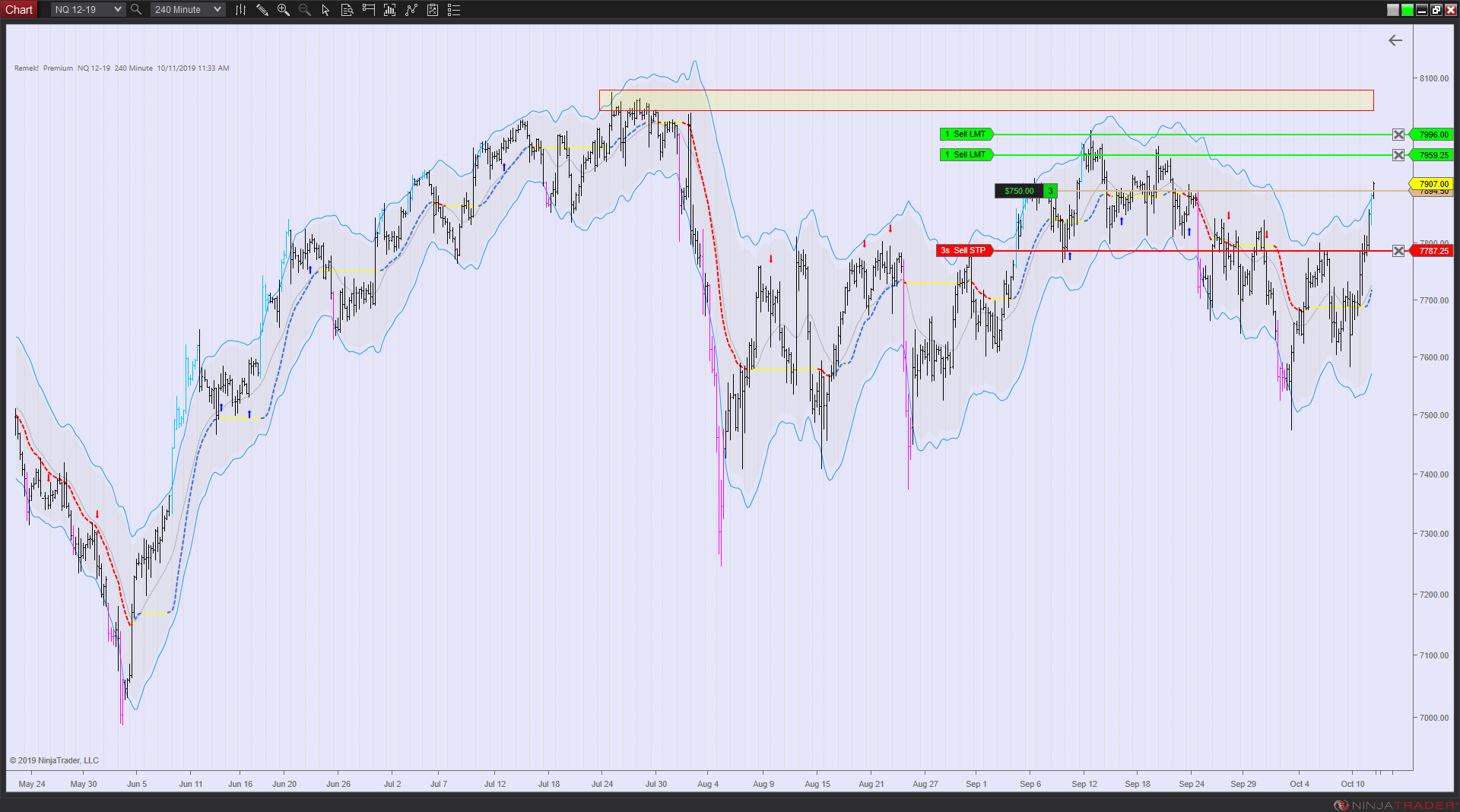

Study notes on trading pullbacks (see chart on right):

- make sure there is a trend and it is strong. Avoid overextended or fading trends.

- enter trades as trading timeframe trend re-asserts control over LTF pullback channel (which is in fact an opposite trend on the lower timeframe)

- place stops outside expected noise

- be ready to handle complex pullbacks

- take partial profits at 1R or previous high whichever comes first, trail the rest

- the above are guidelines. define your own rules

FOR THE TRADING DAY OF Tuesday, 2019 10 29

NOTE: FOMC tomorrow, expect limited volatility until 2pm Wednesday.

News at 10am ET.

Indexes: all time highs reached. Next few days will provide clues as to what may come next.

Commodities: GC: weekly bullflag, long-term bullish potential intact. CL: bullflag on daily in progress, as expected. Will be looking for long coming out of that bullflag.

Currencies: bearflag on daily DX starting to move. Expect long setups on major cross-currencies. Long on 6A.

Financials:

12noon ET update: good longs on 6E, 6A

9am ET update: Scaling back involvement on indexes (FOMC, Wed 2pm ET). Good long setups on 6A, 6B, 6E.

FOR THE TRADING DAY OF Monday, 2019 10 28

News at 8.30am ET.

Indexes: most likely, testing all time highs. From then on, there are various scenarios. For now, you may want to remove profits and monitor the indexes’ behaviour.

Commodities: GC, SI: the expected - and likely long-term - bullish move out of the tigh range has started. CL: bullflag on 240min supported by daily structure.

Currencies: bearflag on daily DX. Expect long setups on major cross-currencies. (6E, 6A, 6B may not wait for the open.) Monitoring.

Financials:

1pm ET update:

9am ET update:

REMEK! PREMIUM 2019 10 28 - Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

10pm ET update:

FOR THE TRADING DAY OF Friday, 2019 10 25

News at 10am ET.

Indexes: trading in a tight range all this week. The most likely scenario is still reaching all time highs.

Commodities: GC, SI: the expected - and likely long-term - bullish move out of the tigh range has started. We haven’t seen this opportunity on the precious metals for ten years! Be aware of its potential significance, and position yourself accordingly while managing your risk. CL: bullflag on 240min supported by daily structure.

Currencies: DX bearflag in progress: long setups on 6A, 6E, short on 6J.

Financials: no action items right now

4pm ET update:

Study on pullbacks:

Recognizing a pullback is not enough. Everybody can see a pullback! So how are we different? For starters, understanding pullbacks' 'lifecycle' is important, so we can select the ones with the best potential. What you want to see during the pullback is 'hesitation', 'reluctancy', 'limited volume' (if you watch volume, I do not), a sense of 'lack of large buyers' during the pullback, as it approaches its 'tipping point'. However, if you see something like this DX chart, with strong, 'confident' (and a bit too many) daily green candles, what you may be seeing is a 'dissipating' short momentum (as embodied in the first forceful downleg). When you see this, start to treat the pullback with suspicion, and start thinking of removing the setup from your 'potential trades' list.

This is a bit discretionary, but not everything can be straightjacketed into algorithmic code. Consider the above, learn to recognize when you see 'dissipating' momentum, so you can skip the shaky setups and deploy your capital on the most promising ones. If there are elements of 'art' in trading, I guess this is one. The point is: make up your own rules.

Now, it may happen, that I see this as a suboptimal pullback, remove it from my list, and then it drops and goes to the floor. That's fine. As traders, we have to get used to being wrong VERY OFTEN. The main thing is is to make sure what we do works over a thousand trades.

It may also happen that I remove it from my 'potential trades' list, then a day later, I put it back. As long as it's based on objective criteria, that is perfectly okay. As traders, we can't be married to a position or our opinions. Things change, new information comes in all the time. We have to adapt.

Not a bad week. Back Sunday night!

12noon ET update:

FOR THE TRADING DAY OF thursday, 2019 10 24

News at 8.30am, 10am ET.

Indexes: ES shrugged off 240min bearflag. Most likely heading to all time highs.

Commodities: GC, SI weekly bullflag intact, monitoring for a long entry

Currencies: DX bearflag: look for longs on major currency pairs, e.g. 6E. Note: all long setups are against the USD, in other words, they’re basically the same trade. Be aware of correlated risk.

Financials:

2pm ET update: GC, SI move as expected, wip (work in process, meaning, we’re in a position). ES/NQ: Surprising ‘hesitation’ on the indexes, wip. CL: long wip. 6J: Monitoring for short breakout.

9am ET update:

11pm ET update:

FOR THE TRADING DAY OF Wednesday, 2019 10 23

News at 10.30am ET.

Indexes: bearflag, warning sign

Commodities: GC, SI weekly bullflag intact, monitoring today for a long entry intraday

Currencies: DX weekness. Look for longs on major currency pairs upon pullback Note: all long setups are against the USD, in other words, they’re basically the same trade. Be aware of correlated risk.

Financials:

2pm ET update:

8am ET update:

FOR THE TRADING DAY OF Tuesday, 2019 10 22

News at 10am ET.

Indexes: heading to all time high, position long

Commodities: GC, SI weekly bullflag intact, but no clear setup on daily or 240min

Currencies: DX weekness. Look for longs on major currency pairs upon pullback (See charts below. ). Note: all long setups are against the USD, in other words, they’re basically the same trade. Be aware of correlated risk.

Financials: skipping short on ZB, contradicts weekly pattern

5pm ET summary:

The indexes failed to break out to the previous highs, again. NQ failed first, so at least there was a clue.

Precious metals in a tight range, doing nothing (which is probably the quiet before the storm)

Currencies: USD weakness creating good pullbacks on the 240min charts in several currencies.

Overall, except for currencies, we’re in a treacherous environment…

9am ET update: indexes holding, long to all time highs. Monitoring pullbacks on 6S, 6E

10pm ET update: Setups to watch overnight and tomorrow.

FOR THE TRADING DAY OF Monday, 2019 10 21

No News.

Indexes: bullflag on daily/240min, likely to move to all time highs, be on the lookout for a trending day

Commodities: GC, SI bullish mid-term (weeks out).

Currencies: DX weekness. Look for longs on major currency pairs upon pullback (6E, 6B, 6C, 6A).

Financials: monitoring for a short on ZB (as always wait to be triggered with momentum)

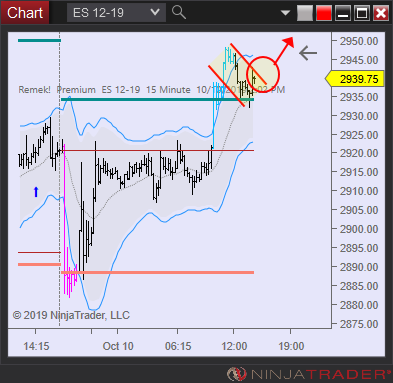

11am ET update: NQ STUDY - See chart for details

An example of the fruitlessness of using tight stops:

1) everybody's long 2) buyers stop buying, market falls, weak hands freak, sell, just to add to the selling pressure 3) weak hands out, buyers step back in, market continues, only without the weak hands.

This is normal market behaviour.

Solution: a) place stops outside the battle zone (have appropriate account size) b) wait for the slaughter to end, then enter with the pros c) trade a larger chart, e.g. the 240min, and the problem largely disappears, since this is mostly a short-term intraday game (which repeats and repeats...)

Bottom line: know this, and have a plan.

RTY big picture:

9.30am ET update: indexes, precious metals bullish.

FOR THE TRADING DAY OF friday, 2019 10 18

No News.

Indexes: with an extremely dull Thursday’s session behind us, waiting for next catalyst, and likely to move it back to the all time highs

Commodities: CL emerging strength. See below for potential entry area.

Currencies: good moves in 6C, 6E in Thursday’s session on USD weekness (see below). 6B rallied. Expected to consolidate in today’s session. Wait for pullbacks (6E, 6A, 6J), do not chase.

Financials:

3pm ET update: indexes will likely end up with a bottom tail on the daily. Strong moves on major currencies against the USD. Further consolidation on precious metals. Respectable results for a tough week.

1pm ET update: pattern failure on the indexes. GC/SI longs intact.

10am ET update:

FOR THE TRADING DAY OF THURSDAY, 2019 10 17

News at 8.30am, 9.15am, 11am ET (reminder: no positions on 10min before and after if trading intraday)

Indexes: waiting for next catalyst, and likely to move it back to the all time highs

Commodities:

Currencies: 6C long, 6J short, 6A short

Financials:

11am ET update:

6am ET update:

FOR THE TRADING DAY OF wednesday, 2019 10 16

News at 8.30am ET.

Indexes: bullish bias (see yesterday for details)

Commodities:

Currencies: 6C long, 6J short, 6A short

Financials: ZB short

1pm ET update:

FOR THE TRADING DAY OF Tuesday, 2019 10 15

No News.

Indexes: waiting for clues

Commodities: Bullish setups on GC, SI (240min)

Currencies: long setting up on 6C

Financials: monitoring for a short

4.15pm ET update: you’ve heard me many times talk about ‘pattern failures’ and the important information they carry. And I’ve mentioned that pattern failures themselves can fail (at which point some of you must have thought the guy’s gone mad :)… Well, today we had an example of a pattern failure failing. First, a week ago or so, our bullflag on the indexes broke down, and a bearish continuation was in the cards. With today’s action, that failure of that bullflag has failed. In other words, the bears were unable to hold their grip on the opportunity to bring this market further down. Long story short: bulls back in control.

3pm ET update:

2pm ET update: strongly bullish session on the indexes

8.30am ET update: quiet start of the week. Watching 6C and others shown below.

FOR THE TRADING DAY OF Monday, 2019 10 14

General comment: US bank holiday, Canadian Thanksgiving. Expect reduced activity on the markets.

No News.

Indexes: due to the expected reduced volume, we will skip intraday trades in tomorrow’s session. We’ll be monitoring for any noteworthy events.

Commodities: Bullish setups on GC, SI (see below)

Currencies:

Financials:

11am ET update: GC, SI

Study: We have talked about the importance of the information pattern failures ‘broadcast’. Here’s an example of using such information.

SI: LTF pattern failure as entry into HTF move. See how a failure of the bearflag on the intraday timeframe would become the trigger for the long trade on the 240min.

A bit different on the surface, but fundementally the same situation on GC.

FOR THE TRADING DAY OF friday, 2019 10 11

General comment: whether for political or economic drivers, the second half of this week demostrates just how difficult it has been to navigate the markets lately.

No News.

Indexes: strong pre-session open

Commodities: GC/SI bullflag on weekly intact.

Currencies: several significant pattern failures yesterday created a difficult trading environment. Monitoring today.

Financials: ZB long has failed for now.

4pm ET update: a bullish quasi trend day on the indexes with late-session profit taking. A tough week, with striking pattern failures on several currencies. Precious metals are holding together well on the weekly. The unprecedented uncertainties in the US (and the world, e.g. UK, Middle East, Hong Kong) are not making our job any easier, but we expect our rock-solid technical approach to be a reliable guide as we move towards the end of the year.

FOR THE TRADING DAY OF thursday, 2019 10 10

News at 8.30am ET

Indexes: no new information after FOMC, no directional bias

Commodities: GC bullflag on weekly. SI long on daily

Currencies: 6C short, 6B short

Financials: ZB long setting up (complex bullflag) on 240min

4pm ET update:

12noon ET update: good long in indexes, underwater but holding on SI/GC, short on 6A

9am ET update: RTY Mean reversion mode is likely. ES Think first pullback IF it breaks above (for now: no bias, chop).

FOR THE TRADING DAY OF wednesday, 2019 10 09

News at 10.30am ET (CL), 2pm ET FOMC (note: we rarely trade the indexes on FOMC days)

Indexes: standing by

Commodities: GC bullflag on weekly. SI long setting up on 240min.

Currencies: 6C short, 6B short (see below)

Financials: ZB long setup on 240min

4pm ET update: FOMC behind us, no new information

8am ET update:

FOR THE TRADING DAY OF tuesday, 2019 10 08

News at 8.30am ET. Note: Wednesday 2pm FOMC.

Indexes: expect sideways action ahead of Wednesday’s FOMC

Commodities: GC bullflag on weekly. SI long setting up on 240min.

Currencies: 6C short setting up

Financials: ZB long setup on 240min

8am ET update:

6am ET update:

10pm ET update:

FOR THE TRADING DAY OF Monday, 2019 10 07

No News.

Indexes: strong bottom tail on weekly, indicating bearish momentum has dissipated. Bullish outlook for today’s session.

Commodities: GC bullflag on weekly. Consolidating on daily. If intraday, wait with longs. SI long setting up on 240min.

Currencies: 6C short setting up

Financials: ZB long setting up

2pm ET update: CL short setting up

10pm ET update:

FOR THE TRADING DAY OF friday, 2019 10 04

News at 8.30am ET .

Indexes: mean reversion in late yesterday’s session. Monitoring if it can hold into the Friday close.

Commodities: continue to look for bullflags on GC/SI. Long on ZB

Currencies:

Financials: ZB grinding higher 'under the radar', with no clear setup. Finding an entry in the 'grind' is a challenge, but not impossible using LTF charts.

Warning: 'grinds' tend to end in a sharp reversal (which in this case is not expected, though, before previous highs are reached.)

10am ET update:

7am ET update: open positions

FOR THE TRADING DAY OF thursday, 2019 10 03

News at 8.30am ET .

Indexes: the lack of a strong rebound means lack of buyers, means another leg down is becoming more probable

Commodities: GC/SI strongly bullish, look to go long pullbacks, use 240min to set stops (MGC is an option). CL expect another leg down on the 240min

Currencies: DX: mean reversion expected as part of a bullish trend (see below). Watching for shorts against USD strength

Financials: ZB grinding higher 'under the radar', with no clear setup. Finding an entry in the 'grind' is a challenge, but not impossible using LTF charts.

Warning: 'grinds' tend to end in a sharp reversal (which in this case is not expected, though, before previous highs are reached.)

10.30am ET update: we’re often wrong. This is not that day.

7am ET update:

FOR THE TRADING DAY OF wednesday, 2019 10 02

News at 10.30am ET (CL).

Indexes: dealing with a 10 year old bull market that shows signs of tiredness. Nothing extraordinary at this point. Standing by.

Commodities: GC/SI strongly bullish, look to go long pullbacks, use 240min to set stops (MGC is an option) CL short with room to go (see below)

Currencies: DX: mean reversion expected as part of a bullish trend (see below). 6S room to go, watching for pullback to go short

Financials: no clarity on ZB

2pm ET update: strong performance today, GC, SI, CL, ZB all winners. We stayed away from the indexes for now (partly because we were invested) but we’re closely monitoring the situation on US indexes.

11am ET update: our method shines

9.30am ET update: a few good pre-open setups and entries. Managing positions.

7am ET update: selling, leading to more selling on the indexes

FOR THE TRADING DAY OF Tuesday, 2019 10 01

News at 10am ET.

Indexes: strong bullish bias, a visit to all time highs is likely. Long in progress.

Commodities: pullback into previous support on weekly GC (excellent entry area into a mid-term long position, think MGC on smaller accounts)

Currencies: 6A short in progress. Short setups on 6B, 6E, 6J, 6S (all against the USD, so be mindful of correlation)

Financials: watch for a potential breakdown on ZB (see below)

2pm ET update: let’s see how the ES closes. A big downday would be significant new information, and bad news for bulls. Intraday bullflags on GC/SI. DX: it’s not done yet with that double top, so we can expect a few more intraday shorts on cross-currencies in the next day or two.

General comment: these are extraordinary times, which is reflected on the markets. US indexes have been pushing for new highs for weeks, which has beens offset by macro (political and economic, see 10am news today) troubles, creating confusion, and resulting in an market environment that is even more unpredictable than usual. But: there are also opportunities coming our way on currencies and precious metals that we’re keeping an eye on.

7am ET update: Trailing runner on 6A, short on 6E (if not short already)

10pm ET update: