Remek! Premium week ending 2019 04 26

Actionable real-time market intelligence for short-term traders

Designed to remove the obstacles between you and successful trading.FOR THE TRADING DAY OF FRIDAY, 2019 04 26

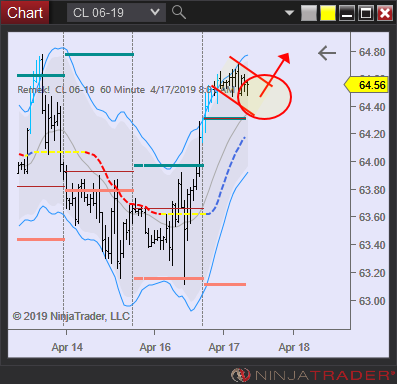

Market close: when we talked about a ‘trecherous road to the top’, this is what we meant. Lots of back-and-forth intraday today on the indexes, which made trading this timeframe frustrating and difficult. Plan for Monday: Indexes: wait and see, okay to stay out for a day or two. Currencies: good opportunities expected (keep an on the DX), be alert. Commodities: pattern failure on the CL, give it a day to see what that means. GC: we stopped tracking the pullback on 240min. Waiting for clues. General: what seems like a ‘mess’ on the markets’ may be just repositioning by large players now that the markets (indexes) are back at all time highs. No rush on Monday, we need quality setups to act! Good weekend to all!

Studies: 6E volatility, CL pattern failure, NQ anti, GC pattern failure

10am update: volatility, likely news-related. It’s okay to stay out.

News at 8.30am Eastern.

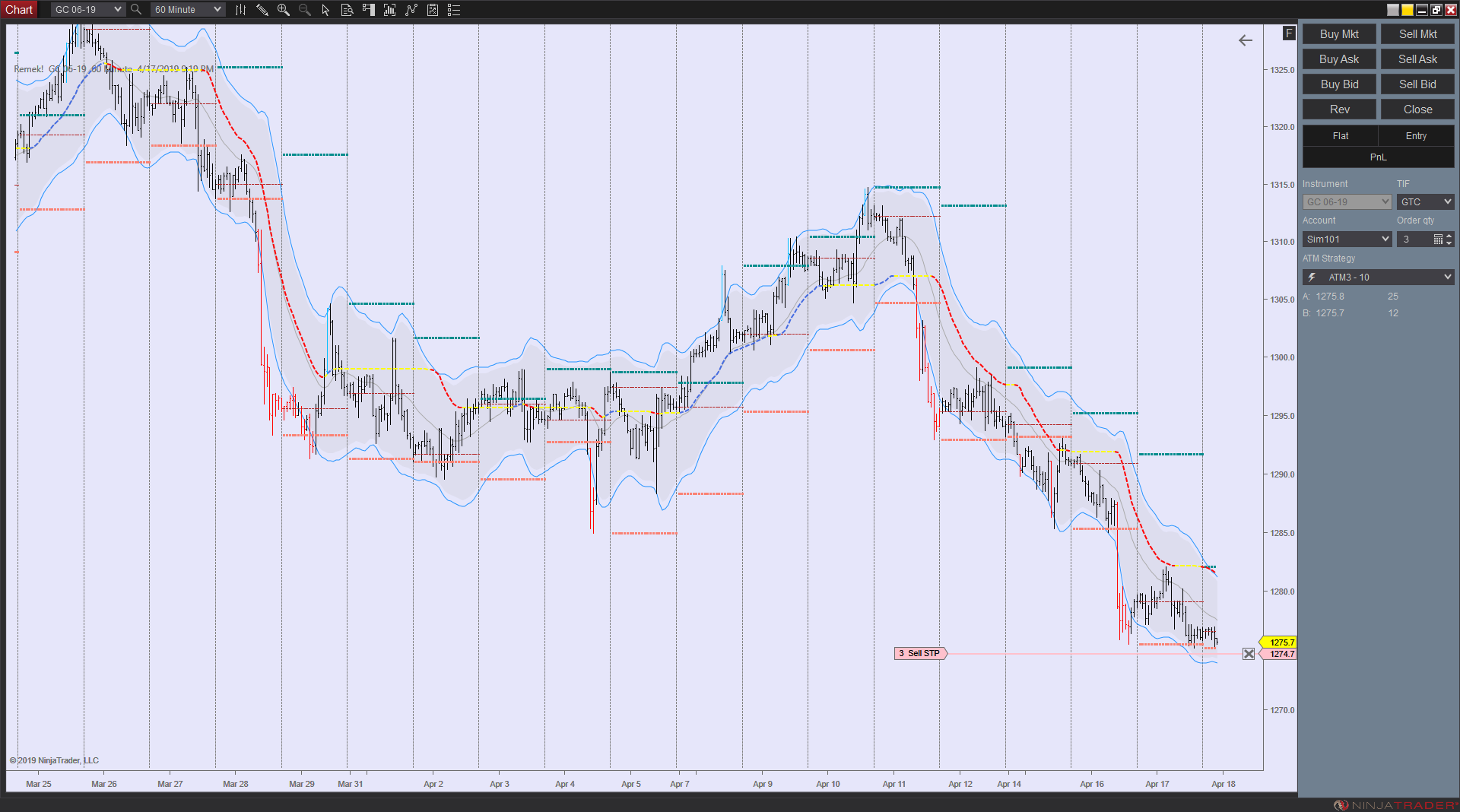

9.30am: dropped GC from short. Long ZB.

6E, 6S, 6C: trail to the previous low (see weekly). If not in trade, be on guard for another pullback on the daily, which may give you an opportunity to participate. These are all driven by strength in USD, so be mindful of correlated risk. You may look for entries on the 240min or the daily, depending on your money management rules.

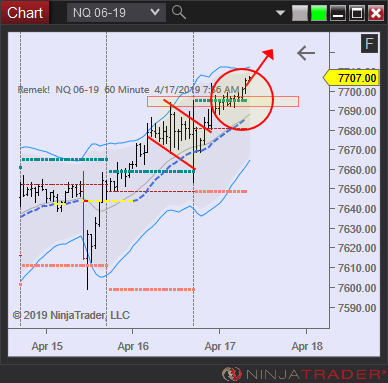

NQ: 240min anti, caution with longs

FOR THE TRADING DAY OF thursday, 2019 04 25

2pm update

ES: setting up for long, GC: setting up for short (although if it doesn’t break down soon, we’ll lose interest), CL: setting up for long, Currencies: several short setups due to strengthening of the USD (DX)

Any questions? Write to me. I want everybody to know what we’re doing and how we’re doing it!

News: 8.30am consider no trading 10min before and after to avoid increased volatility. Have a good session. Will drop by around noon.

6am: CL triggered in, 6E/6S: triggered. Strength on DXs translates into excellent setups on several currencies (be mindful of correlated risk). GC setting up for a short on 240min. See jgps on right for details.

With several shorts on currencies either setting up or underway, with ZB (long) and GC (short) setting up, it is important to be patient and wait for the trigger. There are two rules: IF trigger, THEN enter and IF setup fades THEN standby. This latter means that there is a certain number of candles we’re willing to wait for the trigger, after which we stop being interested. (i.e. the setup fades). E.g. GC is setting up, but it’s taking a long time (see 240min). If it doesn’t get triggered soon, I’ll stop being interested.

Definitions: setting up: price is slowly, with no conviction, moving in the opposite direction within the channel/pullback/consolidation area. Trigger: price leaves the channel and starts to move out with conviction (i.e. momentum). We want to join IF price moves out. Three things can happen: a) price moves out with momentum: we want to join b) price just hangs out and does nothing (fades): we stop being interested c) pattern breaks down/fails: we stop being interested and we start to keenly monitor the situation for a potential, and often powerful, move the other way. See the ZB setup this morning for an example. We don’t know what will happen, but we have a plan for each scenario. Makes sense? Trading this with Momentum or Momentum Pro is recommended because it will give you the signals and thus extra confidence.

Note: See your DX chart. The currencies below reflect the move on the DX. After weeks and weeks of nothing, life (momentum) has returned to currencies. We’re monitoring the following setups for potential entries:

Notes: Today was breakeven thanks to the currency trades in the afternoon. Currencies are moving at last, and we’ll be watching them. Also, I abandoned an NQ in the morning, my time stop told me to get out, although the trade would be a winner by now. (One more reason to stay on the 240min timeframe.)

I’m realizing I’m sending too many emails, several emails of the same setup. I will stop doing that. My main timeframe is the 240min (4hr). I’m always looking for setups on that timeframe, and confirmation on the dialy. I use smaller charts (15min or tick charts) only to finetune an entry that I see on the 240min and to trail a runner. 240min is the ‘trading chart’, it’s relatively noise-free and still shows the intraday action. That’s what has worked for me, and that’s what produced the equity curve of past year. Now, if you trade smaller timeframes (I advise you not to go below 15min or similar though), that’s fine, but then I suggest this:

look at the setup I sent you by email on the 240min.

if you’re trading the 240min, just follow me

if you’re trading a smaller chart, time your entry on the smaller chart a la “Precision Chart” style, i.e. look for a pullback i.e. a Momentum signal (arrow or BH stripe) on the smaller chart. Think 1R on your own timeframe.

I will only send one email of one setup, even if it can be ‘translated’ into one or more trades on the smaller timeframe. That also means I may send you a chart at, say 2am, setting up, but it may only trigger at noon. I will not resend the same chart. To keep track, just use pen and paper to write down what instruments we’re watching. I will continue to send you an email, though, if we get triggered into the trade.

I hope it makes sense, feel free to write with any comments. Thanks!

PS: the chart on the left shows in practice, yesterday, and today, what I mean above. The setups are on the 240min (in this case, supported by the daily). But you can enter on the Precision Chart! (e.g. a 1000 tick chart), see red circles.I hope it makes sense. This is a beautiful methodology and it works!

FOR THE TRADING DAY OF Wednesday, 2019 04 24

Which timeframe you do ZB (see below) will depend on your money management rules. We’re standing by for the 240min trigger.

3pm update 6J: working. ZB: waiting for trigger on 240m. Indexes: consolidating (bullish for tomorrow). 6C: working. 6B: working.

11.15am update Got out of GC. We may re-enter if there’s another setup. For the record: the GC entry was justified, see chart on right. Watching 6B 240min for short trigger.

10.30am update

A crappy day was overdue :). Watch “CL” report at 10.30. ES/NQ grinding higher (we’re standing by). 6E working fine. GC giving us a hard time. Stay on 240min charts, don’t dig into the noise.

Ground rules:

We have a “time stop” rule: if the trade is not working after 4-5 bars on the trading timeframe, we get out and move on to other opportunities.

Better have a slightly losing day than a catastrophic loss. It’s okay to leave it and be back tomorrow. We expected a minefield at the double-top. This is a major event that can effect other markets, e.g. DX (and thus other currencies). It’s okay to stand by for a day or two.

Notes The indexes have, for all practical purposes, reached the all-the-time-high area. This is historic. What happens next, of course, nobody knows. What do we do? We observe and watch for clues. What are watching for? Price rejection. The more time price spends in this area, the more likely a bullish continuation. If, however price cannot stay at this level, that may be a sign of price rejection, in which case, we may switch into bearish mode. What we will not do: get chopped up. Once I see clues, I’ll share them with you. This is not a time to rush in.

News: 10.30am CL. I’d rather see a deep pullback on CL on the 240min before thinking of more longs. Although we may not get it.

General note: sometimes I may mention a term that may be new to you or which I use with a particular meaning. You may want to google the remek.ca website quickly to see if I ever wrote about it on the Remek! website. Say you want to know if I ever wrote anything about a ‘complex pullback’. This is what you would enter into google: complex pullback site:remek.ca. This way google will only search within the remek.ca site. Many of you will know this trick already, but I thought it’s worth putting it here.

Let’s see what the morning brings.

FOR THE TRADING DAY OF TUESDAY, 2019 04 23

3pm update A great day, see trades below. Expect more difficult days than this, down the line :)

Good reading and trades on the indexes (ES, NQ), which are no extended, so we’ll wait a bit for them to come back before we turn into a cheetah again :)

Our GC and 6E trades worked nice, further proof that our method has an edge. Notice how we manage these trades: a) first target = previous high/low b) second target = 1R c) third target = runner. Sometimes “previous high/low” is all there is in the trade, so you have to make sure you pull up stops, and remove profits if there is no more “steam” in the move. Yes, GC and 6E turned, but we were long gone by then.

Thank you for joining me this morning! If you have any questions, just write. Done for the day, we’ll be back with more updates soon.

Check out the Premium Documentation.

10am Managing GC and 6E. Secondary entry on GC. Bullish pullbacks on ES/NQ. Managing existing positions only. Daily results as of today.

9am join us in the Premium room, click above (pw: remek-premium_2019)

NotesFollow usual process (check news times marked in red: https://us.econoday.com/byweek.asp?cust=us, no intraday trades 10min before and after)

ES, NQ: look out for pullbacks, difficult intraday environment, consider moving to higher timeframes (min. 240min)- GC: WIP, managing short

CL: extended on the daily, enticing to look for longs intraday, but I want to see a pullback on the 240m first

not every day is full of opportunities (i.e. good setups), and this may be such a day. Do not force suboptimal setups just to ‘trade’.

Setups and positions 8amFOR THE TRADING DAY OF Monday, 2019 04 22

2019 04 22 Daily review and tradesREMEK! PREMIUM DAILY REVIEW 2019 04 22 - Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

2019 04 21 6pm Daily pre-market previewREMEK! PREMIUM 2019 04 21 - Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Something to consider on the weekend.

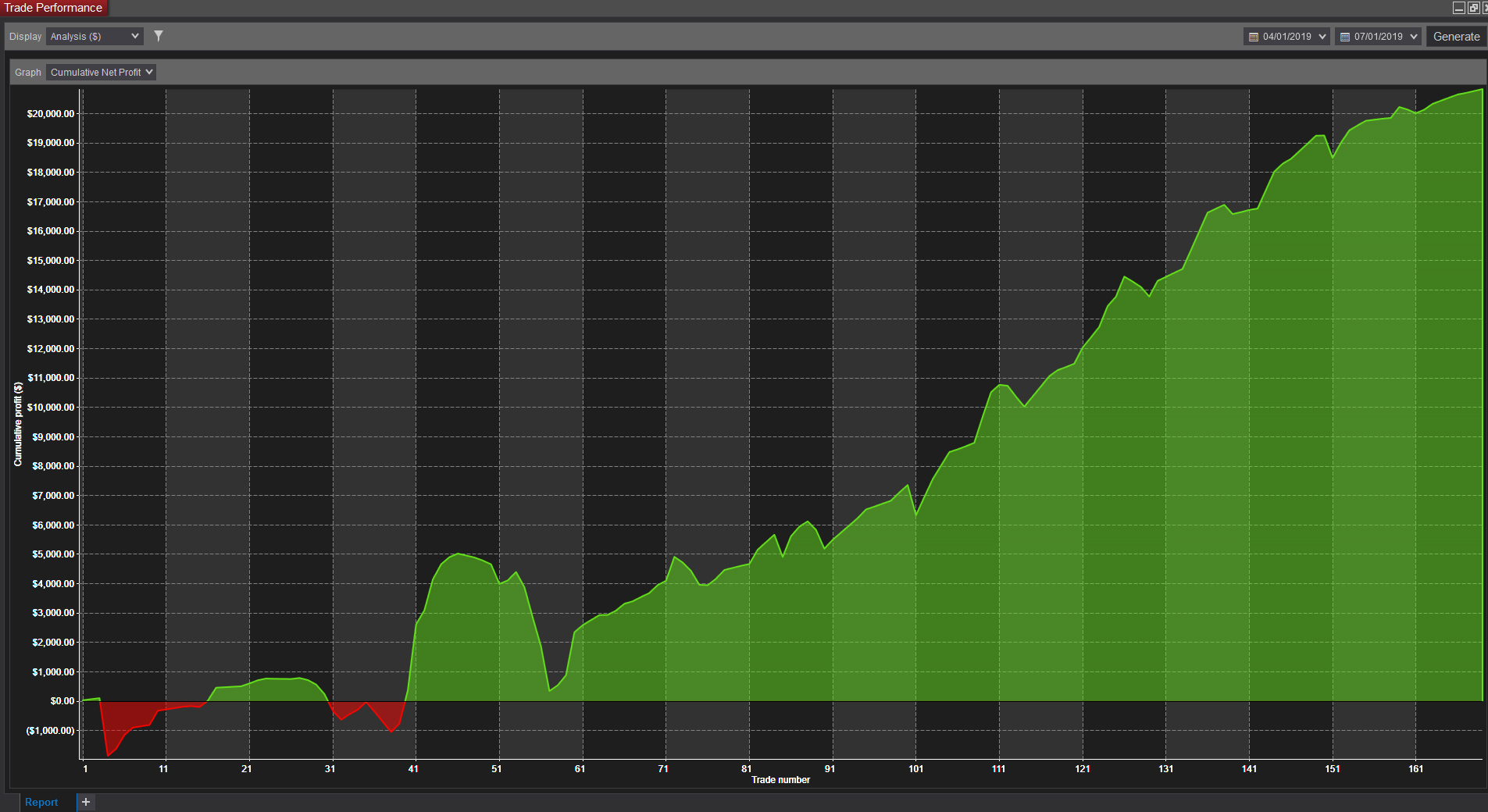

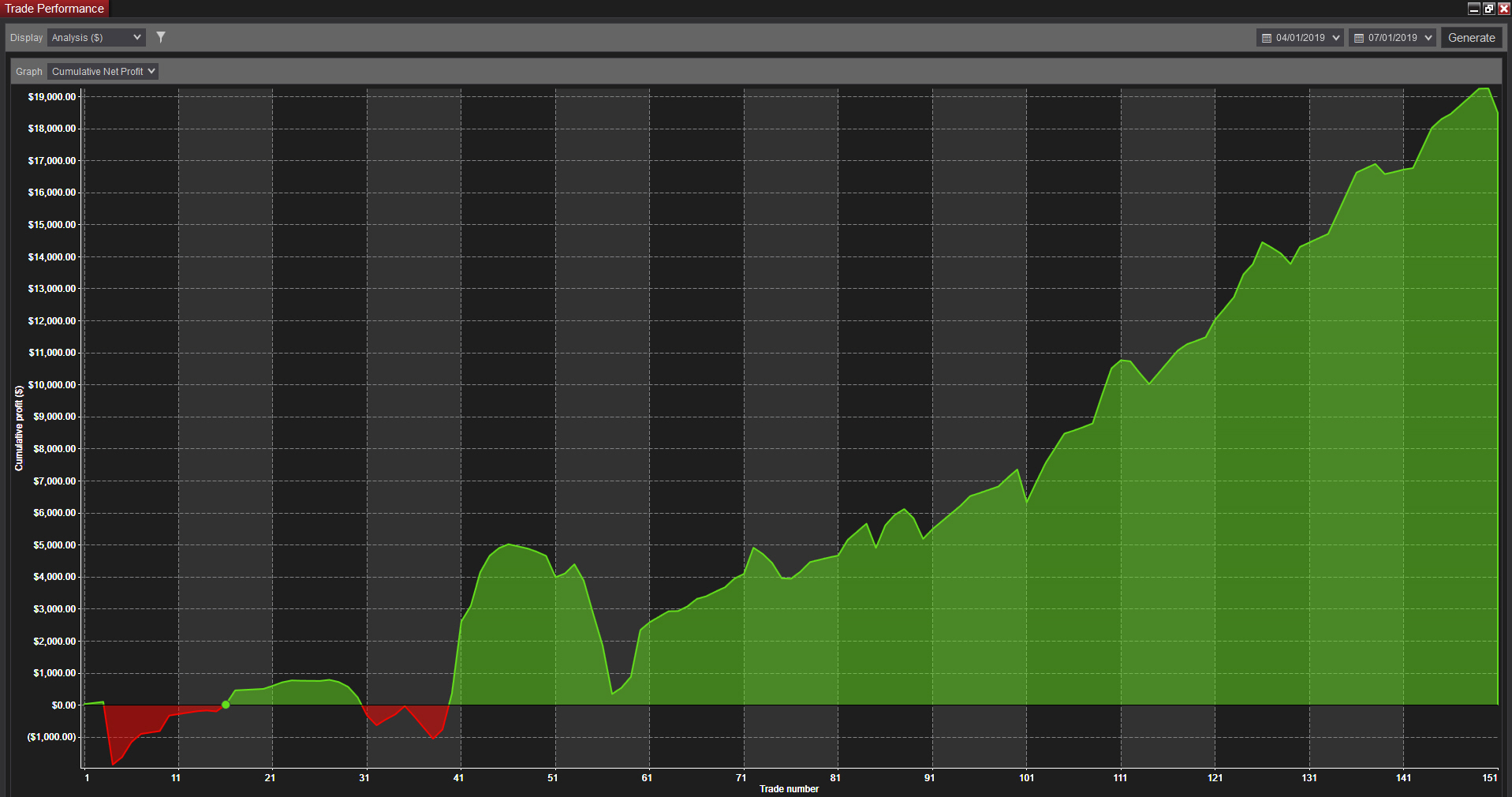

Markets closed for Good Friday. We’ll be back on Sunday night. Enjoy the weekend! Here’s the result of the first two weeks of our Remek! Premium trades, trades that we have been sharing with you.

Remek! Premium as of 2019 04 01

FOR THE TRADING DAY OF Thursday, 2019 04 18

Note: tomorrow, US markets closed. Enjoy the long weekend. Review your trades, read the Documentation, get ready for next week.

We’re not short on 6S. We can’t jump on every horse we see. Note: good to see currencies are starting to move. (6E, DX, 6S), after a couple of weeks of doing not much.

12noon Markets move. Premium reacts. An excellent week on Premium!

10.30am A few good signals this morning as shown in the jpgs below. Good longs on the ES, NQ, one good short on 6E. Tomorrow markets are closed. We’ll continue on Sunday night. A good week, see results below.

It’s a short week, do not load up tomorrow. You may even skip the session. As to the indexes (ES, NQ), we’ve been in a very tight range on the daily chart for many days. So consider this:

a) the market tends to do what causes the biggest damage to most traders.

b) think about what that might be

c) yes: a shakout, followed by a ride to the all time highs.

d) don’t be the one that is shaken out, be the one who rides

My personal take: mostly, intraday traders will be shaken out. Look at the daily chart, past 5 days, then look at the same days intraday. The intraday is a very-hard-to-trade, mostly-random ‘madness’. At the same time, the daily has been just grinding higher quietly. Bottom line, either move up to daily, or scale back your risk if you’re intraday, or, at least tomorrow, stay out.

The bottom line: after so many days of contracted volatility, it would be surprising to see a daily candle with a large bottom tail. Don’t get caught.

Currencies: no trend on DX, still waiting for clues from the market. No positions for now. Our time on currencies will come soon :) and we will rock!

8.30am: session! Click above to join. Pw: remek-premium_2019

FOR THE TRADING DAY OF WED, 2019 04 17

7pm update: another good Premium day. We’re flat.

Here’s a snapshot of our in-house Premium Momentum trades. This methodology works.

Consider the ideas below for today. News: 8.30am, CL report: 10.30. Short week, less than usual volume. 1R is fine. Mindful trading!

FOR THE TRADING DAY OF TUESDAY, 2019 04 16

4pm market close:

CL moved as expected, see daily bullflag.

GC, index trades, see below.

2pm Closed all trades except overnight ones. Equity curve below. Back in the evening and/or early morning.

Remek! Premium equity curve. 2019 04 16

Our trades are working beautifully. See emails for details. Manage trades well. Be ready for a trend day on the indexes. In good times, too: stick to your risk rules!

for the trading day of MONDAY, 2019 04 15

https://us.econoday.com/byweek.asp?cust=us

Timeframe conflict on the CL: what may look like a bearflag in the works on the 240m chart, is actually part of a bullflag on the daily. We do not go against the HTF structure, so we skip this trade idea on the 240m chart and focus on the bullflag on the daily.

Positions working well.GC SHORT, ES, NQ LONG